Subject: Request for Tax Receipt for Fundraiser Dinner Attendance — Fulton, Georgia Dear [Fundraiser Committee/Event Organizer], I hope this letter finds you well. I am writing to kindly request a tax receipt for my attendance at the recent fundraiser dinner held in Fulton, Georgia on [date]. As a participant committed to supporting your cause, I understand that donations made at the event are eligible for tax deductions. I have included my relevant details below to assist you in issuing the tax receipt accurately: Full Name: [Your Full Name] Mailing Address: [Your Complete Address] Phone Number: [Your Contact Number] Email Address: [Your Email Address] Please ensure that the tax receipt includes the following information: 1. Event Details: — Event Name: [Fundraiser Dinner Event Name] — Event Date: [Date of the Event— - Location: [Specific Venue in Fulton, Georgia] 2. Donation Details: — Amount Contributed: [Amount Donated— - Payment Method: [Specify Payment Method (e.g., Cash, Check, Credit Card)] — Donation Type: [Specify whether it was a General Donation or a Specific Fund/Program] 3. Organization Information: — Fundraiser Beneficiary: [Name of the Organization/Charity] — Registration/Tax ID Number: [Organization's Tax Exempt ID] I kindly request that you provide the tax receipt in a format acceptable for tax purposes, such as a physical copy mailed to the provided address or a digital copy sent via email. If any additional information is required or if there are any specific procedures in place for issuing tax receipts, please do not hesitate to let me know, and I will promptly provide any necessary documentation or complete any required forms. Thank you for organizing such a memorable and impactful fundraiser dinner. I appreciate your dedication to making a difference in our community, and I am honored to have been a part of the event. Your cooperation in providing the tax receipt will greatly assist me in fulfilling my obligations as a taxpayer. Please acknowledge receipt of this letter and confirm when I can expect to receive the tax receipt. Your assistance in this matter is highly appreciated. Once again, thank you for your commitment to improving lives through charitable initiatives. Sincerely, [Your Full Name] [Your Contact Information]

Fulton Georgia Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee

Description

How to fill out Fulton Georgia Sample Letter For Tax Receipt For Fundraiser Dinner - Request By Attendee?

