The San Antonio Texas Seller's Affidavit of Nonforeign Status is a legal document utilized during real estate transactions in San Antonio, Texas. This affidavit serves the purpose of verifying the seller's non-foreign status, ensuring compliance with the Foreign Investment in Real Property Tax Act (FIR PTA). By submitting this affidavit, sellers declare their legal status as a U.S. citizen, resident alien, or domestic trust. This affidavit acts as a safeguard for the buyer and the Internal Revenue Service (IRS) to prevent potential tax evasion by foreign sellers. According to FIR PTA, if a foreign individual or entity sells a U.S. real property interest, the buyer is required to withhold a specific percentage of the total sales price as income tax. By providing the San Antonio Texas Seller's Affidavit of Nonforeign Status, sellers prove that they are not subject to this withholding. It is important to note that various types of San Antonio Texas Seller's Affidavit of Nonforeign Status may exist, each catering to specific scenarios or parties involved. These may include: 1. San Antonio Texas Seller's Affidavit of Nonforeign Status — Individual: This form is used when an individual seller, who is either a U.S. citizen or a resident alien, wishes to sell a property located in San Antonio, Texas. The individual must provide their personal information, including name, address, social security number, and other required details. 2. San Antonio Texas Seller's Affidavit of Nonforeign Status — Domestic Trust: In cases where a domestic trust, which is treated as a U.S. person for tax purposes, is selling a property in San Antonio, Texas, this form is applicable. The trustee of the trust usually completes and signs this affidavit, providing necessary trust details, EIN (Employer Identification Number), and other relevant information. 3. San Antonio Texas Seller's Affidavit of Nonforeign Status — Joint Filers: For married couples or domestic partners who file joint tax returns and wish to sell their San Antonio, Texas property, a Joint Filers affidavit may be used. This form collects information from both partners, including names, addresses, social security numbers, and other essential data to establish their non-foreign status collectively. These different types of San Antonio Texas Seller's Affidavit of Nonforeign Status serve a common purpose of confirming the seller's non-foreign status and assisting in FIR PTA compliance during real estate transactions in San Antonio, Texas. It is crucial for both buyers and sellers to complete these affidavits accurately to ensure a smooth and legally compliant property transfer process.

San Antonio Texas Seller's Affidavit of Nonforeign Status

Description

How to fill out San Antonio Texas Seller's Affidavit Of Nonforeign Status?

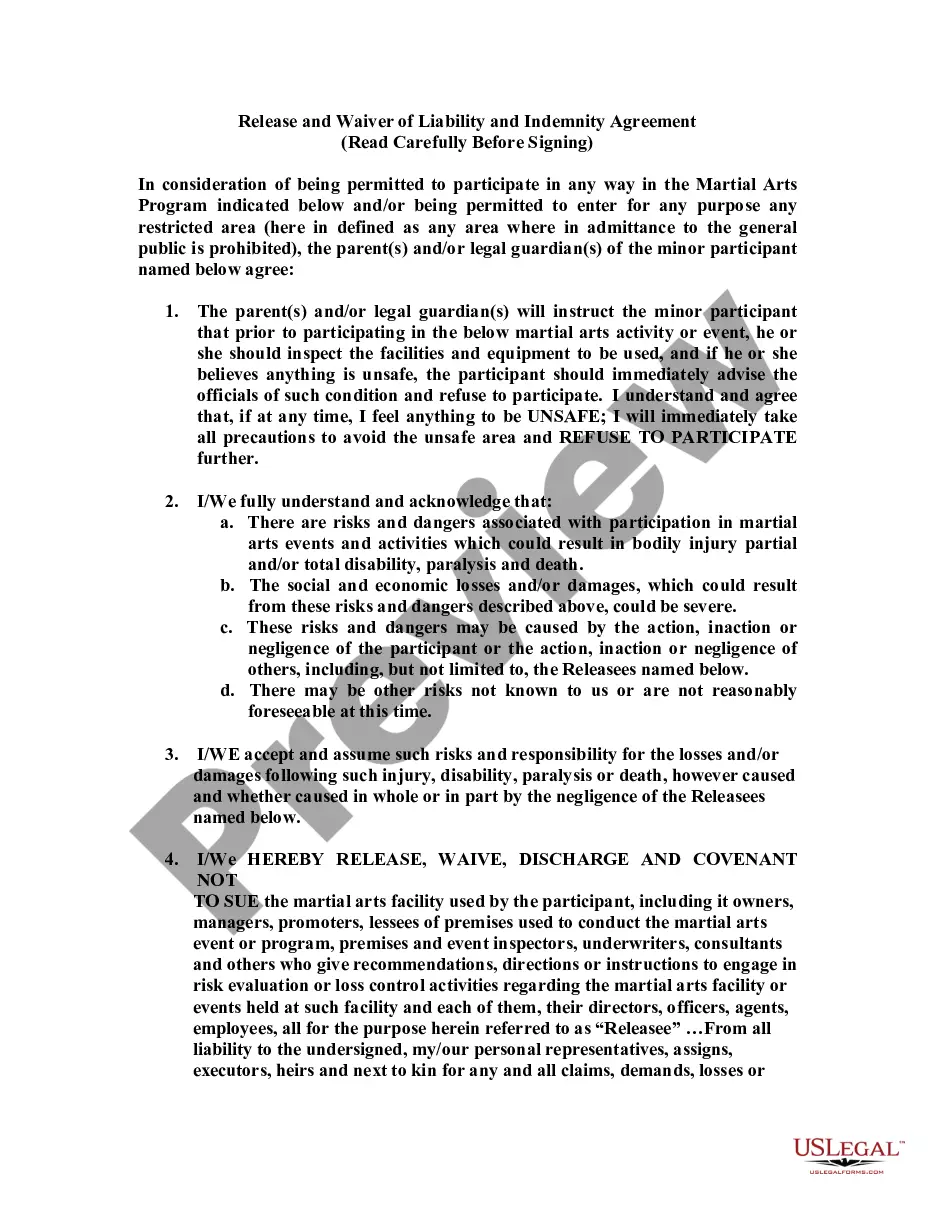

Do you need to quickly create a legally-binding San Antonio Seller's Affidavit of Nonforeign Status or probably any other form to take control of your personal or corporate matters? You can go with two options: hire a professional to draft a valid paper for you or draft it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant form templates, including San Antonio Seller's Affidavit of Nonforeign Status and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra hassles.

- To start with, carefully verify if the San Antonio Seller's Affidavit of Nonforeign Status is adapted to your state's or county's laws.

- In case the form comes with a desciption, make sure to verify what it's intended for.

- Start the searching process again if the document isn’t what you were looking for by using the search bar in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the San Antonio Seller's Affidavit of Nonforeign Status template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Moreover, the documents we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!