The Riverside California Seller's Affidavit of Nonforeign Status is an important legal document used during real estate transactions to establish a seller's non-foreign status, which is crucial for compliance with the Internal Revenue Service (IRS) regulations. This affidavit is specifically required when a non-U.S. citizen or non-resident alien sells property located within the United States. The Seller's Affidavit of Nonforeign Status serves as proof that the seller is not a foreign person and is subject to certain provisions under the Foreign Investment in Real Property Tax Act (FIR PTA). FIR PTA requires the buyer of U.S. real estate property from a foreign seller to withhold a percentage of the purchase price as tax. However, if the seller qualifies for an exemption, they can submit the affidavit to indicate that no withholding is necessary. The affidavit typically includes essential information such as the seller's name, address, taxpayer identification number (TIN), the property's location, and the purchase price. It also requires the seller to certify under penalties of perjury that they are not a foreign person as defined by the IRS, meaning they are either a U.S. citizen, a resident alien, or meet specific exemption criteria outlined by FIR PTA. There are no different types of Riverside California Seller's Affidavit of Nonforeign Status, as the affidavit itself is a standardized form. However, Riverside County, California, may have specific guidelines or requirements on how the affidavit should be completed or filed. It is essential for sellers and their representatives to consult with a qualified attorney or a real estate professional familiar with local regulations to ensure compliance with all necessary procedures. In conclusion, the Riverside California Seller's Affidavit of Nonforeign Status is a crucial document in real estate transactions involving non-U.S. citizen or non-resident alien sellers. By submitting this affidavit, sellers can establish their non-foreign status to be exempt from FIR PTA withholding requirements if they meet the qualifications specified by the IRS. Proper completion and submission of this affidavit ensure a smooth and compliant property transfer process.