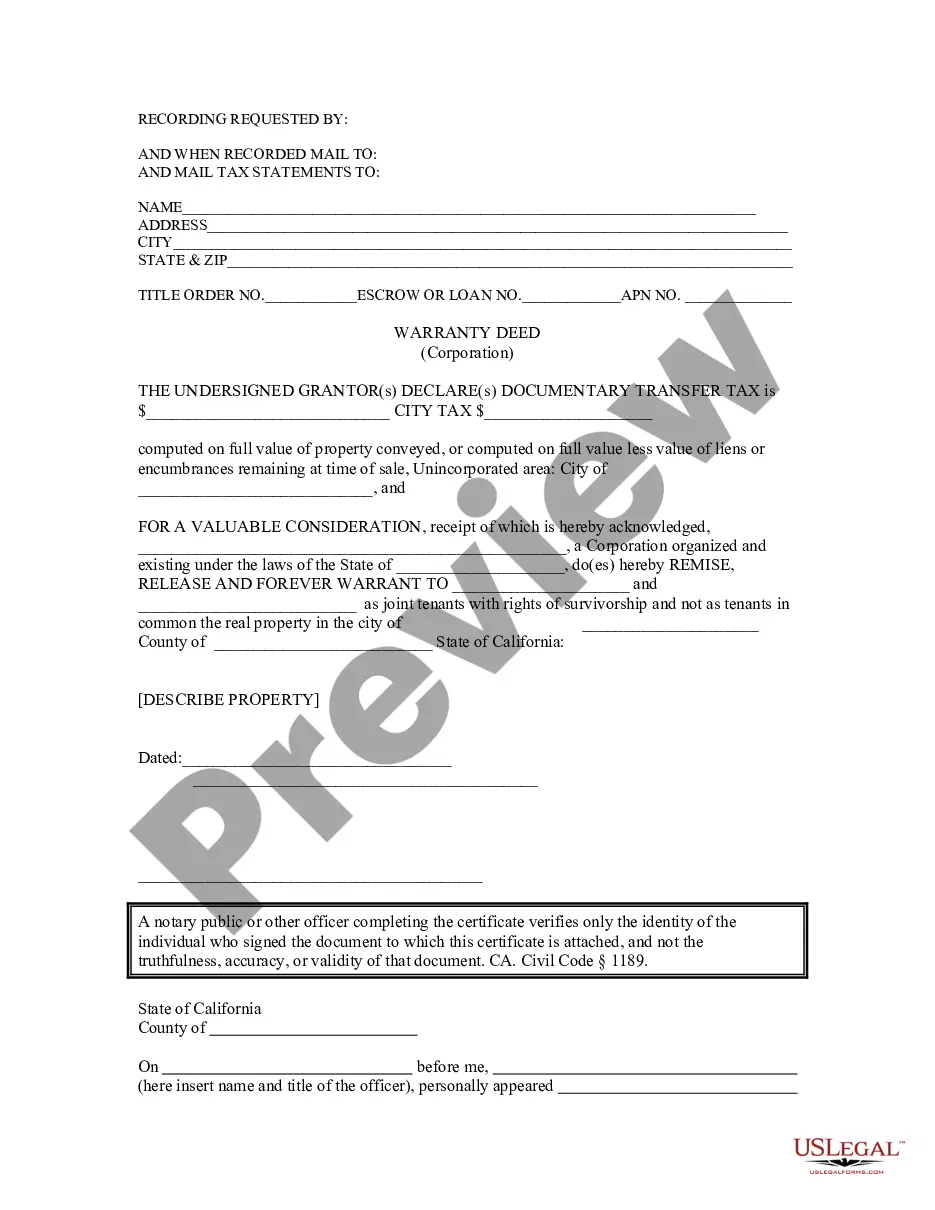

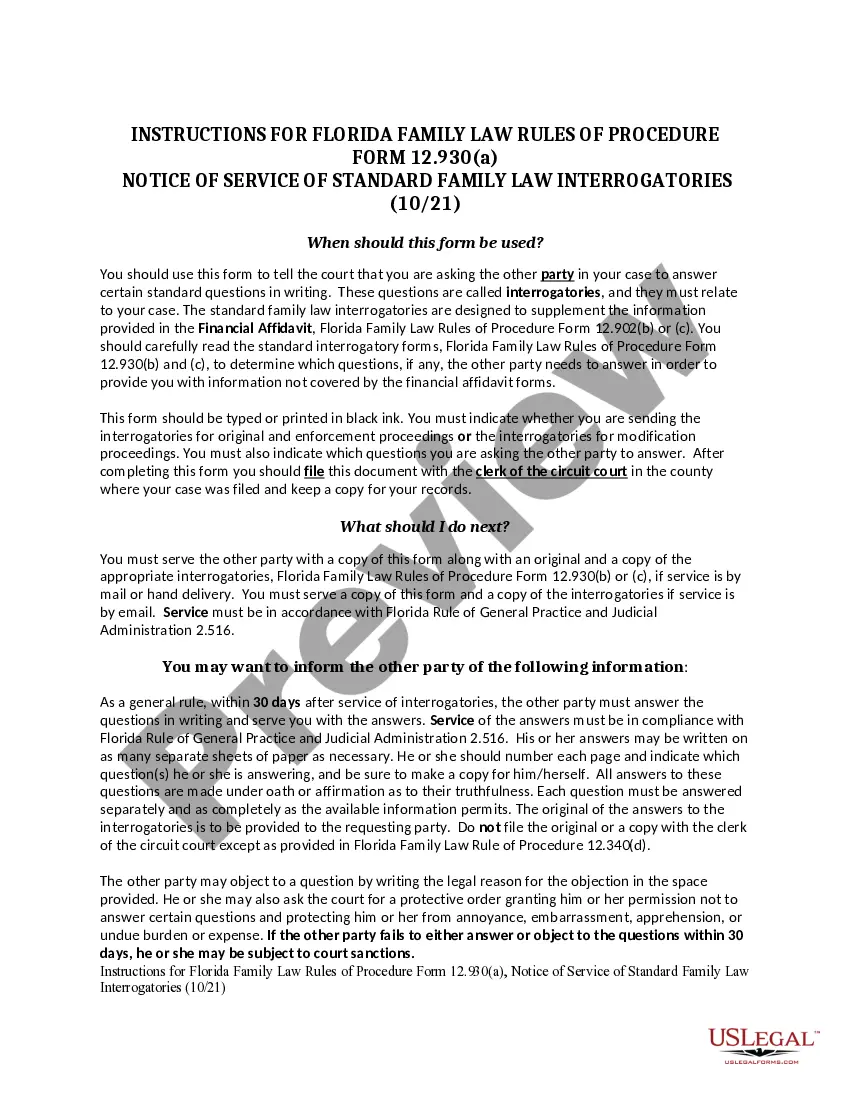

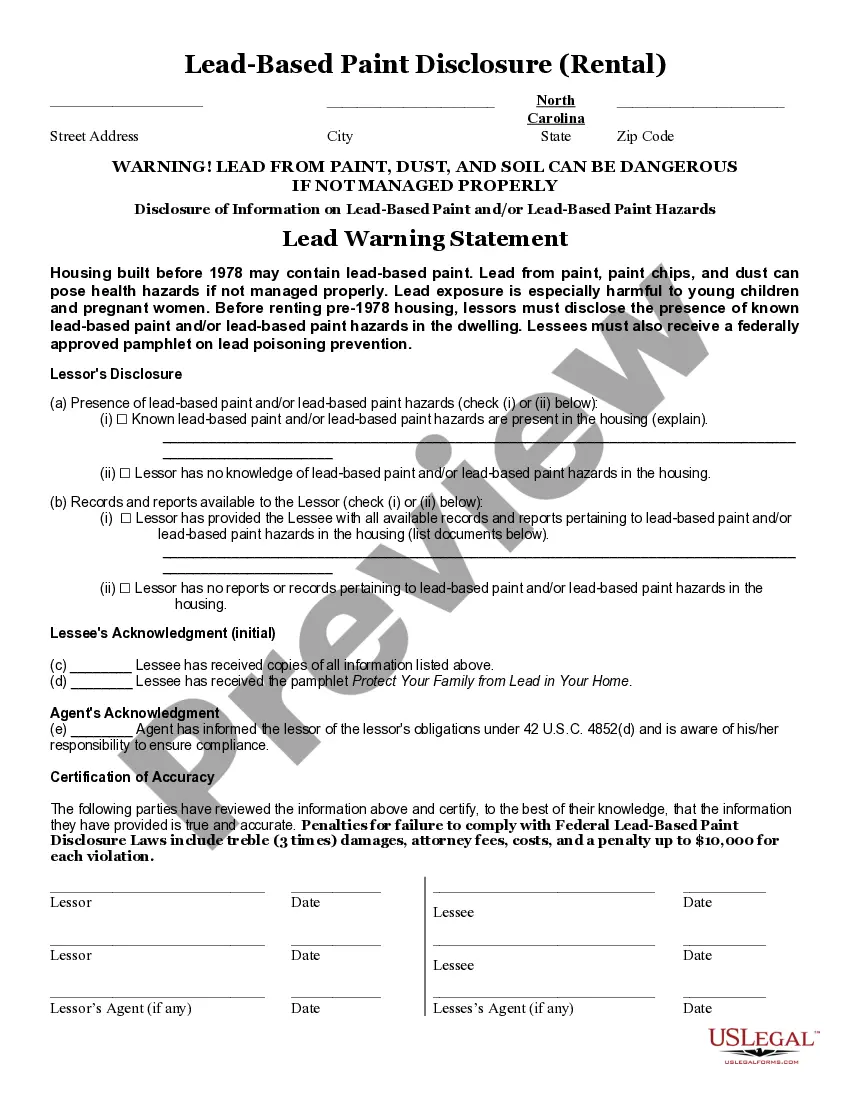

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Fulton Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less challenging. You can also find detailed resources and guides on the website to make any activities related to document completion simple.

Here's how to purchase and download Fulton Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the legality of some records.

- Check the related document templates or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment method, and buy Fulton Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Fulton Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee, log in to your account, and download it. Needless to say, our website can’t replace an attorney entirely. If you have to cope with an exceptionally challenging case, we recommend using the services of an attorney to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork with ease!

Form popularity

FAQ

Thank you for your great generosity! We, at charitable organization, greatly appreciate your donation, and your sacrifice. Your support helps to further our mission through general projects, including specific project or recipient. Your support is invaluable to us, thank you again!

A tax receipt can be issued only in the name of the individual or organization that actually gave the gift. If the donation is made by a cheque written on a joint bank account, the tax receipt should be issued in both names on the cheque, and the receipt may be used by either party to claim a tax credit.

Each donor receipt should include the name of the donor as well. Many donor receipts also include the charity's address and EIN, although not required. The donor, however, should have records of the charity's address. Donor receipts should include the date of the contribution.

