The Orange California Crummy Trust Agreement for Benefit of Child with Parents as Trustees is a legal document that creates a trust for the benefit of a child, with the parents serving as trustees or settlers. This type of trust agreement allows parents to set aside assets for their child while maintaining control over how and when those assets are distributed. The purpose of the Crummy Trust Agreement is to take advantage of the annual gift tax exclusion by allowing the parents to make annual gifts to the trust, up to the maximum amount allowed by law, without incurring gift taxes. By utilizing the Crummy power of withdrawal, the transfers made by the parents are considered present interest gifts, which are excluded from gift taxes. There are variations of the Orange California Crummy Trust Agreement, including: 1. Crummy Trust Agreement with Limited Withdrawal Power: This variation restricts the withdrawal power of the child to a specified portion of the assets held in the trust. This allows the child to exercise a limited amount of control over the trust assets while still ensuring that the assets remain outside the child's taxable estate. 2. Crummy Trust Agreement with Special Needs Provisions: This type of trust agreement includes provisions to ensure that the child with special needs is taken care of financially while still maintaining eligibility for government benefits. These provisions may allow for discretionary distributions from the trust to supplement the child's needs without jeopardizing their government benefits. 3. Crummy Trust Agreement with Education Planning: In this variation, the trust is specifically structured to support the child's education expenses. The trust funds can be used to cover tuition, fees, books, and other related expenses, providing a reliable source for educational funding. 4. Crummy Trust Agreement with Charitable Provisions: This type of trust agreement combines the benefits of the Crummy trust structure with charitable giving. The parents can designate a portion of the trust assets to be distributed to charitable organizations, allowing them to support causes they care about while still providing for their child's financial future. The Orange California Crummy Trust Agreement for Benefit of Child with Parents as Trustees offers parents a flexible and tax-efficient solution for estate planning. It ensures that their child's financial needs are taken care of and allows for the transfer of assets without incurring gift taxes. Consultation with an experienced estate planning attorney is crucial to draft a trust agreement that aligns with the specific needs and objectives of the parents and child involved.

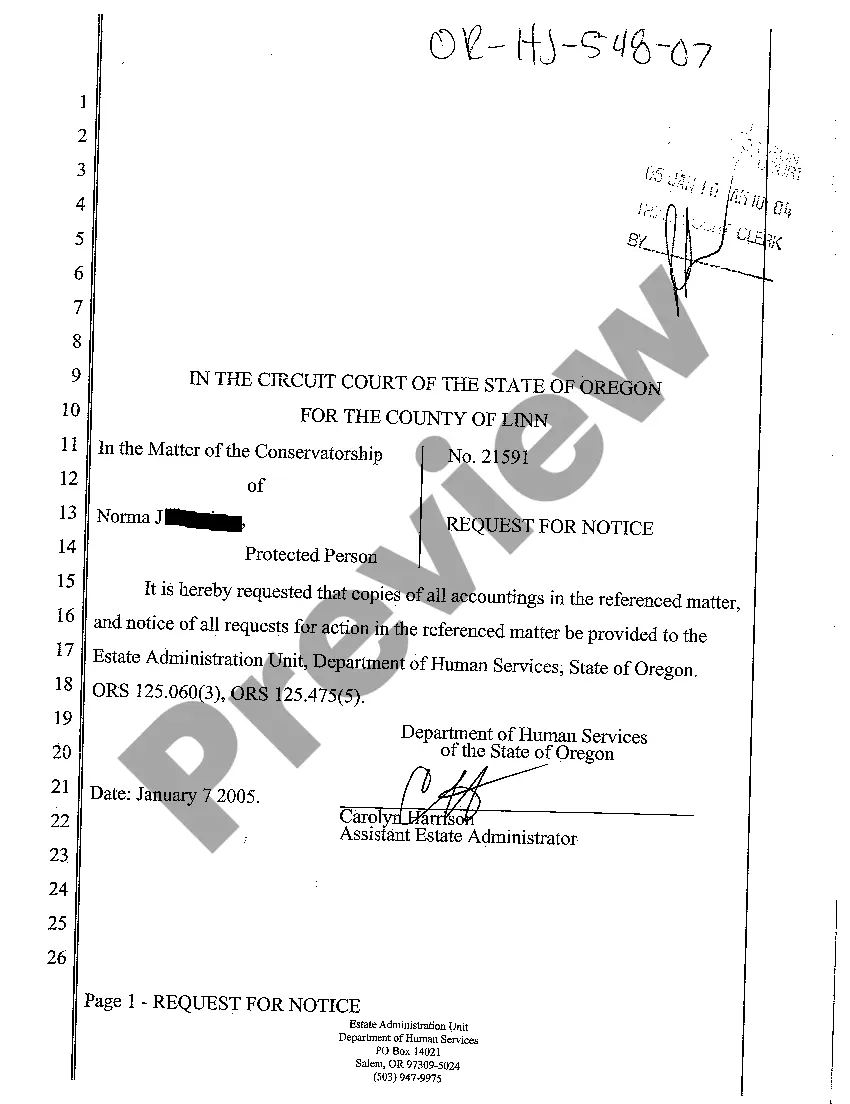

Orange California Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Orange California Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

How much time does it typically take you to draw up a legal document? Since every state has its laws and regulations for every life situation, locating a Orange Crummey Trust Agreement for Benefit of Child with Parents as Trustors suiting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Apart from the Orange Crummey Trust Agreement for Benefit of Child with Parents as Trustors, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Orange Crummey Trust Agreement for Benefit of Child with Parents as Trustors:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Orange Crummey Trust Agreement for Benefit of Child with Parents as Trustors.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!