A San Diego California Promissory Note Payable on a Specific Date is a legally binding agreement between a lender and a borrower in San Diego, California. It outlines the terms and conditions under which the borrower agrees to repay a specific amount of money borrowed, including the principal amount and any applicable interest, on a predetermined date. The purpose of a Promissory Note is to establish clear expectations for both parties involved and ensure that the repayment terms are understood and followed. By signing this document, the borrower acknowledges their obligation to repay the debt according to the agreed-upon terms. There are various types of San Diego California Promissory Note Payable on a Specific Date that can be used depending on the specific situation or purpose. Below are some examples: 1. Fixed-term Promissory Note: This type of promissory note specifies a specific date on which the entire principal, along with any accrued interest, must be repaid in full. It is commonly used for personal loans, business loans, or other types of financial obligations. 2. Installment Promissory Note: Unlike the fixed-term note, an installment promissory note allows for repayment in smaller, regular installments rather than a lump sum payment. The borrower agrees to make periodic payments, typically monthly or quarterly, until the principal and interest are fully repaid. 3. Balloon Promissory Note: In a balloon promissory note, the borrower agrees to make smaller payments over a specific period of time; however, a large balloon payment is due on a specific date. This type of note is often used in real estate transactions or business loans where the borrower expects a large sum of money to become available at a later date. Regardless of the specific type of San Diego California Promissory Note Payable on a Specific Date, it is crucial to include important details such as the names and addresses of both parties, the loan amount, the interest rate (if applicable), the repayment schedule, and any late payment penalties or default provisions. Additionally, the note should clearly state the consequences of non-payment or default and the rights and remedies available to the lender in such scenarios. In conclusion, a San Diego California Promissory Note Payable on a Specific Date is a legal document that solidifies the repayment obligations between a lender and a borrower in San Diego, California. Different types of promissory notes can be utilized, such as fixed-term, installment, and balloon notes, depending on the specific circumstances of the loan. It is crucial for both parties to carefully review and understand the terms and conditions outlined in the note to ensure a smooth and mutually beneficial lending experience.

San Diego California Promissory Note Payable on a Specific Date

Description

How to fill out San Diego California Promissory Note Payable On A Specific Date?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including San Diego Promissory Note Payable on a Specific Date, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various types varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find detailed materials and guides on the website to make any tasks related to document execution simple.

Here's how you can purchase and download San Diego Promissory Note Payable on a Specific Date.

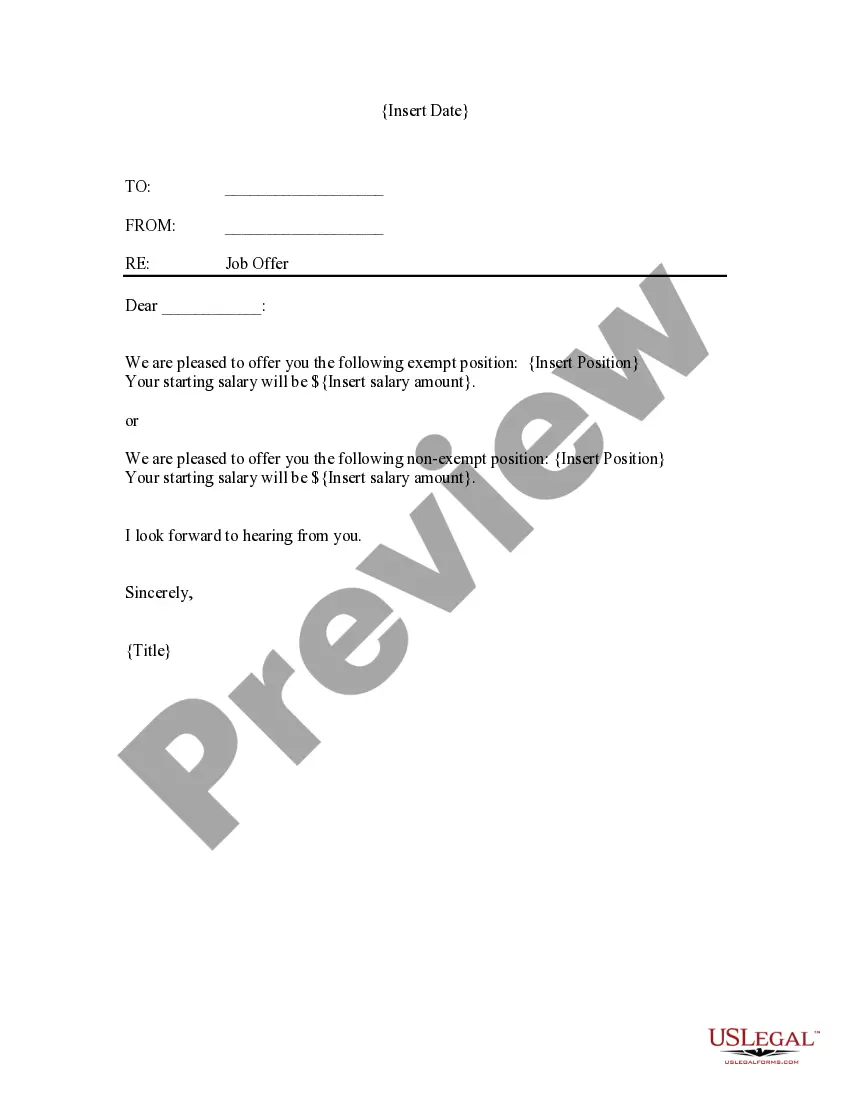

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the legality of some records.

- Examine the similar forms or start the search over to locate the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase San Diego Promissory Note Payable on a Specific Date.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed San Diego Promissory Note Payable on a Specific Date, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney completely. If you have to cope with an exceptionally difficult case, we recommend getting a lawyer to check your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!