Franklin Ohio Release and Indemnification of Personal Representative by Heirs and Devises is a legal document that provides protection to the personal representative who is handling the estate of a deceased individual (the decedent). This document is intended to release the personal representative from any liability or claims brought by the heirs and devises of the estate. In the context of probate and estate administration in Franklin, Ohio, this release and indemnification serves as a crucial agreement between the personal representative and the beneficiaries of the decedent's estate. It ensures that the personal representative can carry out their duties without the fear of potential legal actions or disputes. The Franklin Ohio Release and Indemnification of Personal Representative by Heirs and Devises essentially provides legal protection to the personal representative against claims arising from their administration of the estate. This means that heirs and devises cannot hold the personal representative personally responsible for any losses, errors, or mistakes that may occur during the estate administration process, as long as the personal representative has acted in good faith and within the bounds of their duties. This document also indemnifies the personal representative, which means that the heirs and devises of the estate agree to compensate the personal representative for any reasonable and necessary expenses incurred while administering the estate. It ensures that the personal representative will not be personally liable for any costs related to the estate administration, such as court fees, legal fees, or other expenses directly associated with the probate process. Different types or variations of the Franklin Ohio Release and Indemnification of Personal Representative by Heirs and Devises may include specific clauses or provisions tailored to the unique circumstances of each estate. For instance, there may be different indemnity provisions in cases where there are disputes or concerns about potential mismanagement of assets. However, the core purpose of these documents remains the same — to protect the personal representative from personal liability and to outline the obligations of the heirs and devises in compensating the personal representative for their administration efforts. In summary, the Franklin Ohio Release and Indemnification of Personal Representative by Heirs and Devises is a vital legal document that ensures the personal representative can fulfill their duties without facing personal liability. By signing this agreement, the heirs and devises release the personal representative from any claims and agree to cover reasonable expenses incurred during the estate administration process. This document provides peace of mind to both the personal representative and the beneficiaries, enabling the smooth transfer of assets and the proper handling of the decedent's estate.

Franklin Ohio Release and Indemnification of Personal Representative by Heirs and Devisees

Description

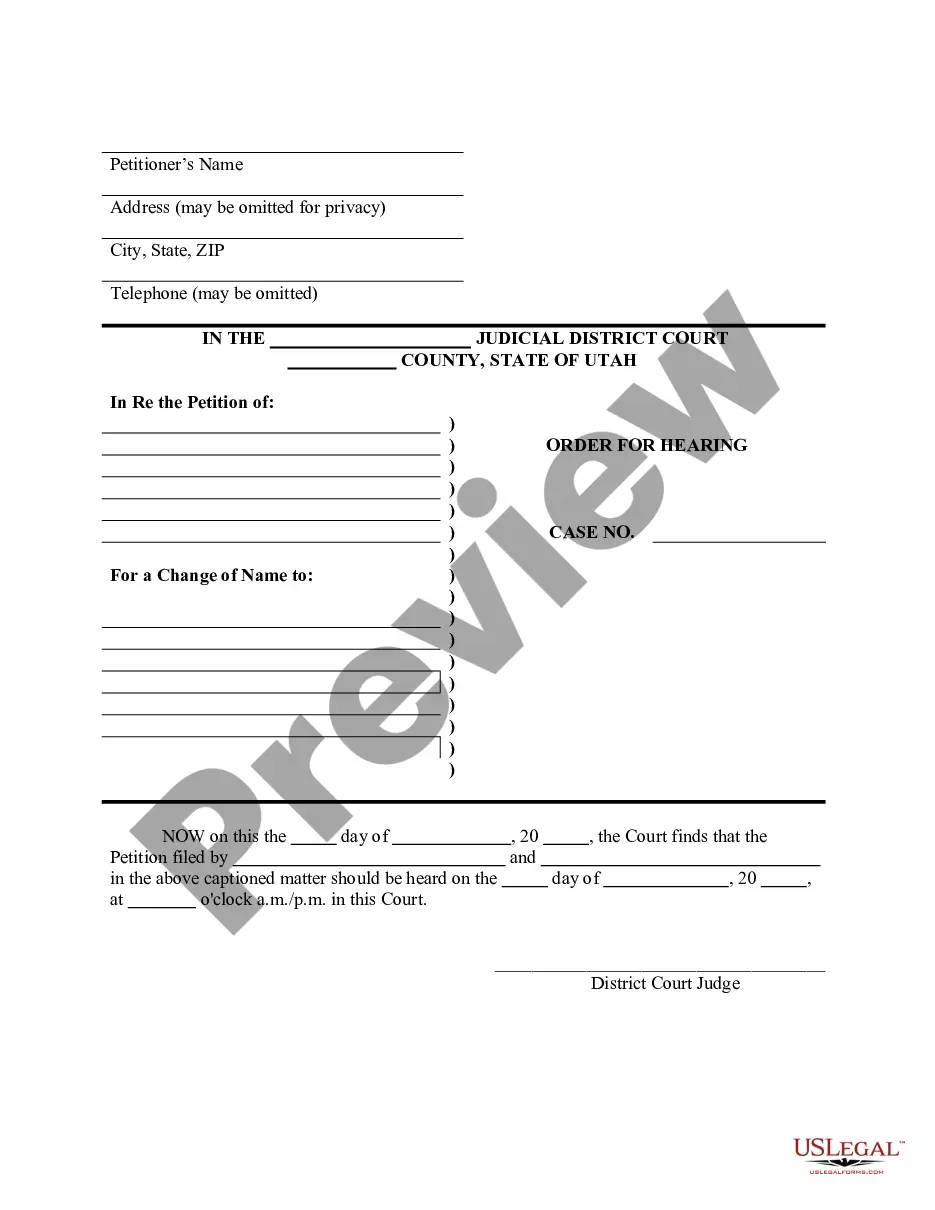

How to fill out Franklin Ohio Release And Indemnification Of Personal Representative By Heirs And Devisees?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Franklin Release and Indemnification of Personal Representative by Heirs and Devisees is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Franklin Release and Indemnification of Personal Representative by Heirs and Devisees. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Release and Indemnification of Personal Representative by Heirs and Devisees in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

In North Carolina, creditors have 90 days after initial publication or mailing of a creditor notice to make a claim against the estate. While illegitimate claims are uncommon, the executor must review and vet all claims, then pass approved claims to the probate court judge.

In North Carolina, creditors have at most 3 years from the date of death to file claims against the estate.

On the form, you state that the value of the estate's personal property (everything but real estate) is less than $20,000 (or less than $30,000 if the surviving spouse inherits everything under state law) and that at least 30 days have passed since the person's death.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

The California petition for final distribution gives the court a detailed history of the probate case. More specifically, it explains why the estate is ready to close and outlines the distributions to beneficiaries.

Q: How do I claim against an estate? Step 1: Establish grounds to make a claim.Step 2: Check the time limits.Step 3: Consider entering a caveat.Step 4: Consider Alternative Dispute Resolution.Step 5: Follow the Pre Action Protocol.Step 6: Commence court proceedings.

The final distribution of probate is the transfer of title and assets to the heirs and beneficiaries named in the decedent's estate. This takes place after the probate has been fully administered and the judge signs off that the estate is settled and can be distributed.

A will must be filed with the court in North Carolina. State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

In North Carolina, creditors have 90 days after initial publication or mailing of a creditor notice to make a claim against the estate. While illegitimate claims are uncommon, the executor must review and vet all claims, then pass approved claims to the probate court judge.