The Suffolk New York Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees is a legal document that establishes a specific type of trust in Suffolk County, New York. This trust, commonly known as a Crummy Trust, allows parents to transfer assets to their child while still maintaining control over how those assets are used. The Crummy Trust Agreement provides a structure in which parents can set aside assets for their child's benefit, ensuring financial security for their future. By utilizing this trust, parents can protect assets from potential creditors, estate taxes, and other financial complications. Additionally, it allows parents to specify detailed instructions regarding the use and distribution of the trust assets. There are various types of Crummy Trust Agreements that can be established in Suffolk County, New York. Some of them include: 1. Standard Crummy Trust: This trust allows parents to make yearly contributions to the trust on behalf of their child. Each contribution is subject to a "Crummy" power, giving the child the ability to withdraw the money during a specific timeframe (usually 30 days). If the child does not withdraw the funds, the money remains in the trust for the child's benefit. 2. Irrevocable Crummy Trust: This type of trust, once established, cannot be modified or revoked by the parents. It provides a level of asset protection and is often utilized for tax planning purposes. 3. Crummy Trust for Education Expenses: This trust specifically designates funds for the child's education expenses. It ensures that the child has access to necessary funds for tuition, books, and other related costs. 4. Crummy Trust for Special Needs: This trust is tailored for children with special needs. It provides ongoing financial support while ensuring that the child remains eligible for government assistance programs. When parents set up a Suffolk New York Crummy Trust Agreement for the Benefit of a Child, they are taking a proactive step towards securing their child's financial future. By making use of different types of Crummy Trusts, parents can customize the trust to meet their specific goals and the unique needs of their child. Overall, the Suffolk New York Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees offers a valuable legal framework for parents seeking to protect, control, and provide for their child's financial well-being.

Suffolk New York Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Suffolk New York Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

