The Franklin Ohio Crummy Trust Agreement for Benefit of Child with Parents as Trustees is a legal document that establishes a trust for the benefit of a child, with the child's parents as the trustees. This type of trust is commonly used to secure financial assets for a child's future, ensuring their well-being and providing them with financial stability. The Franklin Ohio Crummy Trust Agreement allows the parents to set aside a specific amount of assets or property, which will be managed by a designated trustee until the child reaches a certain age or achieves certain milestones. The trust can be created during the parents' lifetime or through a testamentary provision in their will. This specialized type of trust is referred to as a Crummy Trust, named after the Crummy vs. Commissioner legal case, which significantly influenced the use of this type of trust. The Crummy Trust is specifically designed to take advantage of the annual gift tax exclusion, allowing money or property to be transferred into the trust up to a certain threshold without incurring gift taxes. By structuring the trust properly, parents can maximize the amount of assets they can transfer into the trust without incurring gift tax liabilities. There are various types of Franklin Ohio Crummy Trust Agreements that can be tailored to specific circumstances or preferences of the parents. Some common variations include: 1. Educational Crummy Trust: This type of trust focuses on funding the child's education expenses such as tuition, books, and other related costs. 2. Health Care Crummy Trust: This trust is designed to provide for the child's healthcare needs, including medical insurance, doctor visits, and other related expenses. 3. Special Needs Crummy Trust: This trust is specifically created for children with special needs or disabilities, allowing them to maintain eligibility for government benefits while still receiving additional financial support. 4. Lifetime Crummy Trust: In some cases, parents may choose to establish a trust that supports their child beyond reaching a certain age or milestone. With a lifetime Crummy Trust, the child can receive distributions from the trust throughout their lifetime. It is essential for parents to consult with an experienced attorney to determine the most appropriate type of trust and ensure compliance with Ohio state laws and regulations. Creating a Franklin Ohio Crummy Trust Agreement provides peace of mind for parents, knowing that their child's financial future is secure and well-managed.

Franklin Ohio Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Franklin Ohio Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business purpose utilized in your county, including the Franklin Crummey Trust Agreement for Benefit of Child with Parents as Trustors.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Franklin Crummey Trust Agreement for Benefit of Child with Parents as Trustors will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Franklin Crummey Trust Agreement for Benefit of Child with Parents as Trustors:

- Ensure you have opened the correct page with your local form.

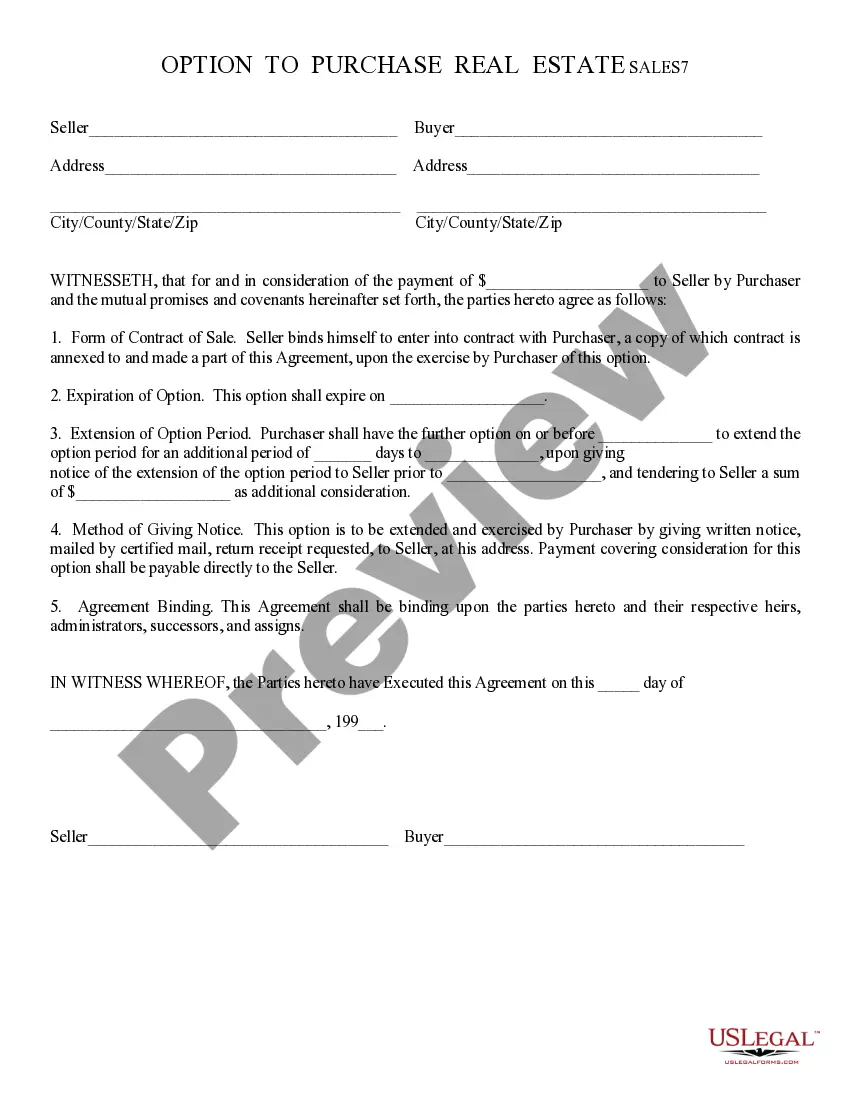

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Franklin Crummey Trust Agreement for Benefit of Child with Parents as Trustors on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!