Collin Texas Covenant Not to Sue by Widow of Deceased Stockholder: A Comprehensive Overview Introduction: In the state of Texas, Collin County holds a unique provision known as the Collin Texas Covenant Not to Sue by Widow of Deceased Stockholder. This legal arrangement seeks to protect widows of deceased stockholders from potential lawsuits and ensures their financial stability during trying times. In this article, we will delve into the details of this covenant, its purpose, benefits, and explore any potential variations or types. Definition and Purpose: The Collin Texas Covenant Not to Sue by Widow of Deceased Stockholder is a legally binding agreement that shields widows of deceased stockholders from personal liability in relation to any existing or future lawsuits involving their late spouses' stockholder rights or obligations. The primary purpose of introducing such a covenant is to protect widows from becoming entangled in complex legal battles and to provide them with security while they navigate the transition after the death of a stock holding spouse. Benefits: 1. Legal Protection: The covenant acts as a shield against potential lawsuits, safeguarding the widow's personal assets and preventing her from addressing legal matters that her late spouse was previously involved in. 2. Financial Security: With the covenant in place, widows can rest assured that their financial stability will not be compromised due to legal claims against their deceased spouse's stocks or assets. This helps alleviate additional stress during the grieving process. 3. Peace of Mind: By obviating the need for widows to actively participate in or manage legal proceedings, they can focus on adapting to their new circumstances and prioritize emotional healing without the added burden of litigation. Types of Collin Texas Covenant Not to Sue by Widow of Deceased Stockholder: Although the primary purpose and concept of the covenant remain the same, it's worth noting that certain variations or types may exist. These could include: 1. Limited Covenant Not to Sue: This type of covenant might specify certain limitations or exclusions concerning the scope or duration of its effect. This could mean that the widow is only exempt from lawsuits related to stockholder rights, while other legal matters may not fall under its protection. 2. Customized Covenant Not to Sue: In some cases, a widow and the relevant stakeholders may negotiate and draft a covenant tailored to their specific needs and requirements. This type of covenant may take into consideration the widow's financial and personal circumstances, providing even greater protection and peace of mind. Conclusion: The Collin Texas Covenant Not to Sue by Widow of Deceased Stockholder is a crucial legal mechanism designed to protect widows from undue legal burdens and financial instability. By shielding them from potential lawsuits related to their late spouse's stockholder obligations, this covenant serves as a valuable resource during a challenging period. As with any legal arrangement, it is advisable to consult legal professionals experienced in Texas state law to ensure the covenant is properly executed and its benefits fully realized.

Collin Texas Covenant Not to Sue by Widow of Deceased Stockholder

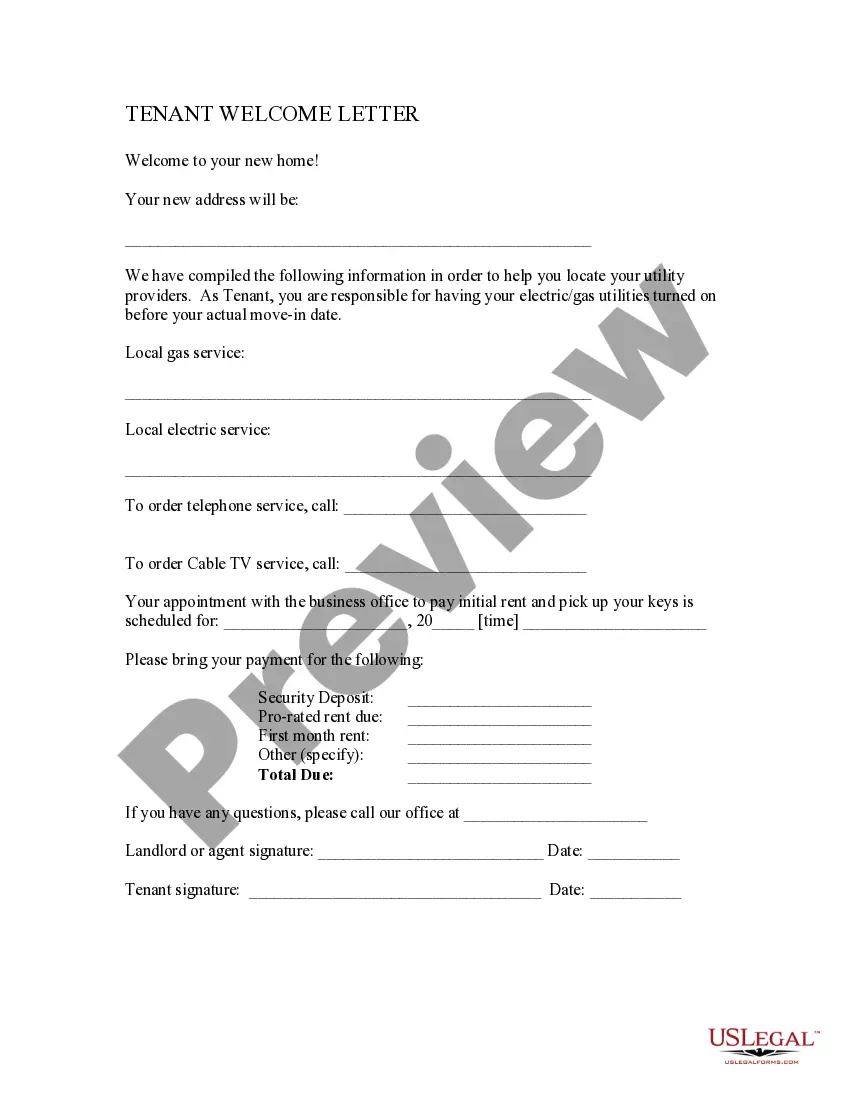

Description

How to fill out Collin Texas Covenant Not To Sue By Widow Of Deceased Stockholder?

Drafting papers for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Collin Covenant Not to Sue by Widow of Deceased Stockholder without expert assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Collin Covenant Not to Sue by Widow of Deceased Stockholder on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guide below to get the Collin Covenant Not to Sue by Widow of Deceased Stockholder:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!