The Houston Texas Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees is a legal document that allows parents to set up a trust fund on behalf of their child. This type of trust is established to provide financial security and protection for the child's future and is named after the Crummy family, who popularized the concept in the 1960s. The Crummy Trust Agreement is a beneficial tool for parents seeking to plan for their child's financial well-being. By creating this trust, parents can ensure that their assets are protected and utilized in accordance with their wishes, even after they pass away. It allows parents to have control over how their assets are distributed to their child, and prevents the child from accessing the entire trust fund at once. There are several types of Crummy Trust Agreements available to suit different circumstances and objectives. Some variations of the Houston Texas Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees include: 1. Revocable Crummy Trust: This type of trust allows the trustees (parents) to have the flexibility to make changes or revoke the trust during their lifetime. It provides them with more control and the ability to modify the trust's provisions as and when needed. 2. Irrevocable Crummy Trust: Unlike a revocable trust, an irrevocable Crummy Trust cannot be modified or revoked by the trustees once it has been created. This type of trust offers more asset protection and tax advantages since the assets are considered separate from the trustees' estate. 3. Generation-Skipping Crummy Trust: This trust is designed to pass wealth directly to grandchildren or future generations while bypassing the child as a beneficiary. It can help minimize estate taxes and provide a lasting financial legacy for multiple generations. 4. Special Needs Crummy Trust: This type of trust is specifically tailored for children with special needs. It allows parents to provide funds for the child's care, amenities, and medical needs while preserving eligibility for government benefits. In conclusion, the Houston Texas Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees is a comprehensive legal tool that parents can use to secure a stable financial future for their child. By establishing this trust, parents can ensure the proper management and distribution of their assets while retaining control over the funds. With various types of Crummy trusts available, parents can choose the one that best aligns with their specific needs and goals.

Houston Texas Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Houston Texas Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Houston Crummey Trust Agreement for Benefit of Child with Parents as Trustors, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Houston Crummey Trust Agreement for Benefit of Child with Parents as Trustors from the My Forms tab.

For new users, it's necessary to make some more steps to get the Houston Crummey Trust Agreement for Benefit of Child with Parents as Trustors:

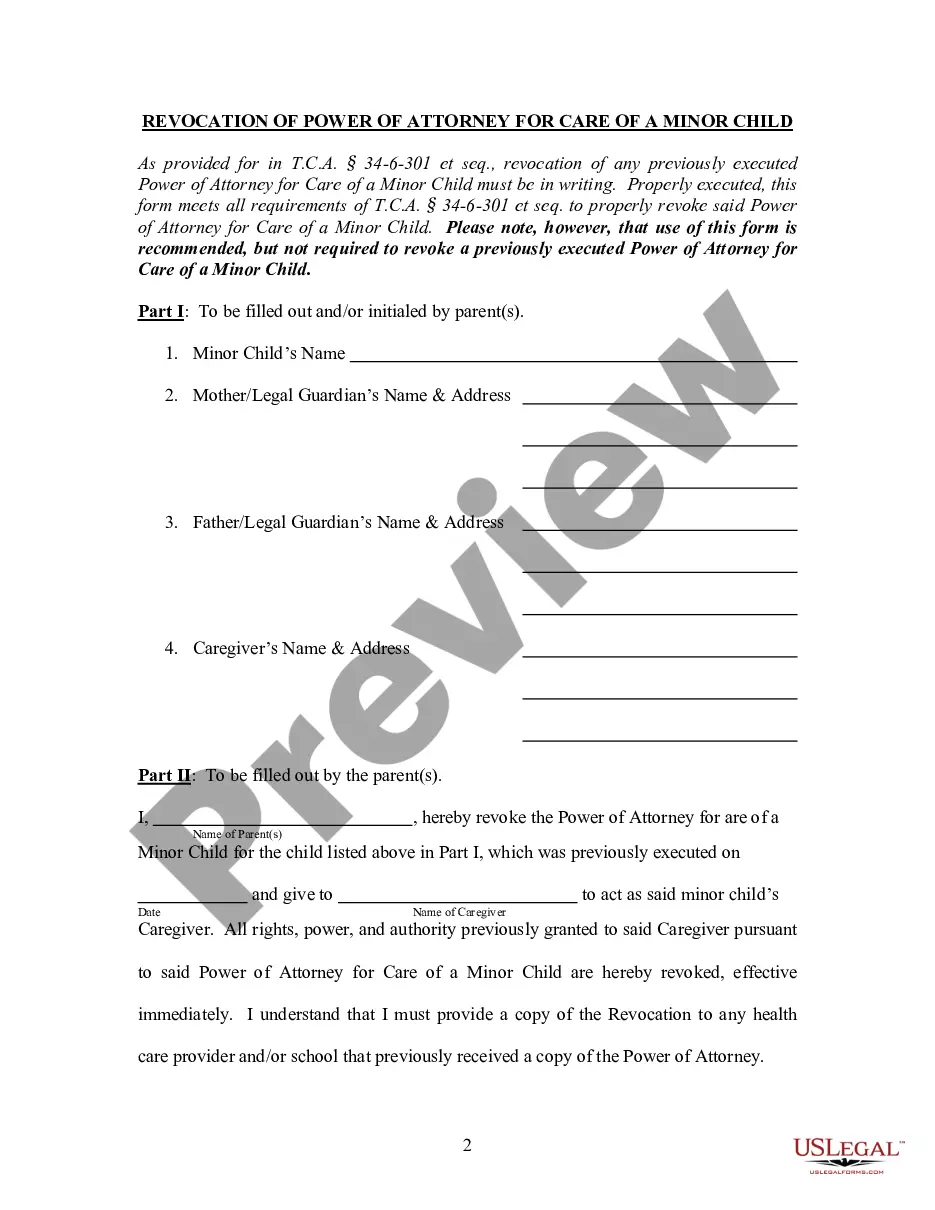

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!