Montgomery County, located in the state of Maryland, boasts a robust financial sector, home to numerous accounting firms catering to both businesses and individuals in need of professional financial services. This article will delve into the concept of Montgomery Maryland Model Letter Accountants to Auditors, outlining the significance and types of such letters exchanged between accountants and auditors. In Montgomery Maryland, Model Letter Accountants to Auditors refers to a communication tool utilized by accountants to provide essential information and documentation to auditors. This model letter serves as a bridge between the accounting firm responsible for preparing financial statements and the external auditing firm responsible for conducting an independent examination of these financial statements. The primary purpose of this letter is to facilitate effective communication and collaboration between accountants and auditors, ensuring a smooth workflow and enabling both parties to fulfill their responsibilities accurately and efficiently. Different types of Montgomery Maryland Model Letter Accountants to Auditors may include: 1. Engagement Letter: This letter outlines the terms and conditions of the engagement between the accounting firm and the auditing firm. It discusses the objectives, scope, and limitations of the audit, as well as the responsibilities of both parties. The engagement letter sets the foundation for the auditors' work and enables accountants and auditors to align their efforts effectively. 2. Management Representation Letter: This letter is prepared by the accounting firm and addressed to the auditors to obtain written confirmation on various representations made by management. It covers areas such as the completeness and accuracy of financial records, absence of fraud, compliance with accounting standards, and disclosure of any known contingencies. By obtaining management's representation through this letter, auditors can ensure the reliability of the information provided. 3. Subsequent Events Letter: This type of letter highlights any significant events or transactions occurring between the date of the financial statements and the auditor's report. It enables the accountants to inform auditors about any subsequent events that may impact the financial statements and assists auditors in determining the appropriate treatment and disclosure of such events. 4. Letter of Inquiry: This letter allows the auditors to request specific information from accountants, seeking clarification on significant accounting policies, procedures, or any other relevant matters. The letter of inquiry helps auditors gain a better understanding of the financial records and ensures accurate reporting. In conclusion, Montgomery Maryland Model Letter Accountants to Auditors plays a vital role in promoting effective communication and cooperation between accounting firms and auditing firms. Whether through engagement letters, management representation letters, subsequent events letters, or letters of inquiry, these letters facilitate the proper exchange of information and enhance the overall quality and reliability of financial reporting.

Montgomery Maryland Model Letter Accountants To Auditors

Description

How to fill out Montgomery Maryland Model Letter Accountants To Auditors?