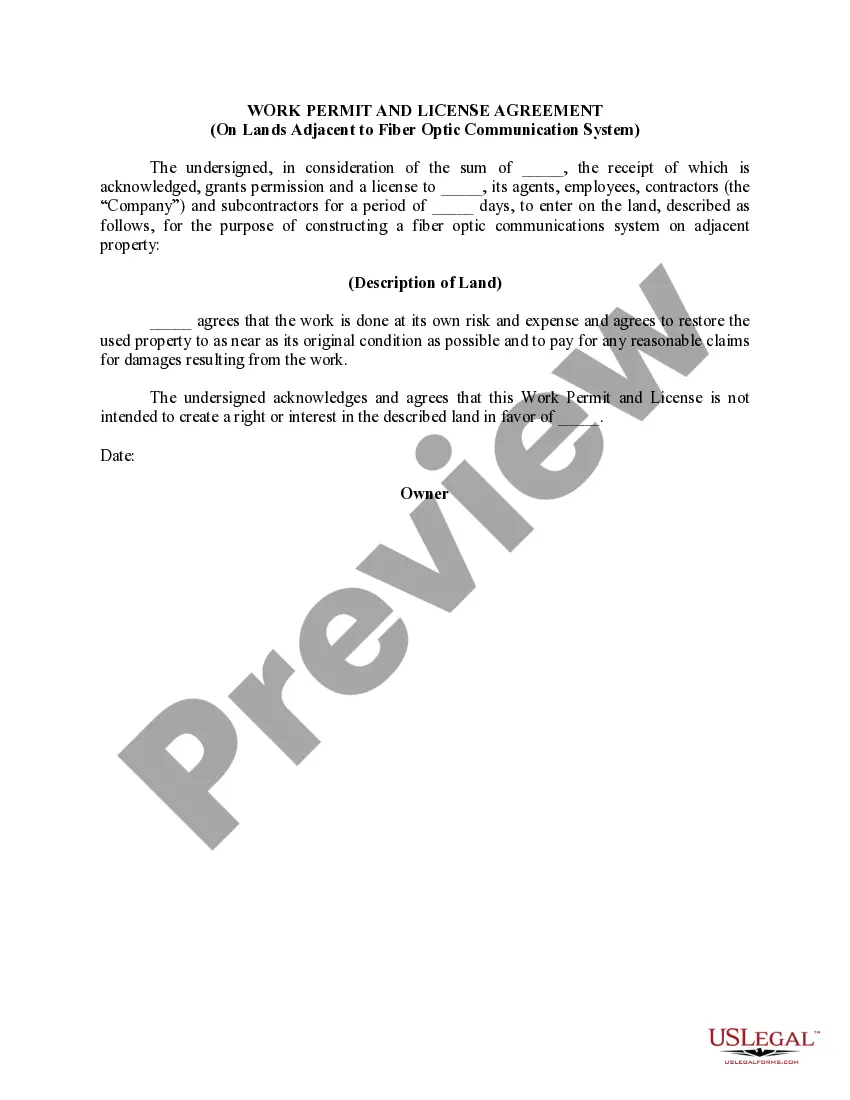

Riverside California Seller's Affidavit of Nonforeign Status

Description

How to fill out Riverside California Seller's Affidavit Of Nonforeign Status?