How To Write the Perfect Donation Request Letter Start with a greeting.Explain your mission.Describe the current project/campaign/event.Include why this project is in need and what you hope to accomplish.Make your donation ask with a specific amount correlated with that amount's impact.

Thank you for your generous gift of (Full Description) which we received on (Date). Your generous contribution will help to further the important work of our organization.

Many fundraising database systems enable nonprofits to send email receipts, but also facilitate more personal interactions. Consider backing up the convenience of an emailed receipt with a hand-signed, mail-merged letter or even a personal phone call or meeting with larger or high potential-value donors.

How Do I Write Donation Receipts? The name of the donor. The name of your organization. Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3) The date of the donation. The amount given OR a description of items donated, if any.

6 IRS Requirements for Every Donor Receipt to Ensure a Charitable Deduction Name of the Charity and Name of the Donor.Date of the Contribution.Detailed Description of the Property Donated.Amount of the Contribution.A Statement Regarding Whether or not Any Goods or Services were Provided in Exchange for the Contribution.

What do you need to include in your donation acknowledgment letter? The name of your donor. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

A formal donor acknowledgment letter should include the following information: A statement declaring the nonprofit's tax-exempt status as a 501c3.The name of the donor that they used to make their gift.The date the gift was received by your nonprofit.A description of the donation.