A Chicago Illinois Crummy Trust Agreement for the Benefit of Child with Parents as Trustees is a legally binding document that establishes a specific type of trust arrangement in accordance with the laws and regulations of Illinois. This trust agreement enables parents to transfer assets to the trust for the benefit of their child while imposing certain restrictions on the child's access to those assets until a predefined event or condition is met. The Crummy Trust Agreement, named after the legal case Crummy v. Commissioner, allows the trustees (the parents) to take advantage of gift tax exemptions by employing the "annual exclusion" concept. The main purpose of a Crummy Trust Agreement is to provide financial support and stability for a child's future needs, such as education, healthcare, or other vital expenses. It empowers parents to safeguard their child's financial security while maintaining control over the assets placed in the trust until a specified age or triggering event, like graduation or marriage. Different variations of the Chicago Illinois Crummy Trust Agreement for the Benefit of Child with Parents as Trustees may include: 1. Crummy Irrevocable Trust Agreement: This type of trust is established as irrevocable, meaning that once the trust is funded and created, it cannot be easily modified or revoked by the trustees. Irrevocability ensures long-term asset protection and tax benefits for the child's future, while also possessing potential estate tax advantages for the trustees. 2. Crummy Revocable Trust Agreement: In contrast to the irrevocable variation, this trust agreement offers flexibility as it can be altered or revoked by the trustees during their lifetime. It allows for potential changes in circumstances and ensures the trustees have control over the assets until they pass away or decide to make changes. 3. Crummy Testamentary Trust Agreement: This type of Crummy Trust Agreement is created within a will and only takes effect upon the death of the trustees. It provides a mechanism for distributing assets for the benefit of the child according to the trustees' wishes and any specified conditions outlined in the trust agreement. It is essential to consult with an experienced estate planning attorney in Chicago, Illinois, when considering a Crummy Trust Agreement. A legal professional can provide guidance based on the specific needs and goals of the trustees, ensuring compliance with Illinois laws and maximizing the benefits associated with this type of trust arrangement.

Chicago Illinois Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

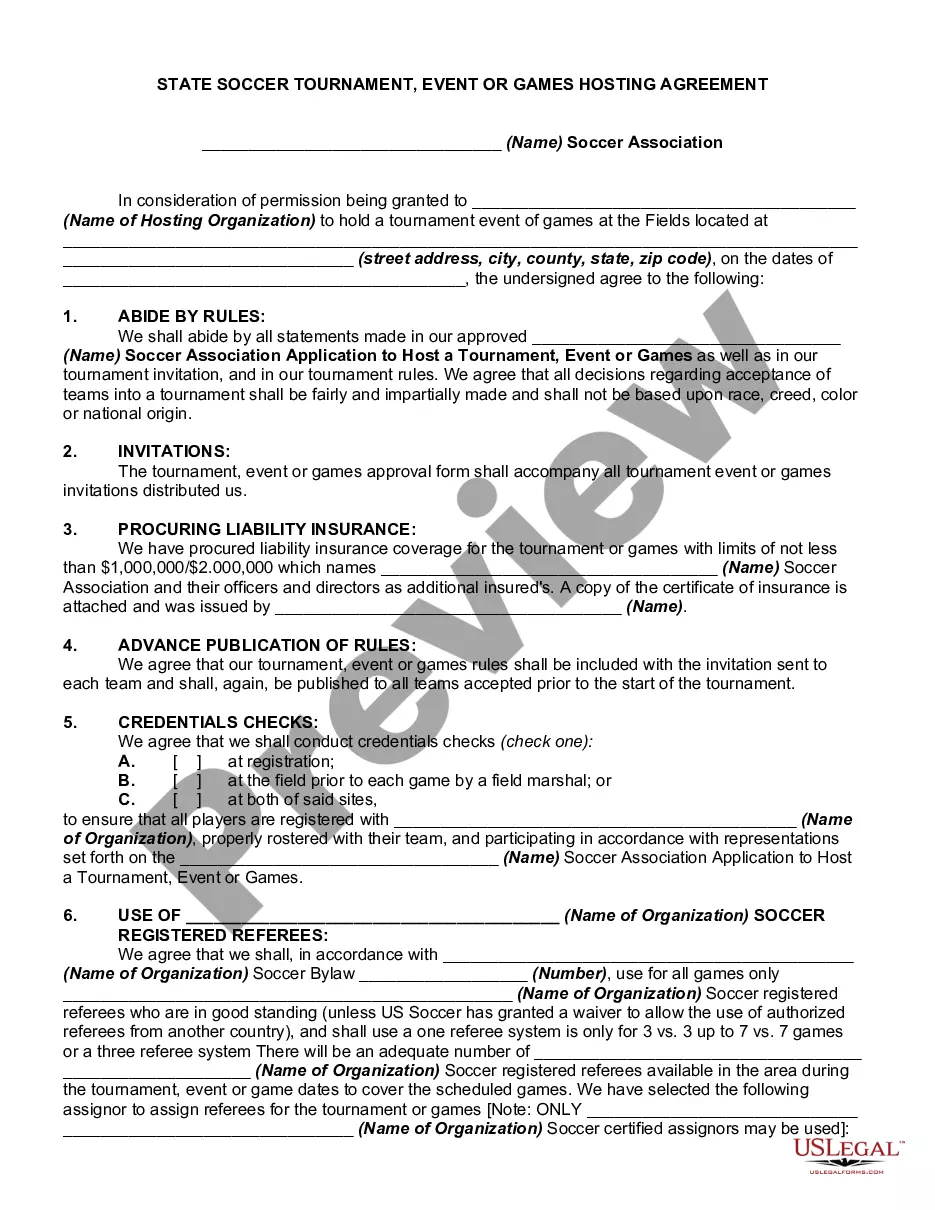

How to fill out Chicago Illinois Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Chicago Crummey Trust Agreement for Benefit of Child with Parents as Trustors is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Chicago Crummey Trust Agreement for Benefit of Child with Parents as Trustors. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Crummey Trust Agreement for Benefit of Child with Parents as Trustors in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!