Contra Costa California Covenant Not to Sue by Widow of Deceased Stockholder is a legal agreement that typically occurs in the context of probate proceedings or company ownership transfers. It is a binding contract between the widow of a deceased stockholder and other relevant parties involved, in which the widow agrees not to pursue legal action against the stockholder's estate, company, or individuals associated with their estate. This type of covenant not to sue serves as a protective measure for both the widow and the estate, ensuring a smooth transition of ownership and preventing potential disputes or litigation. It provides the widow with assurance that any entitlements, benefits, or assets left by the deceased stockholder will be duly transferred without any legal obstacles. The specific terms and conditions of Contra Costa California Covenant Not to Sue by Widow of Deceased Stockholder can vary depending on the circumstances and preferences of the involved parties. It typically includes provisions related to the release of claims and liabilities, non-disclosure of confidential information, non-interference in company affairs, and an agreement to settle any disputes through alternative methods such as mediation or arbitration. It is worth noting that there may be several types or variations of the Contra Costa California Covenant Not to Sue by Widow of Deceased Stockholder, each designed to suit the specific needs and requirements of the parties involved. Some common types may include: 1. Limited Covenant Not to Sue: This type of covenant may limit the scope of the widow's agreement not to sue to specific areas of concern or particular individuals or actions. 2. General Covenant Not to Sue: This is a broader agreement where the widow agrees not to pursue any legal action related to the deceased stockholder's estate, company, or associated entities. 3. Conditional Covenant Not to Sue: In certain situations, the widow may agree not to sue as long as certain conditions are met. For example, the widow may require specific actions to be taken or certain benefits to be provided before waiving their right to pursue legal recourse. Overall, the Contra Costa California Covenant Not to Sue by Widow of Deceased Stockholder ensures a smooth and peaceful resolution of ownership transfers and helps mitigate potential conflicts or disputes. It serves as a legal safeguard for all parties involved and offers a pathway for an amicable resolution in probate proceedings or company succession.

Contra Costa California Covenant Not to Sue by Widow of Deceased Stockholder

Description

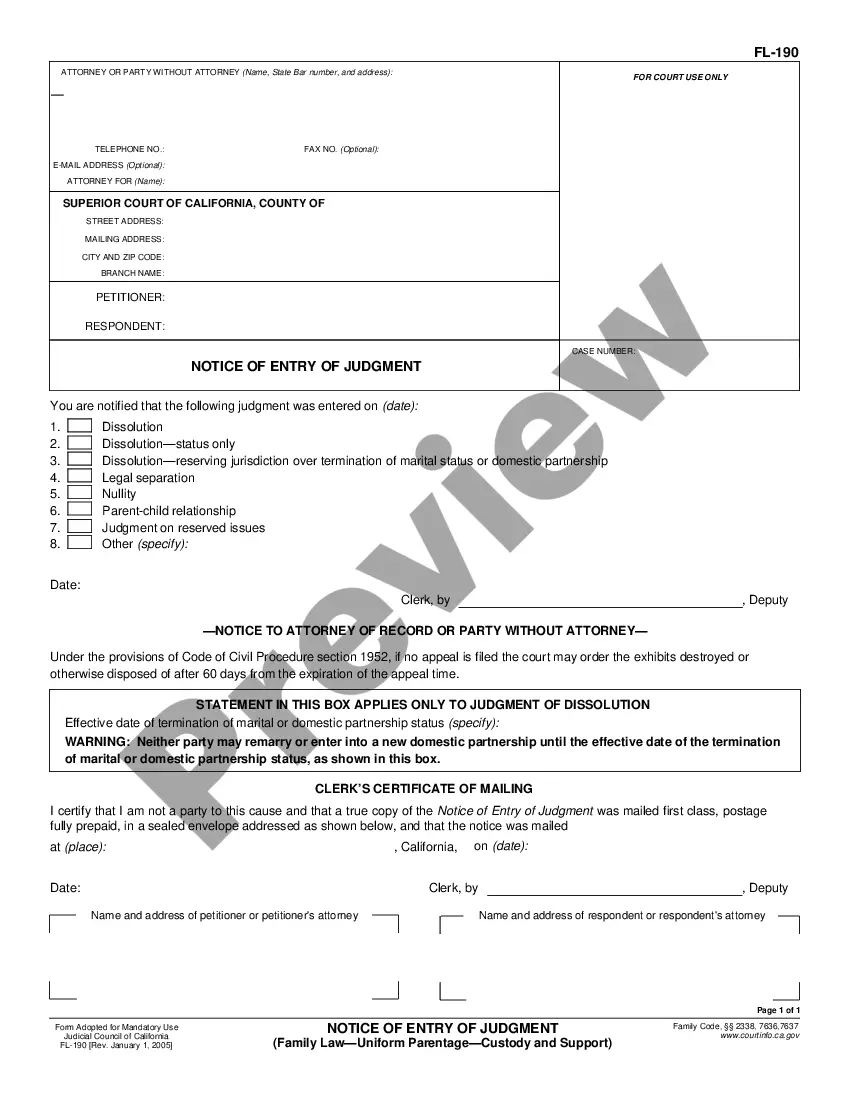

How to fill out Contra Costa California Covenant Not To Sue By Widow Of Deceased Stockholder?

Draftwing paperwork, like Contra Costa Covenant Not to Sue by Widow of Deceased Stockholder, to manage your legal matters is a difficult and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms created for various cases and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Contra Costa Covenant Not to Sue by Widow of Deceased Stockholder template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Contra Costa Covenant Not to Sue by Widow of Deceased Stockholder:

- Make sure that your form is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Contra Costa Covenant Not to Sue by Widow of Deceased Stockholder isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our service and download the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!