Wayne Michigan Release and Indemnification of Personal Representative by Heirs and Devises is a legal agreement that outlines the process by which an appointed personal representative may be released from any legal responsibilities or liabilities related to the administration of an estate in Wayne County, Michigan. This release and indemnification document is an important aspect of estate planning and probate administration. It allows heirs and devises, who are the beneficiaries named in a deceased person's will, to release the personal representative (also known as an executor or administrator) from any claims, demands, or causes of action arising from the personal representative's actions or omissions during the estate administration. The personal representative acts as the fiduciary of the estate, overseeing tasks such as identifying and collecting assets, paying debts and taxes, and ultimately distributing the estate to the rightful heirs and devises. However, unforeseen issues or disagreements can arise during the administration process. In such cases, the release and indemnification agreement protects the personal representative from legal disputes initiated by beneficiaries. The document may include clauses releasing the personal representative from claims related to the interpretation, implementation, or administration of the deceased person's will, as well as any mistakes or errors of judgment made by the personal representative. Indemnification clauses may also specify that the personal representative will be reimbursed for any reasonable expenses or costs incurred while carrying out their duties. Several types of Wayne Michigan Release and Indemnification of Personal Representative by Heirs and Devises exist, including: 1. General Release and Indemnification: This type releases the personal representative from all past, present, and future claims arising from the estate administration. It provides broad protection for the personal representative regarding their actions during the entire process. 2. Partial Release and Indemnification: This type releases the personal representative only from specific claims or liabilities agreed upon by the heirs and devises. It may be used when there are limited concerns or disputes arising from the estate administration. 3. Limited Release and Indemnification: This type releases the personal representative from certain specific claims, liabilities, or acts, providing narrow protection against potential legal actions related to those specific issues. It is important for both personal representatives and the beneficiaries to carefully review and understand the Wayne Michigan Release and Indemnification of Personal Representative by Heirs and Devises document before signing. Seeking legal counsel or guidance is advisable to ensure that the terms are fair, reasonable, and comply with state laws and regulations governing estate administration in Wayne County, Michigan.

Wayne Michigan Release and Indemnification of Personal Representative by Heirs and Devisees

Description

How to fill out Wayne Michigan Release And Indemnification Of Personal Representative By Heirs And Devisees?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Wayne Release and Indemnification of Personal Representative by Heirs and Devisees, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Wayne Release and Indemnification of Personal Representative by Heirs and Devisees from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Wayne Release and Indemnification of Personal Representative by Heirs and Devisees:

