Dear [Auditor's Name], I hope this letter finds you in good health and high spirits. I am writing to provide you with a detailed description of our Phoenix Arizona Model Letter Accountants to Auditors service. Our firm, [Accounting Firm Name], specializes in assisting auditors with their financial statement audits by providing accurate and comprehensive model letters specifically designed for the Phoenix, Arizona region. In today's fast-paced business environment, auditors often encounter challenges in collecting and verifying necessary financial information. Our goal is to streamline the audit process by equipping auditors with model letters tailored to the unique requirements and regulations of Phoenix, Arizona. These letters serve as professional templates, ensuring consistency and compliance throughout the auditing procedures. Our Phoenix Arizona Model Letter Accountants to Auditors service covers various types of letters that address specific needs and scenarios. Here are some of the key types available: 1. Confirmation Letters: We offer pre-drafted letters for accounts receivable, accounts payable, bank balances, inventory, and other significant financial statements areas requiring external confirmation. These letters comply with the relevant accounting standards and local regulatory requirements. 2. Management Representation Letters: Our model letters enable auditors to obtain written representations from management regarding various assertions made in the financial statements. These letters are essential for strengthening the audit evidence and ensuring transparency in the audit process. 3. Inquiry Letters: We provide a range of inquiry letters that auditors can utilize to gather information from third parties. These letters cover areas such as legal matters, related party transactions, contingent liabilities, and other significant areas relevant to the audit. 4. Engagement Letters: Our model engagement letters outline the terms, conditions, and objectives of the engagement between the auditor and the audited entity. These letters are crucial for establishing a professional relationship and clearly defining responsibilities and expectations. 5. Subsequent Event Letters: Auditors can utilize our model letters to communicate with management if any significant events occur after the balance sheet date but before the issuance of the financial statements. These letters address the assessment, disclosure, and potential impact of subsequent events. 6. Audit Inquiry Response Letters: Our model letters assist auditors in responding to audit inquiries from other auditors or regulatory bodies. These letters facilitate effective communication and integration between audit teams, ensuring a seamless audit process. Our Phoenix Arizona Model Letter Accountants to Auditors service is continuously updated to reflect the latest changes in accounting standards, legislative requirements, and best practices. We invest significant resources in research and collaboration with industry experts to ensure the accuracy, relevance, and effectiveness of our model letters. We firmly believe that utilizing our Phoenix Arizona Model Letter Accountants to Auditors service will enhance the efficiency of audits, save valuable time, and provide auditors with confidence in the accuracy of financial information. Each model letter can be customized to fit the specific circumstances of the audit engagement, ensuring compliance with both professional standards and local regulations. We appreciate your time and consideration and would be delighted to discuss our service further or provide you with samples of our model letters. Please do not hesitate to contact us at [Contact Information] for any inquiries or clarifications. Thank you for your attention, and we look forward to the opportunity to support you in your auditing endeavors. Sincerely, [Your Name] [Your Title/Position] [Accounting Firm Name]

Phoenix Arizona Model Letter Accountants To Auditors

Description

How to fill out Phoenix Arizona Model Letter Accountants To Auditors?