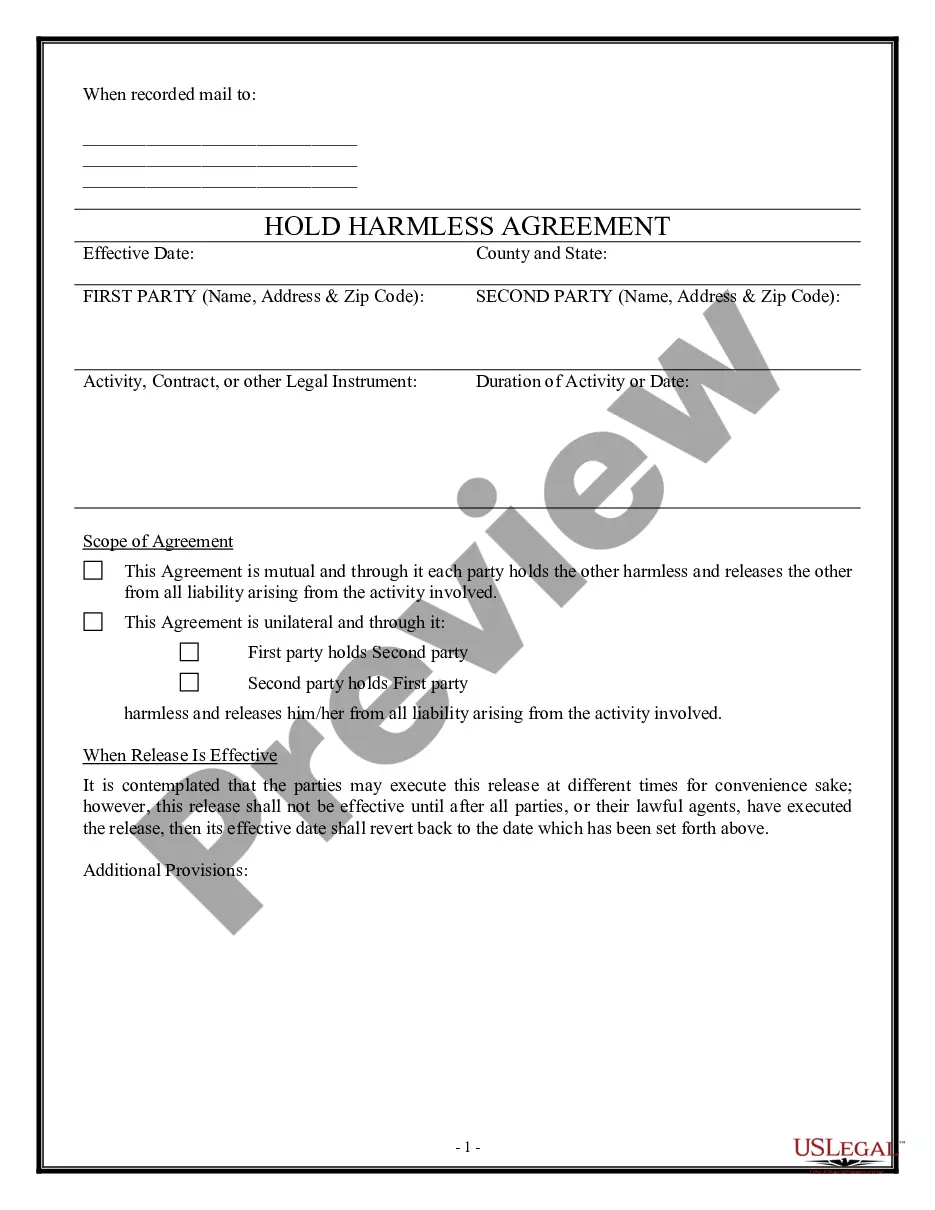

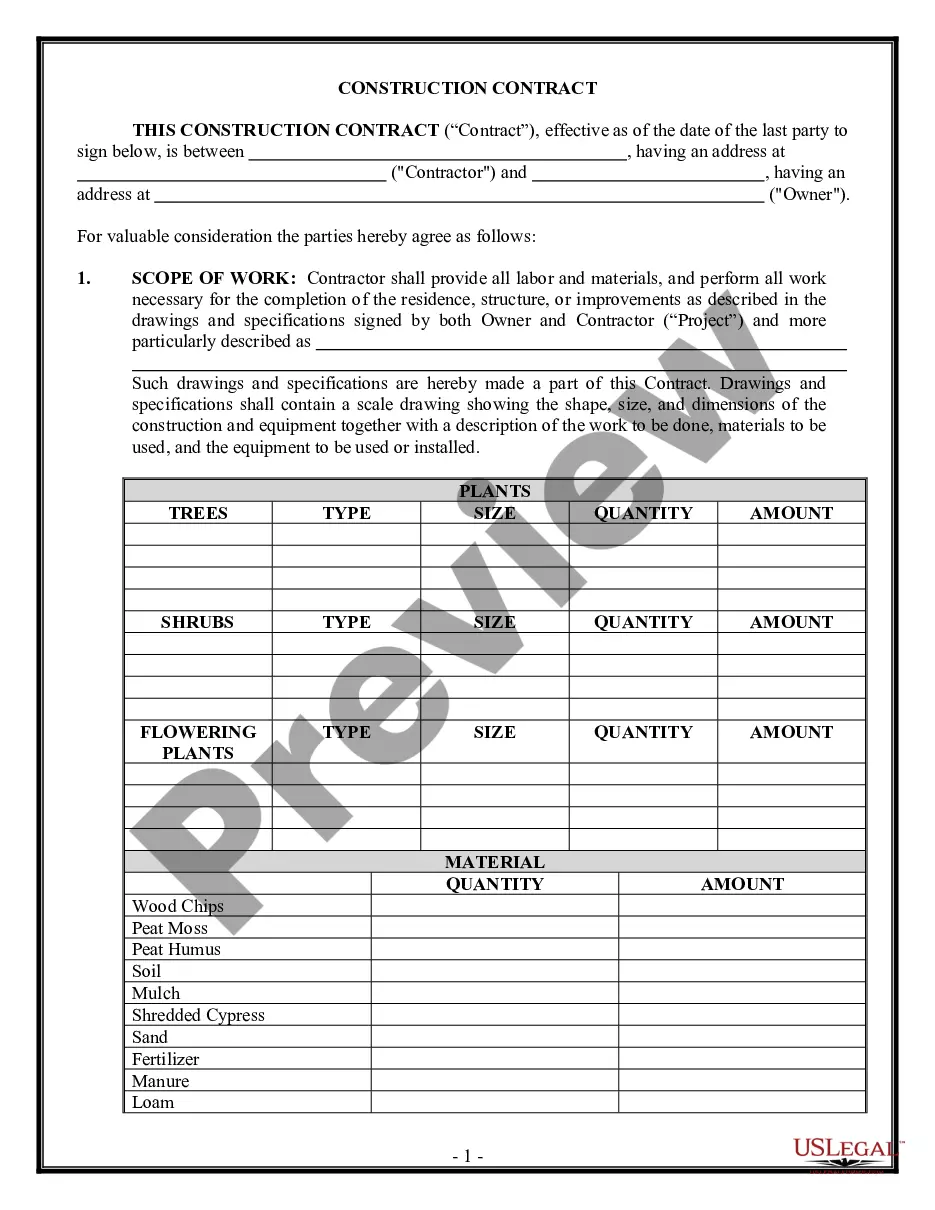

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life situation, locating a Riverside Seller's Affidavit of Nonforeign Status meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the Riverside Seller's Affidavit of Nonforeign Status, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Riverside Seller's Affidavit of Nonforeign Status:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Riverside Seller's Affidavit of Nonforeign Status.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