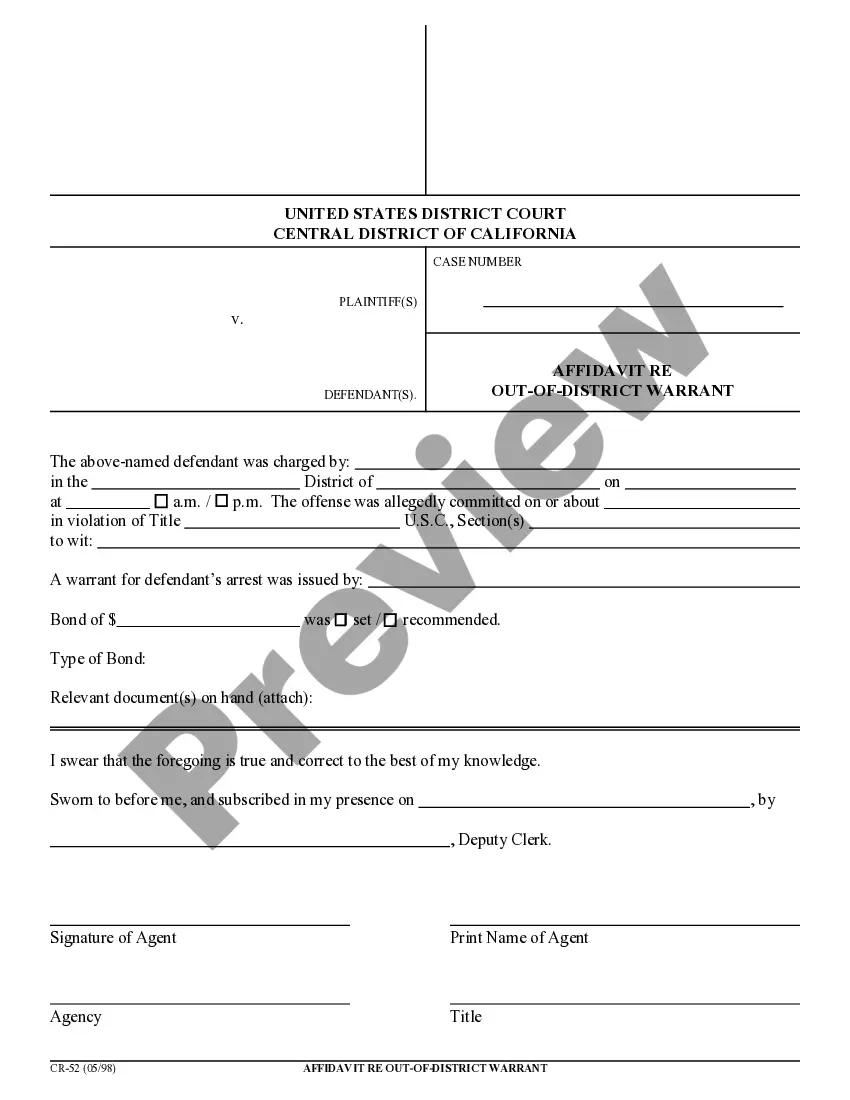

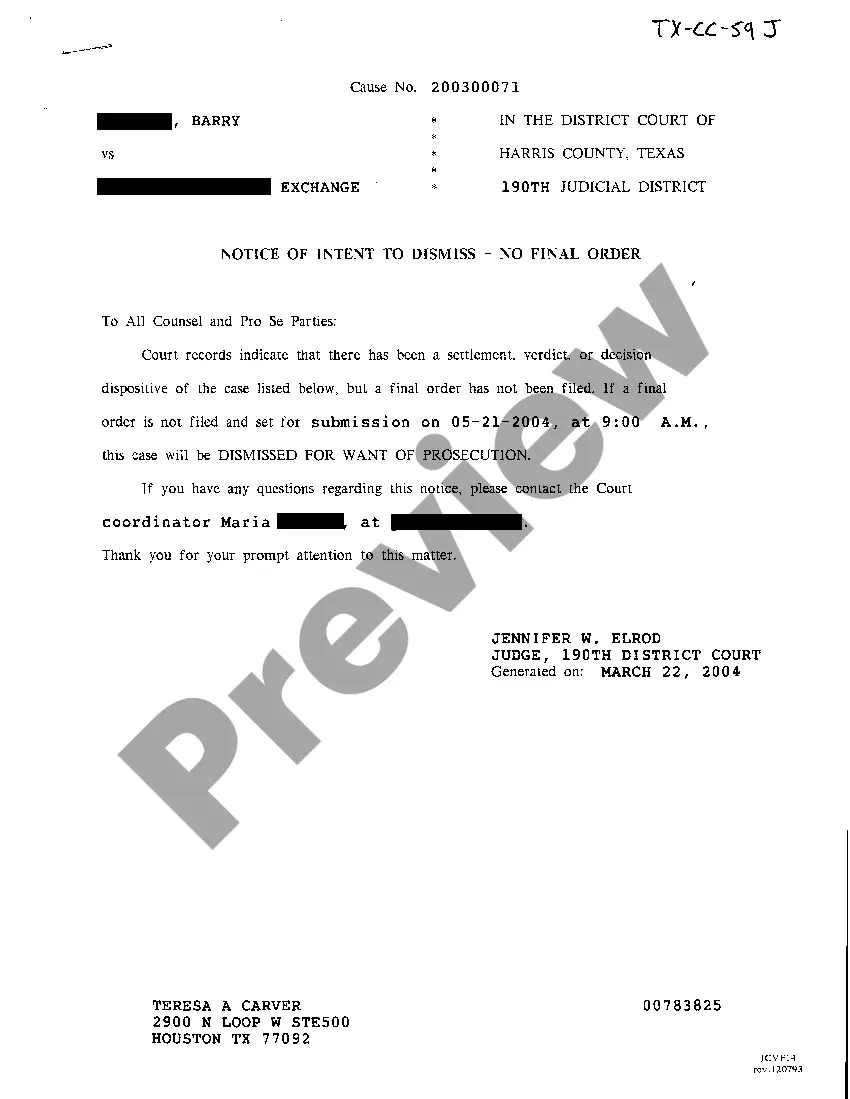

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Who Can Serve As A Personal Representative? An individual appointed as Personal Representative in the decedent's Will. The surviving spouse, if the spouse is a beneficiary under the Will. Other beneficiaries of the Will. The surviving spouse if he or she is not a beneficiary under the Will. Other heirs of the decedent.

In order to get a Letter of Authority, you must open a Probate Estate and petition the Probate Court to become the Estate's Personal Representative. Once the court appoints you as the Personal Representative, you will be issued your Letter of Authority.

A creditor has 4 months from the date of publication or 1 month from the date they receive actual notice, whichever is later, to present their written claim or it will be barred.

Executor Fees in Michigan For example, if in the last year, executor fees were typically 1.5%, then 1.5% would be considered reasonable and 3% may be unreasonable. But the court can take into account other factors such as how complicated the estate is to administer and may increase or decrease the amount from there.

An estate cannot be closed in less than five months from filing. The estate's creditors must be notified of the decedent's death. They are given a four-month period to file their claims against the estate.

If you want to be the personal representative, complete the Application for Informal Probate and/ or Appointment of Personal Representative form. File the form, the decedent's will (if there is one), and a certified copy of the death certificate with the county probate court where the decedent lived.

Since every estate is different, the time it takes to settle the estate may also differ. Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

Formal Probate Most Michigan probate cases can be wrapped up within seven months to a year after the personal representative is appointed. After notice of the probate is given, creditors have four months to file a claim. (Mich. Comp.

An estate cannot be closed in less than five months from filing. The estate's creditors must be notified of the decedent's death. They are given a four-month period to file their claims against the estate.

An executor must account to the residuary beneficiaries named in the Will (and sometimes to others) for all the assets of the estate, including all receipts and disbursements occurring over the course of administration.