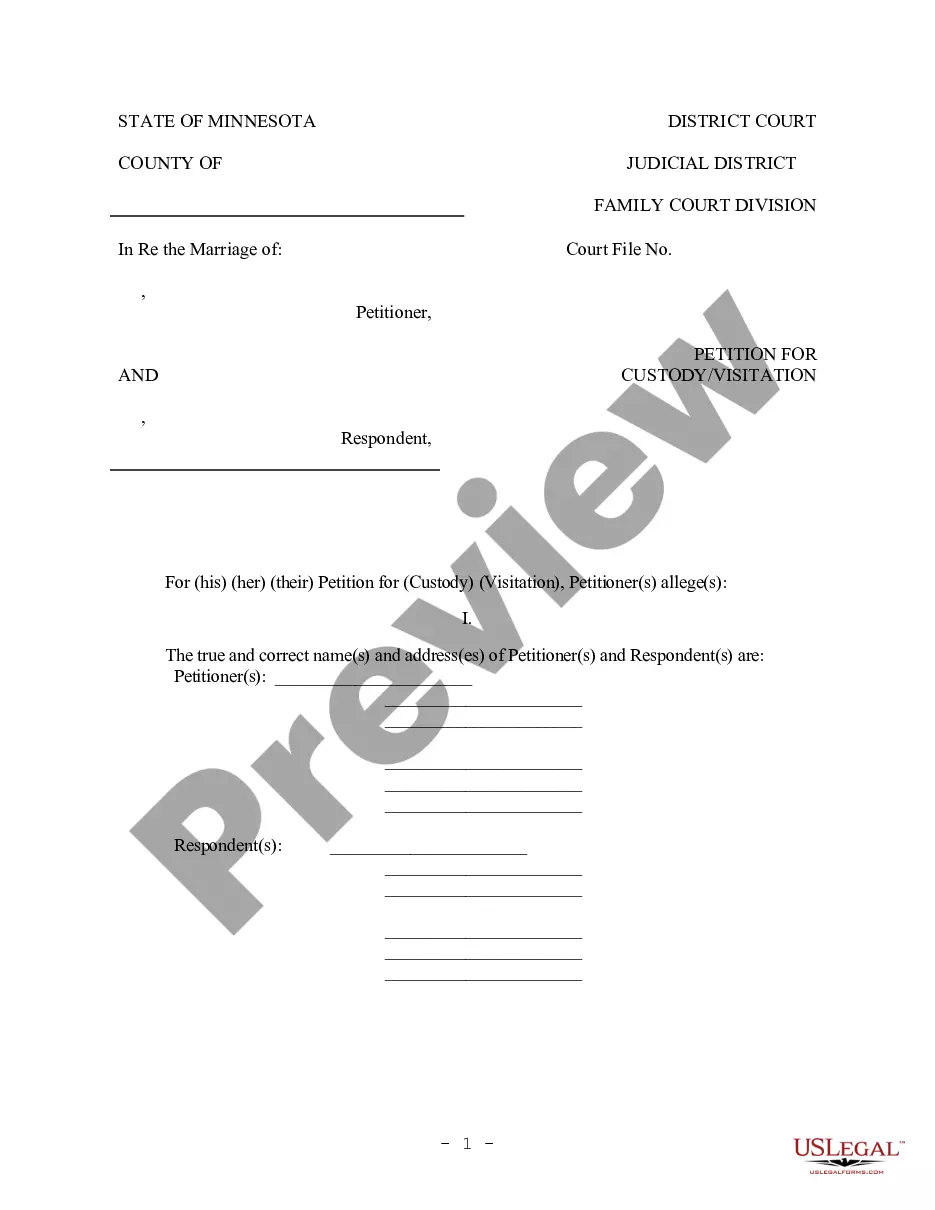

Are you looking to quickly draft a legally-binding Phoenix Model Letter Accountants To Auditors or probably any other document to handle your own or corporate affairs? You can go with two options: hire a legal advisor to write a valid document for you or create it entirely on your own. Luckily, there's a third option - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including Phoenix Model Letter Accountants To Auditors and form packages. We offer templates for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, carefully verify if the Phoenix Model Letter Accountants To Auditors is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to verify what it's suitable for.

- Start the search over if the document isn’t what you were hoping to find by using the search bar in the header.

- Select the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Phoenix Model Letter Accountants To Auditors template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. In addition, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

An audit request list, or a provided by client list (PBC list), is a list of items an auditor will need to perform an audit. The required items tend to be dynamic, meaning the auditor will usually need to change, add, or edit the number and type of documents required as the audit progresses.

Commonly Used Components of Audit Documentation Describes the name of project. Has a title. Includes the auditor's initials. Documents the date completed. Includes a page number and reference. Describes the source, purpose, procedures, results, conclusions. Explains all tick marks. Ensures that all cross-references go two ways.

Audit Engagement Letters The engagement letter documents and confirms the auditor's acceptance of the appointment, the objective and scope of the audit, the extent of the auditor's responsibilities to the client and the form of any reports.

Its purpose is to anticipate and answer your questions. Why Is a Representation Letter Required? The auditor's report lends credibility to financial statements that are used by bankers, investors and others. The auditor must comply with rigorous standards that govern the process and procedures of an audit.

See the exam guidance memos in IRS Operations During COVID-19: Compliance. An IRS audit is a review/examination of an organization's or individual's accounts and financial information to ensure information is reported correctly according to the tax laws and to verify the reported amount of tax is correct.

The technical answer is that the letter is a requirement of the American Institute of Certified Public Accountants, the governing body for CPAs. Thus all CPAs should be requiring this letter for all audit engagements.

Audit Findings In each case, the audit letter typically requests documentation that must be returned to the IRS for review and the IRS will follow up after that information is reviewed. You also can send your own letter to the IRS explaining any issues that require resolution.

Written representation ? A written statement by management provided to the auditor to confirm certain matters or to support other audit evidence. Written representations in this context do not include financial statements, the assertions therein, or supporting books and records.

You received this notice because the IRS is auditing your tax return. We're asking for information to verify items you claimed on your tax return. You must send in the documents needed to close your audit or we will send you an audit report showing our proposed changes. Please don't ignore this notice.