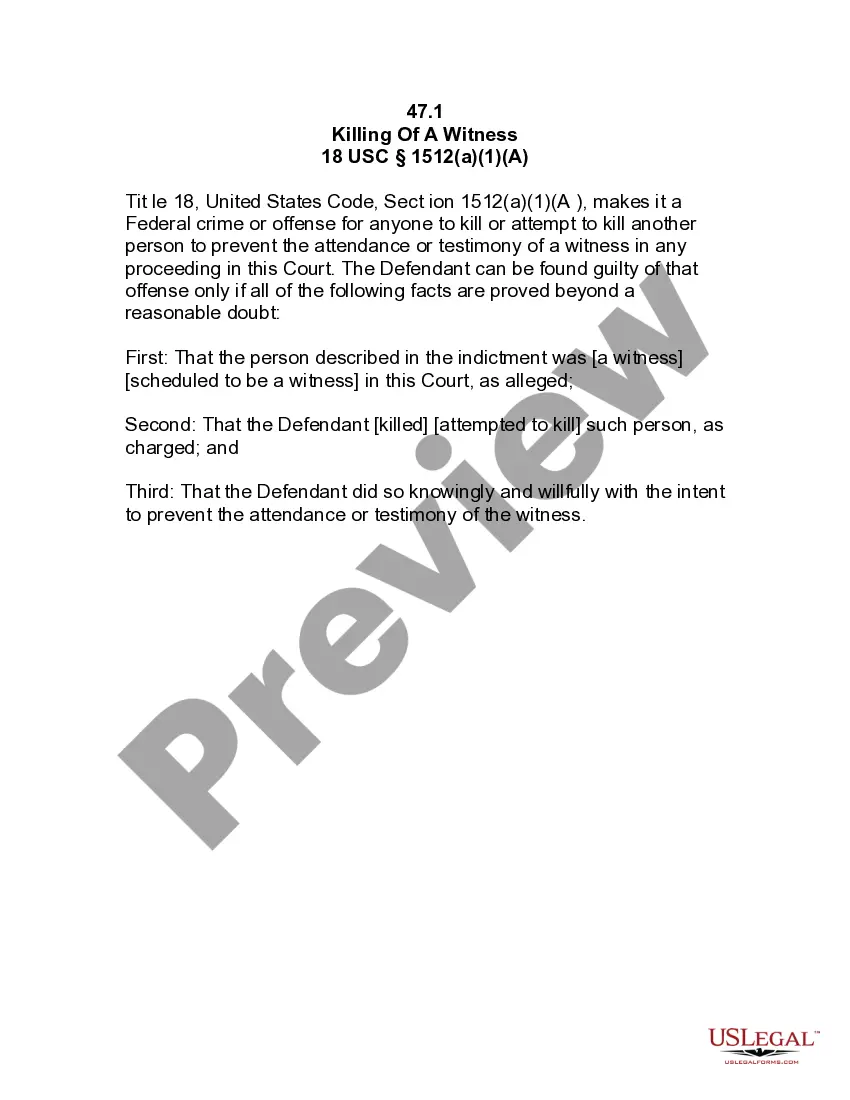

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

The Notice 1445 is just a general letter saying that "Tax Help in Other Language", which introduces IRS offers tax help in different languages.

Under FIRPTA, a buyer who purchases U.S. real estate from a foreign seller is obligated to withhold from seller's proceeds, and submit to the IRS, a percentage of the sales price of the U.S. real property.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

BOSTON Merger and acquisition agreements almost universally require the target or seller to deliver at closing a so-called FIRPTA certificate i.e., an affidavit that either the target is not a United States real property holding corporation or that the seller is not a foreign person, in each case in accordance

The only other way to avoid FIRPTA is via a withholding certificate. If FIRPTA withholding exceeds the maximum tax liability realized on the sale of the real property, sellers can appeal to the IRS for a lower withholding amount.

Nonforeign (not comparable) Not foreign.

The FIRPTA affidavit is for all those local sellers who are not foreigners. This form certifies that the seller of the real estate property is a local seller, and a non-resident alien to provide income tax to the Internal Revenue Service. This form can help your seller in avoiding the FIRPTA withholding.

You can file a Form 843 (Claim for Refund), together with a Form 8288-B, to show the estimated tax on the sale. This is the IRS's official process for obtaining an early refund of FIRPTA withholding. However, the IRS takes a long time to process these requests.