Nassau New York Model Letter Accountants to Auditors is a standardized communication tool used by accountants residing in Nassau, New York, to interact with auditors during financial audits. This letter serves as a formal means of transmitting important information, clarifying procedures, and ensuring effective collaboration between accountants and auditors in the auditing process. The Nassau New York Model Letter Accountants to Auditors addresses a variety of topics related to the audit process. Typically, it includes details about the scope of the audit, critical dates, engagement objectives, and specific requirements set forth by regulatory bodies such as the New York State Department of Taxation and Finance, the Securities and Exchange Commission, or the Financial Accounting Standards Board. Furthermore, this model letter encompasses various types depending on the specific audit engagement: 1. Financial Statement Audits: This type of letter focuses on the process of verifying financial statements and ensuring adherence to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). 2. Internal Control Audits: Here, the letter discusses the evaluation of an organization's internal controls and the effectiveness of their design and implementation in mitigating risks and ensuring financial integrity. 3. Compliance Audits: This category of the letter caters to audits assessing an entity's compliance with specific laws, regulations, or contractual requirements. These can include audits related to tax compliance, government grants, or industry-specific regulations. 4. Forensic Audits: A model letter related to forensic audits emphasizes investigations into financial misconduct, fraud, or other irregularities. It outlines the objectives, methodologies, and support needed to carry out the examination thoroughly. 5. Information Systems Audits: This type of model letter addresses audits that assess an organization's data integrity, IT infrastructure, and security controls to ensure the reliability and confidentiality of financial information. The Nassau New York Model Letter Accountants to Auditors acts as a robust communication tool, streamlining the exchange of critical information between accountants and auditors. By following this standardized format, accountants and auditors can establish clear expectations, enhance efficiency, and maintain the highest standards of professional excellence throughout the auditing process in Nassau, New York.

Nassau New York Model Letter Accountants To Auditors

Description

How to fill out Nassau New York Model Letter Accountants To Auditors?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Nassau Model Letter Accountants To Auditors, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Consequently, if you need the latest version of the Nassau Model Letter Accountants To Auditors, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Nassau Model Letter Accountants To Auditors:

