Suffolk New York Covenant Not to Sue by Widow of Deceased Stockholder is a legally binding agreement that protects the interests and rights of the widow of a deceased stockholder in Suffolk, New York. This covenant acts as a waiver of any legal action that the widow may have against the company or other stakeholders regarding the stockholder's estate and rights. The Suffolk New York Covenant Not to Sue ensures that the widow agrees not to initiate any legal proceedings, including lawsuits or claims, against the company or anyone associated with it, preserving the stability and integrity of the business. It serves as a means to avoid costly and time-consuming litigation while providing the widow with certain benefits and assurances. The covenants may vary in terms of their specific provisions, such as the duration of the covenant, compensation or benefits provided to the widow, or any limitations on her ability to sell or transfer her deceased spouse's stock ownership. Additionally, there may be multiple types of Covenant Not to Sue agreements specific to situation or circumstances. These can include: 1. Limited Covenant Not to Sue: This type of covenant restricts the widow from suing only specific parties concerning certain aspects of the stockholder's estate, providing some level of protection while allowing legal actions against others if necessary. 2. Comprehensive Covenant Not to Sue: A comprehensive covenant encompasses a broader range of potential legal actions, preventing the widow from suing any party connected to the stockholder's estate, including the company, its directors, officers, or shareholders. 3. Conditional Covenant Not to Sue: This type of covenant includes conditions that the widow must meet in order to maintain its enforceability. These conditions might involve reaching a certain agreement, receiving certain benefits, or fulfilling specific obligations. 4. Unconditional Covenant Not to Sue: An unconditional covenant does not impose any explicit conditions on the widow, meaning they are not required to fulfill any specific obligations or meet any particular requirements for the agreement to remain in effect. It should be noted that the specific provisions and terminology used in each Covenant Not to Sue may vary depending on the contractual agreement between the widow and the relevant parties involved. These agreements are typically drafted by legal professionals to ensure compliance with state laws and meet the needs of both parties involved.

Suffolk New York Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out Suffolk New York Covenant Not To Sue By Widow Of Deceased Stockholder?

