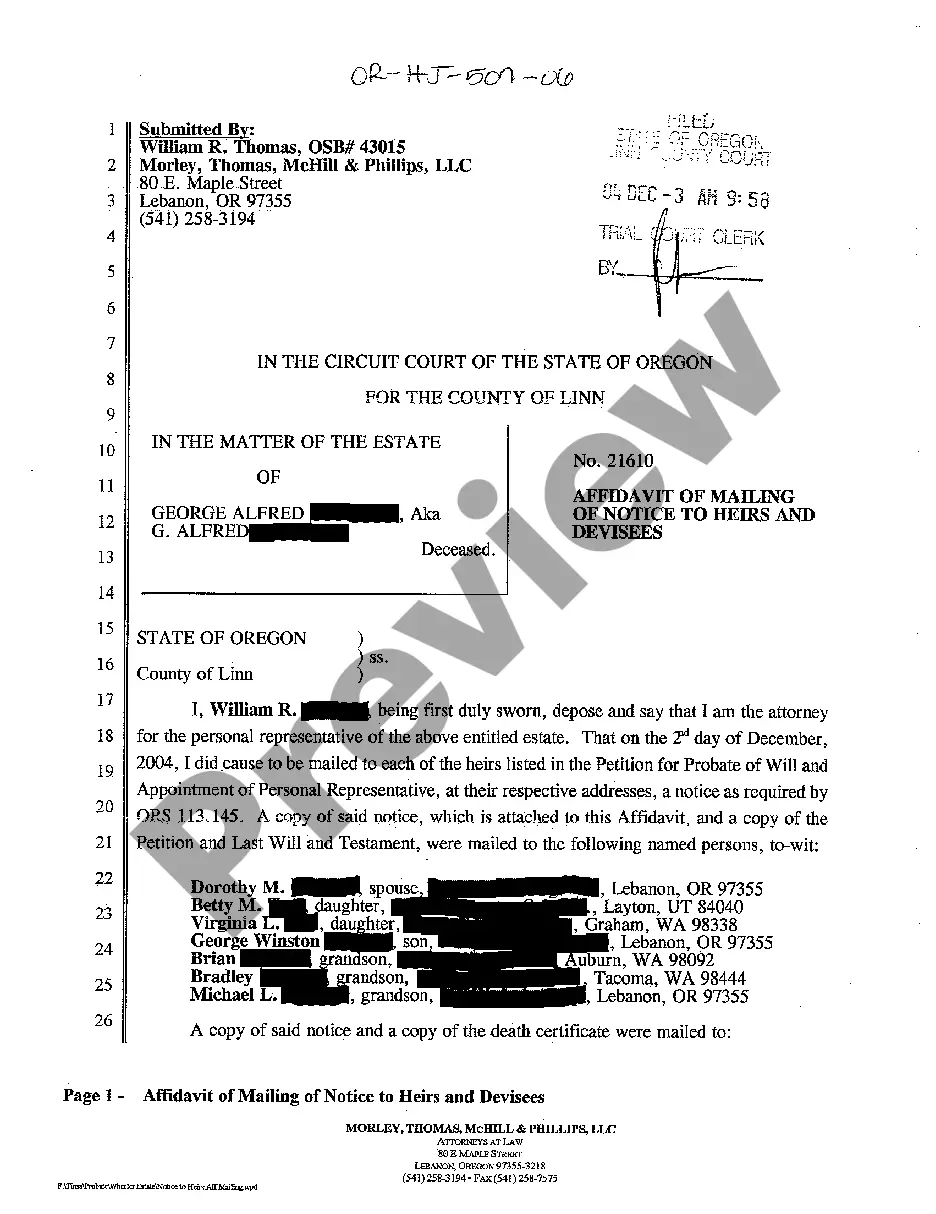

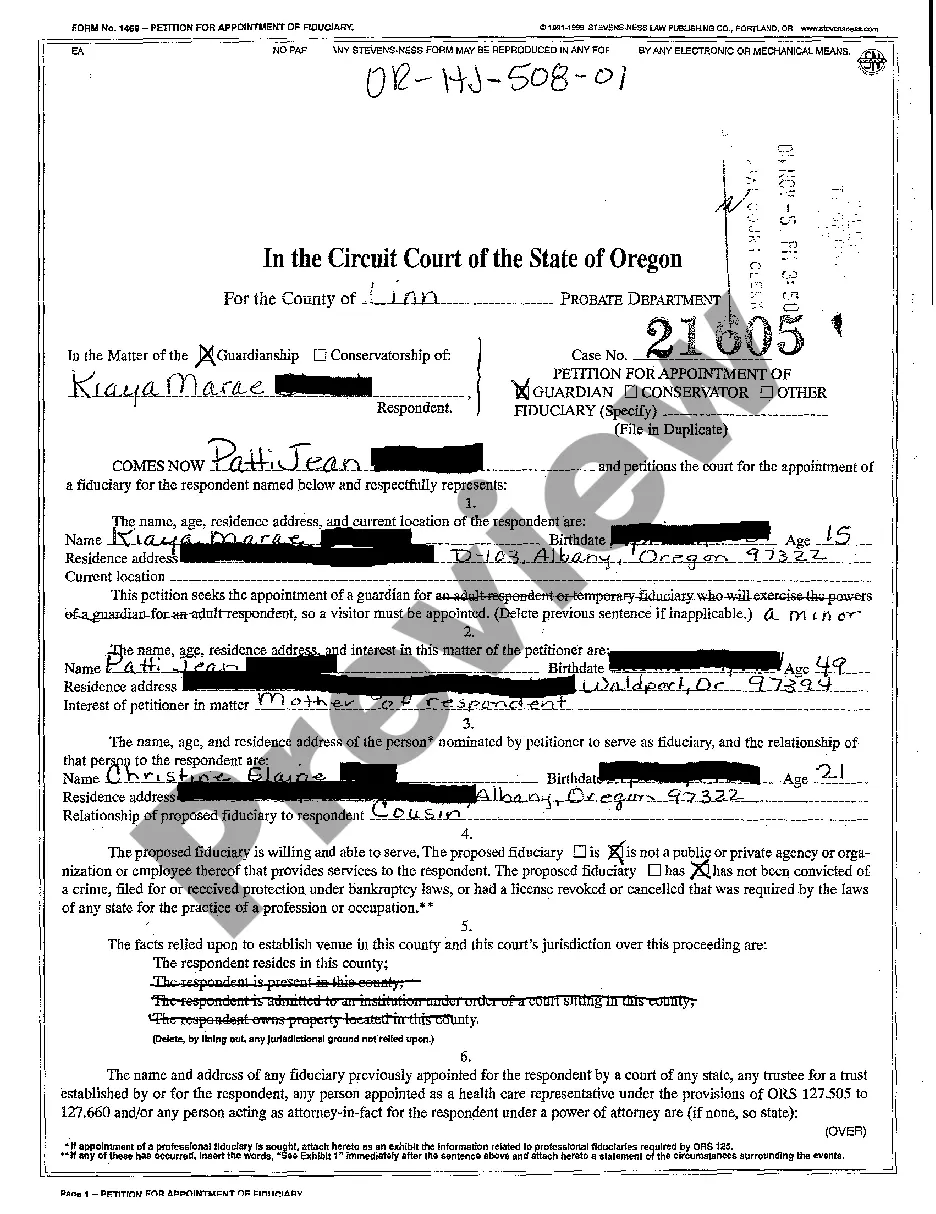

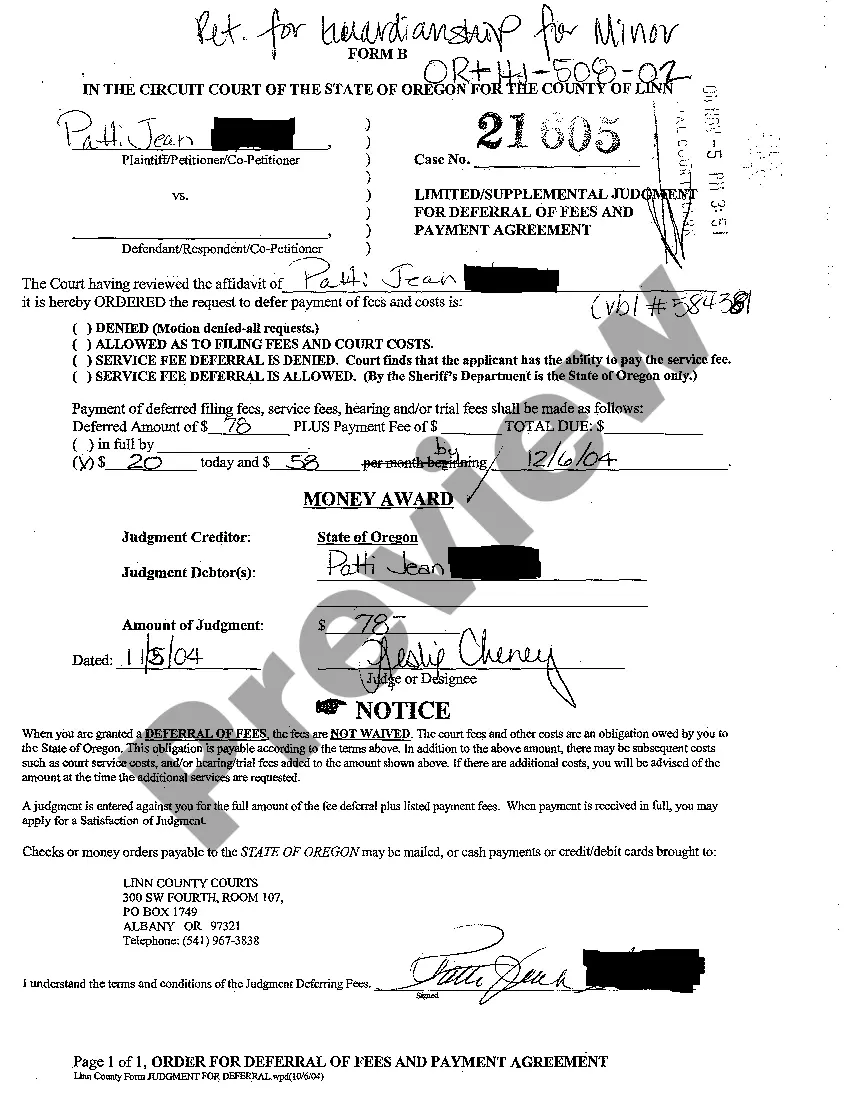

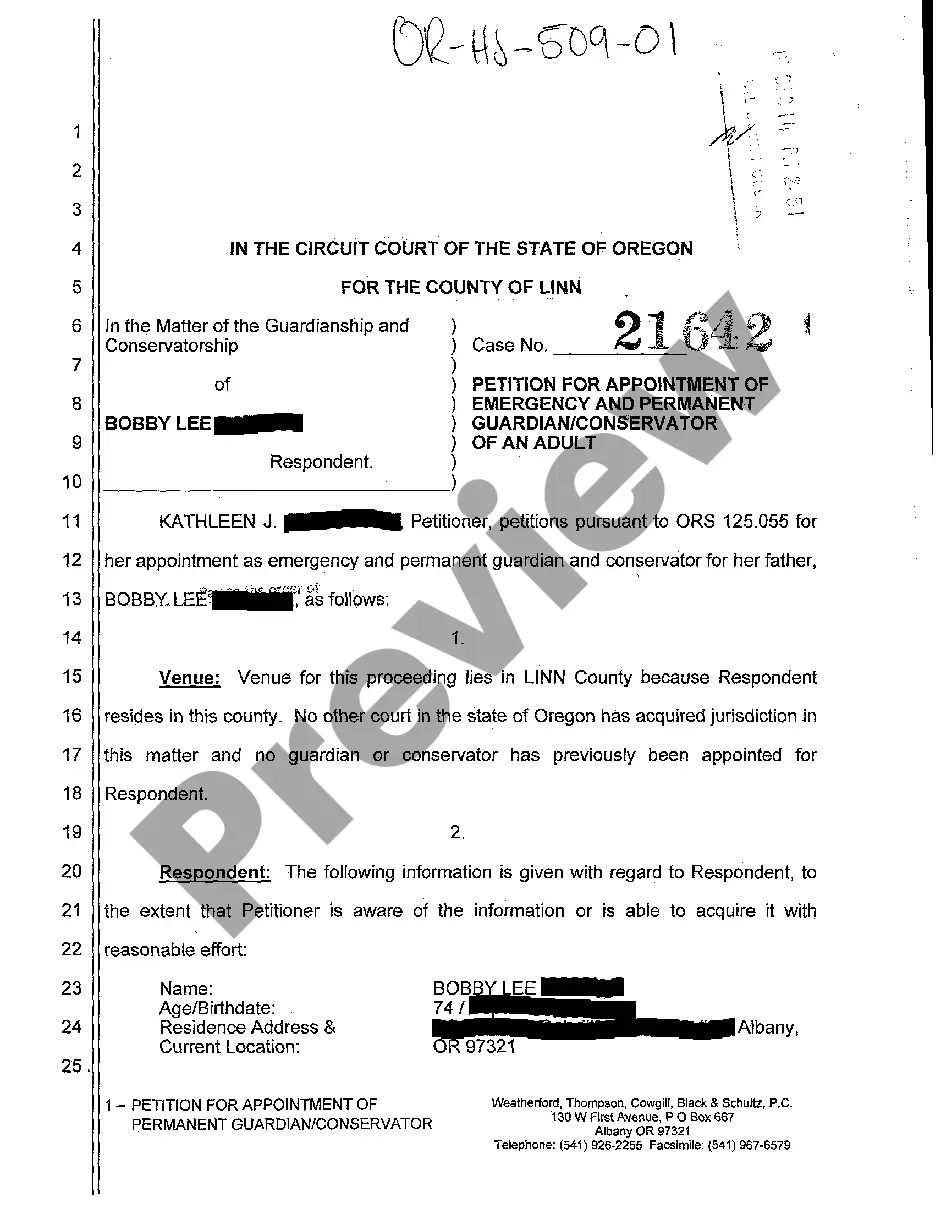

The Kings New York Seller's Affidavit of Nonforeign Status is a legal document used in real estate transactions to establish the seller's citizenship or non-foreign status. This affidavit is of paramount importance as it ensures compliance with the Foreign Investment in Real Property Tax Act (FIR PTA), a federal law aimed at taxing gains made by foreign individuals or entities on the sale of U.S. real property interests. This affidavit requires the seller to provide detailed information regarding their identity, citizenship, residency status, and any potential foreign connections. By completing this affidavit, the seller declares under penalty of perjury that they