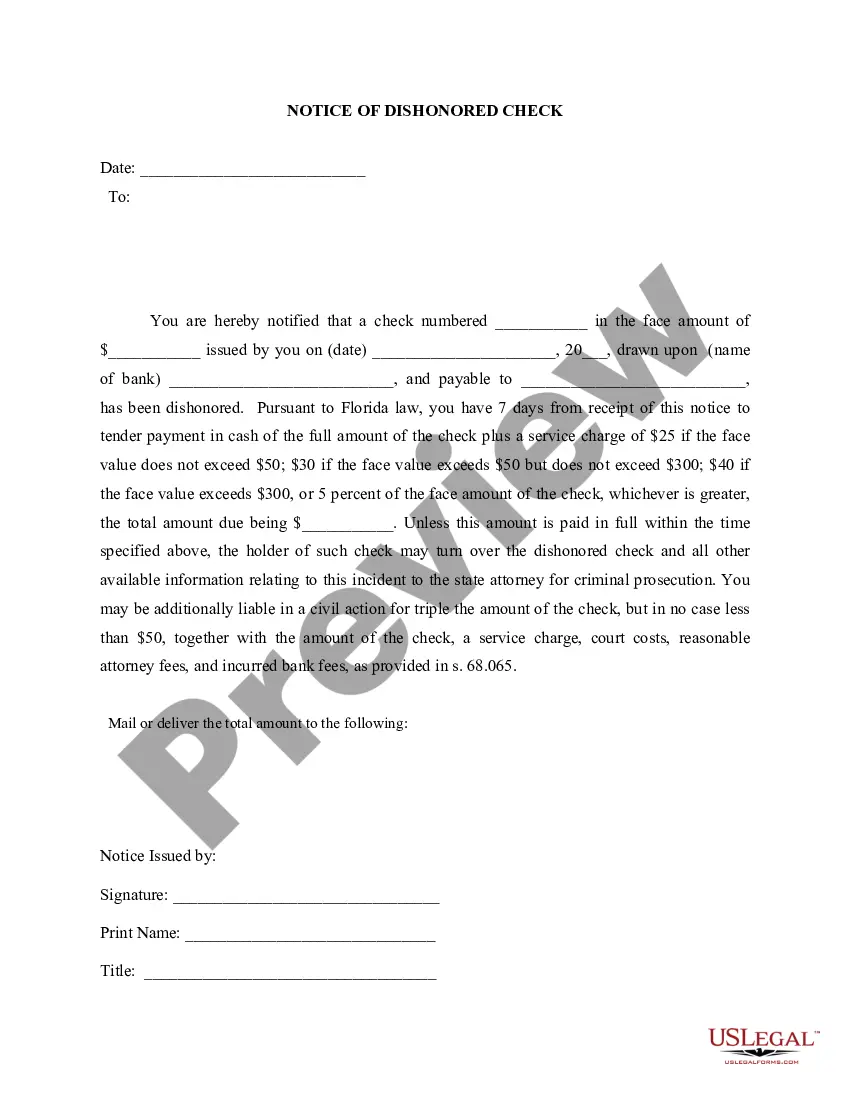

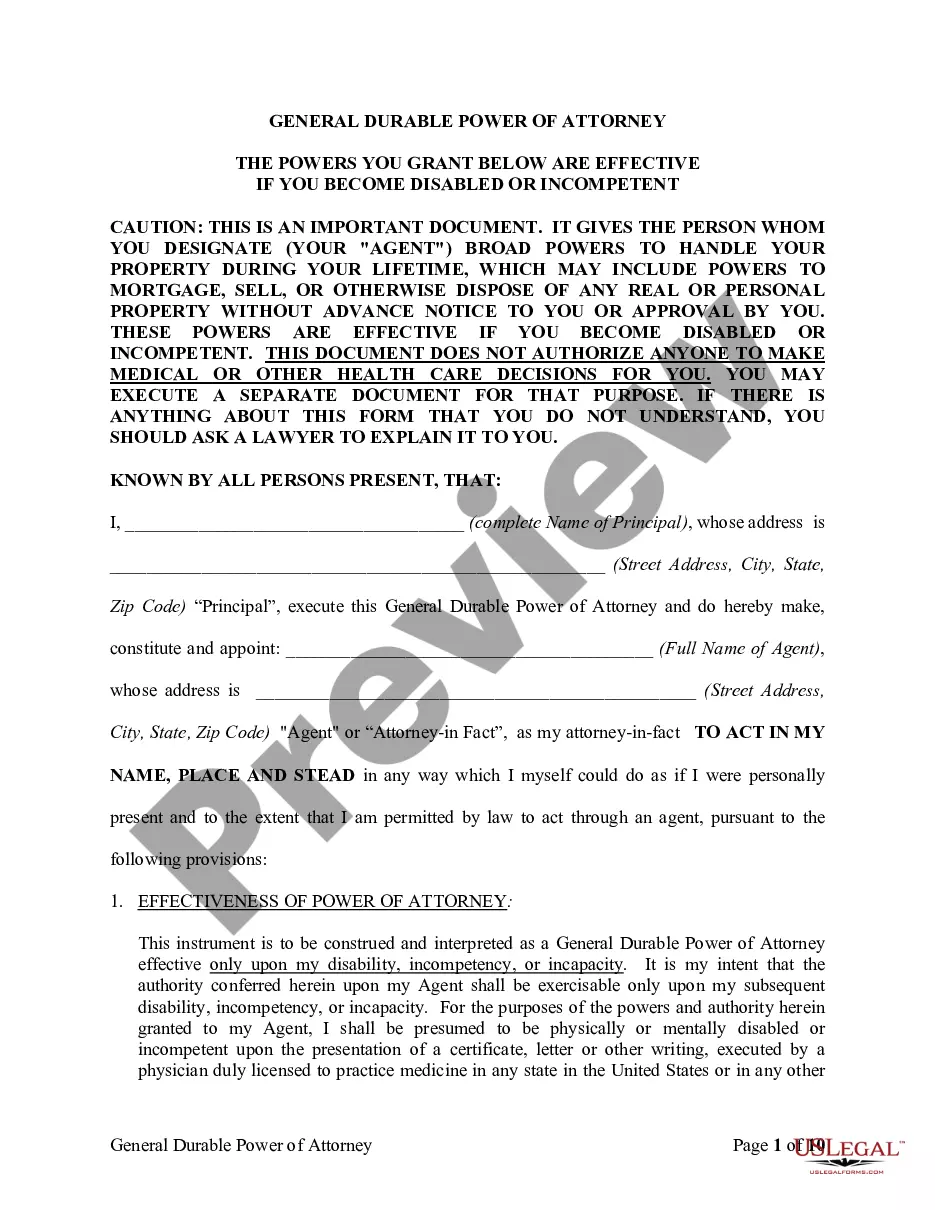

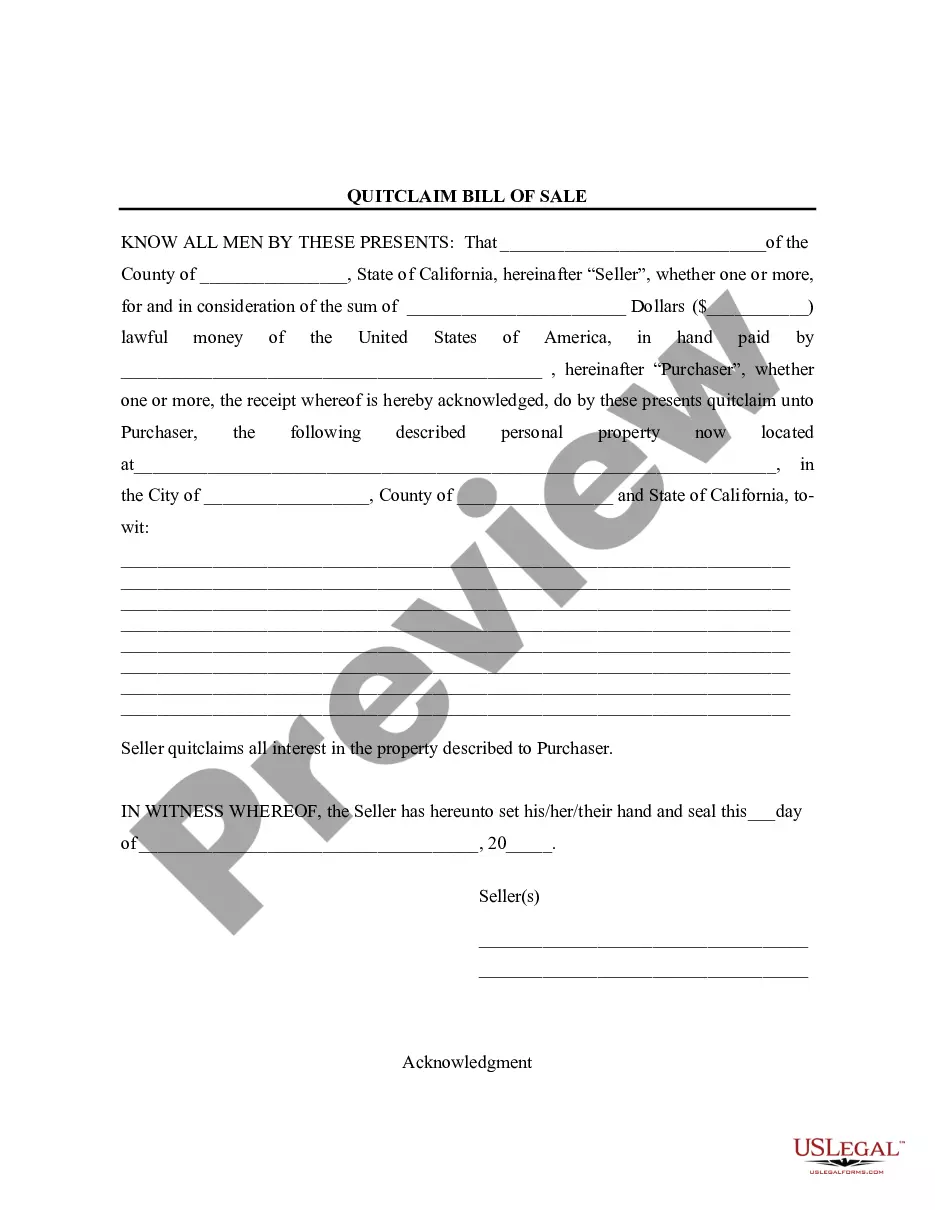

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Nassau Model Letter Accountants To Auditors and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!