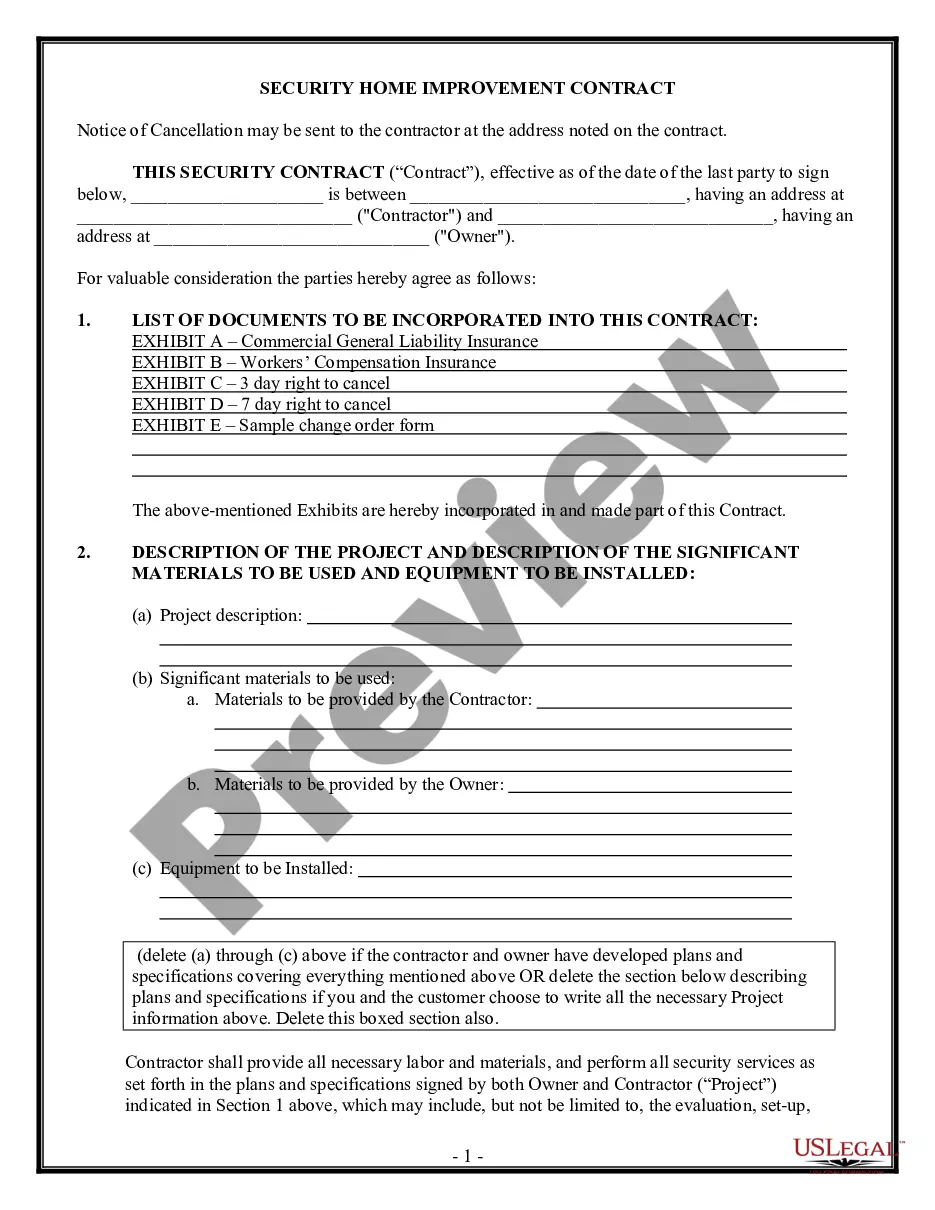

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including Montgomery Model Letter Accountants To Auditors, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any activities related to paperwork completion straightforward.

Here's how to purchase and download Montgomery Model Letter Accountants To Auditors.

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the validity of some records.

- Check the similar document templates or start the search over to find the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Montgomery Model Letter Accountants To Auditors.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Montgomery Model Letter Accountants To Auditors, log in to your account, and download it. Needless to say, our website can’t replace a lawyer entirely. If you have to deal with an extremely challenging situation, we advise getting a lawyer to review your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-specific documents with ease!

Form popularity

FAQ

The first paragraph states the responsibilities of the auditor and directors. The second paragraph contains the scope, stating that a set of standard accounting practices was the guide. The third paragraph contains the auditor's opinion.

Management Letter means a letter prepared by the auditor which discusses findings and recommendations for improvements in internal control, that were identified during the audit and were not required to be included in the auditor's report on internal control, and other management issues.

An unqualified opinion is the most common type given in an auditor's report. Like any auditor's opinion, it does not judge the actual financial position of the company or interpret financial data.

Summary. An audit letter of representation is a form letter prepared by a company's service auditor and signed by a member of senior management. In the letter, management attests to the accuracy and completeness of the information provided to the service auditors for their analysis.

An adverse audit opinion can damage a company's status....The four types of auditor opinions are: Unqualified opinion-clean report. Qualified opinion-qualified report. Disclaimer of opinion-disclaimer report. Adverse opinion-adverse audit report.

Request an account audit letter An audit letter gives your auditor a summary of your account information. They'll need this for financial reporting or audit purposes.

10 Best Practices for Writing a Digestible Audit Report Reference Everything.Include a Reference Section.Use Figures, Visuals, and Text Stylization.Note Key Statistics about the Entity Audited.Make a Findings Sandwich.Ensure Every Issue Includes the 5 C's of Observations.Include Detailed Observations.

The purpose of the letter is to communicate to those charged with governance, such as the Board of Directors, Audit Committee, President, or Management, the scope of audit procedures performed, significant findings, and other information, such as disagreements with management, audit adjustments and significant

Most audit opinion letters consist of three paragraphs. The introductory paragraph identifies the company, accounting period and auditor's responsibilities. The second discusses the scope of work performed. The third paragraph contains the audit opinion.

Montgomery Auditing is a systematic examination of the books and records of business or other organization, in order to ascertain or verify and to report upon the facts regarding its financial operations and the result thereof.