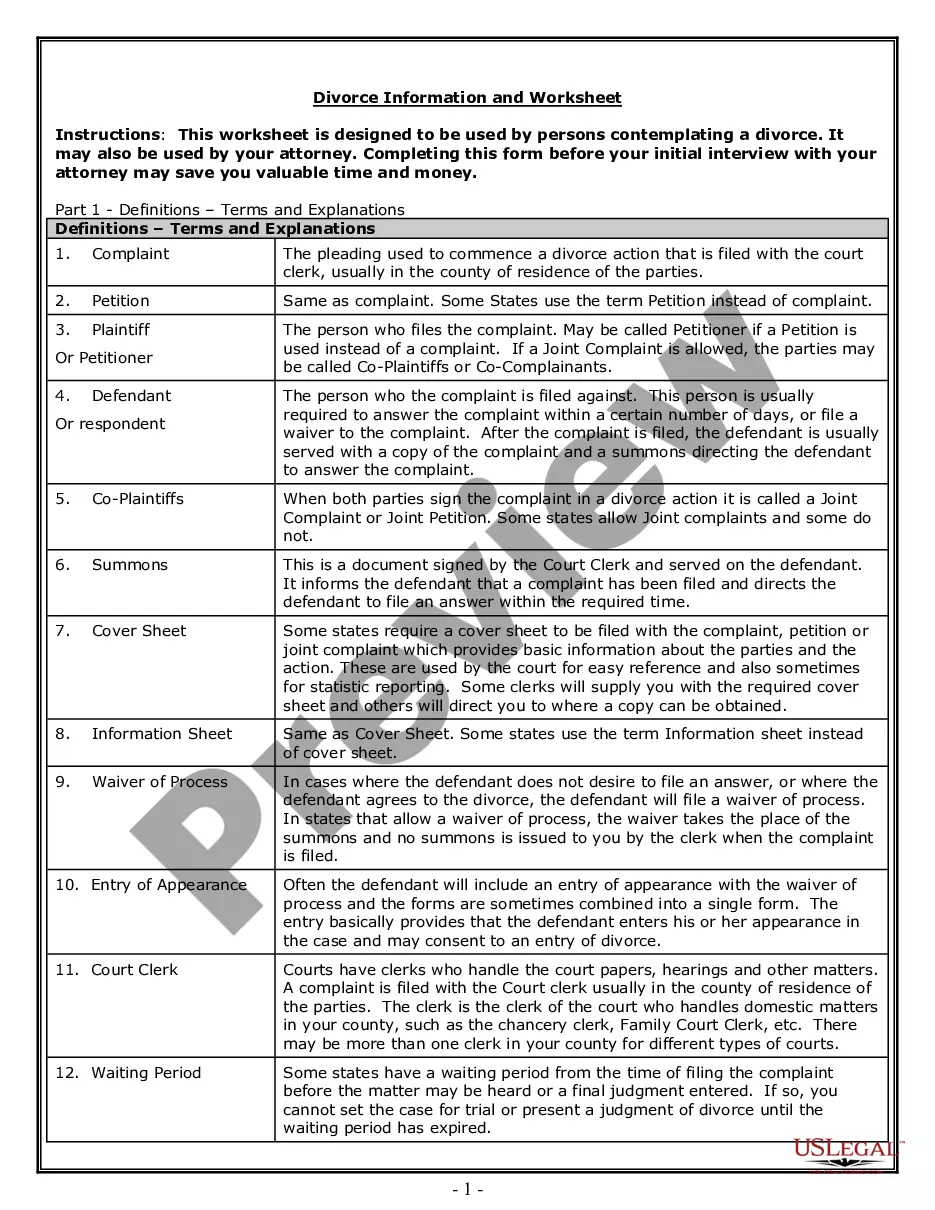

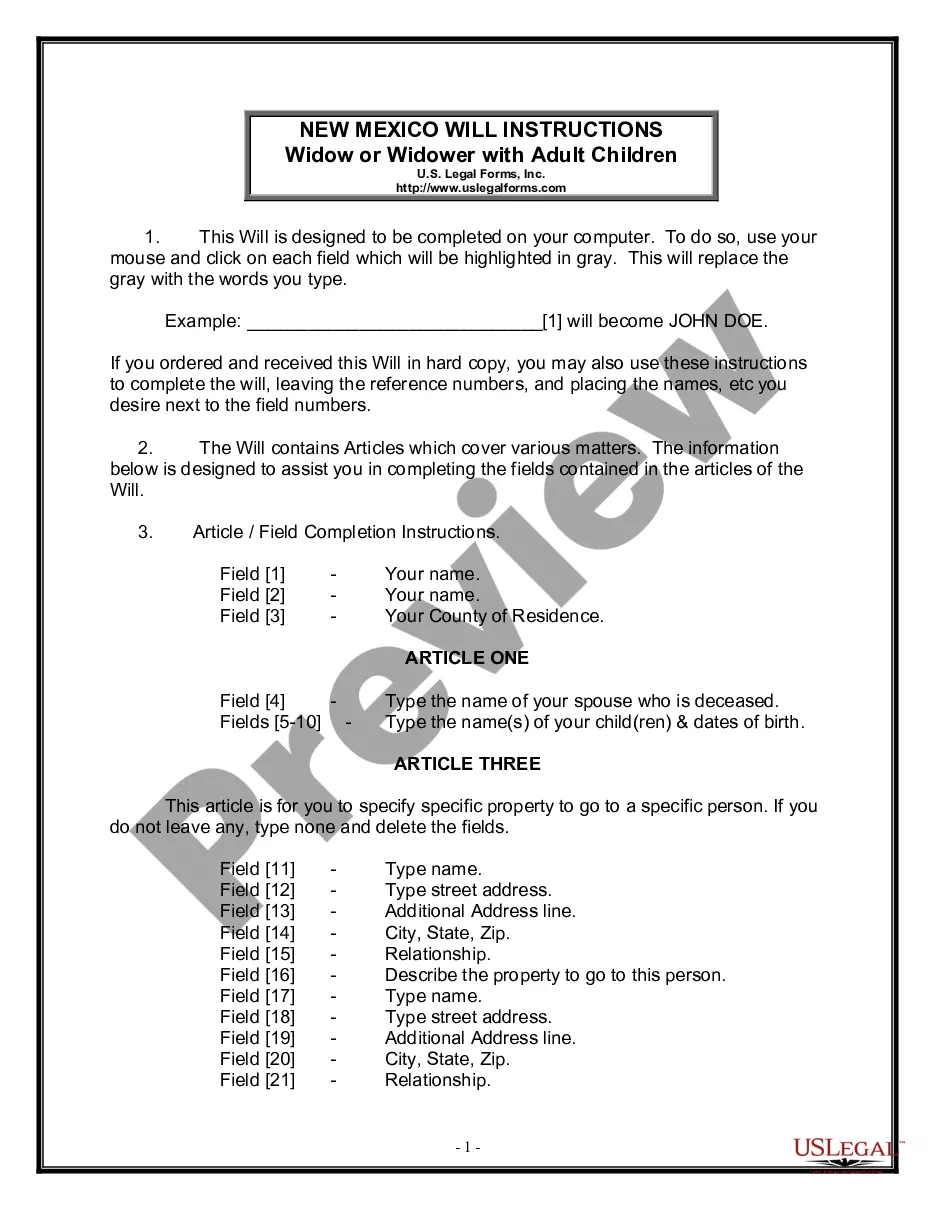

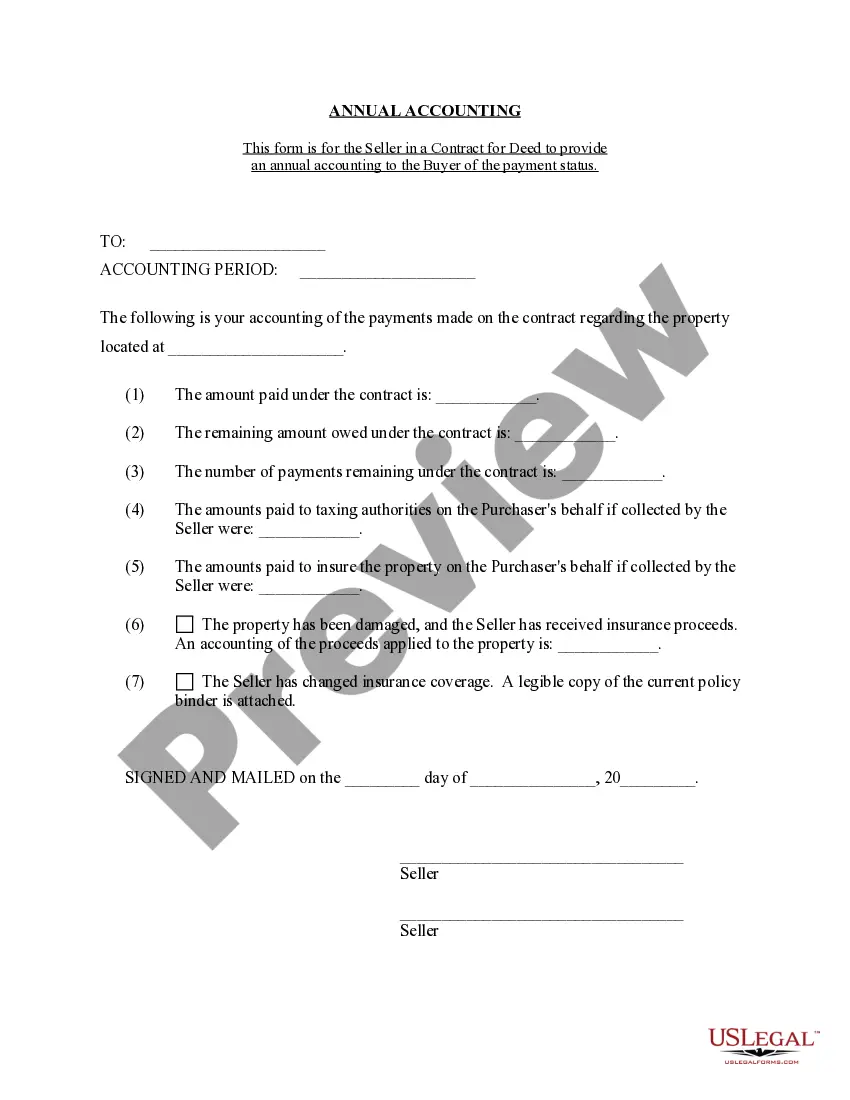

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Suffolk Covenant Not to Sue by Widow of Deceased Stockholder, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Consequently, if you need the current version of the Suffolk Covenant Not to Sue by Widow of Deceased Stockholder, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Covenant Not to Sue by Widow of Deceased Stockholder:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Suffolk Covenant Not to Sue by Widow of Deceased Stockholder and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!