are not a foreign person as defined by FIR PTA, thus exempting the buyer from withholding a portion of the sales proceeds for tax purposes. Different forms or variations of the Kings New York Seller's Affidavit of Nonforeign Status may be required depending on the specific circumstances of the transaction. For instance, if the seller is an individual who is a U.S. citizen or resident alien, Form W-9 is typically used. On the other hand, if the seller is a foreign person, they must complete Form W-8 BEN, certifying their status as a non-U.S. taxpayer. Furthermore, if the seller is an entity such as a corporation, partnership, or LLC, additional forms like Form W-8 BEN-E or Form W-8 MY may be necessary to establish their non-foreign status. It is crucial for both buyers and sellers to understand the significance of the Kings New York Seller's Affidavit of Nonforeign Status, as any failure to comply with FIR PTA regulations could lead to severe penalties or legal complications. Real estate professionals, attorneys, and title companies play a vital role in guiding buyers and sellers through the completion and submission of the necessary paperwork to ensure a smooth and lawful transaction. In conclusion, the Kings New York Seller's Affidavit of Nonforeign Status is a key document in real estate transactions, verifying the seller's citizenship or non-foreign status and ensuring compliance with FIR PTA. By accurately completing the required forms, sellers can exempt buyers from withholding a portion of the sales proceeds, thus safeguarding the legality and smoothness of the transaction.

Kings New York Seller's Affidavit of Nonforeign Status

Description

How to fill out Kings New York Seller's Affidavit Of Nonforeign Status?

Draftwing paperwork, like Kings Seller's Affidavit of Nonforeign Status, to manage your legal matters is a tough and time-consumming process. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for different cases and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Kings Seller's Affidavit of Nonforeign Status form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before getting Kings Seller's Affidavit of Nonforeign Status:

- Make sure that your form is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Kings Seller's Affidavit of Nonforeign Status isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin using our service and get the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can try and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!