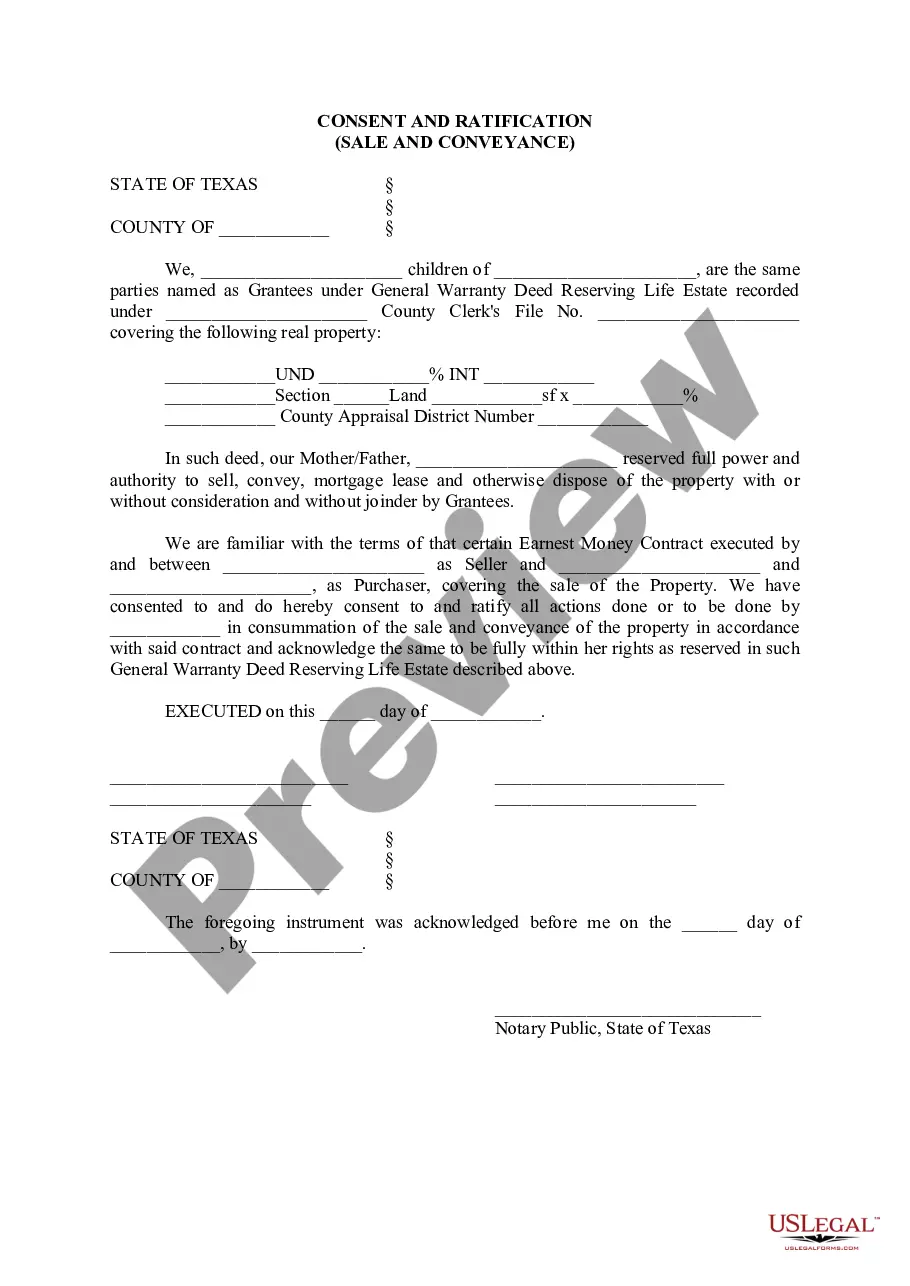

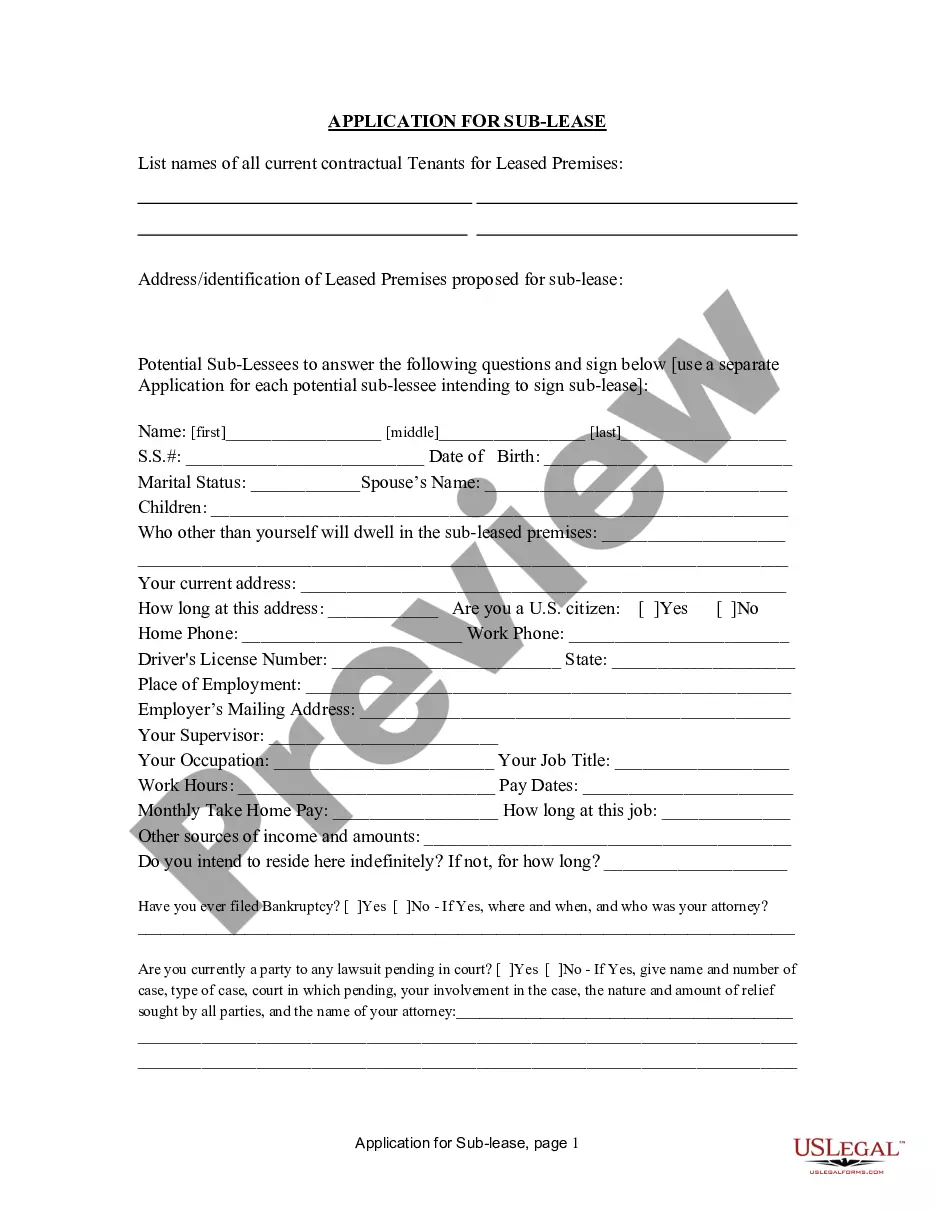

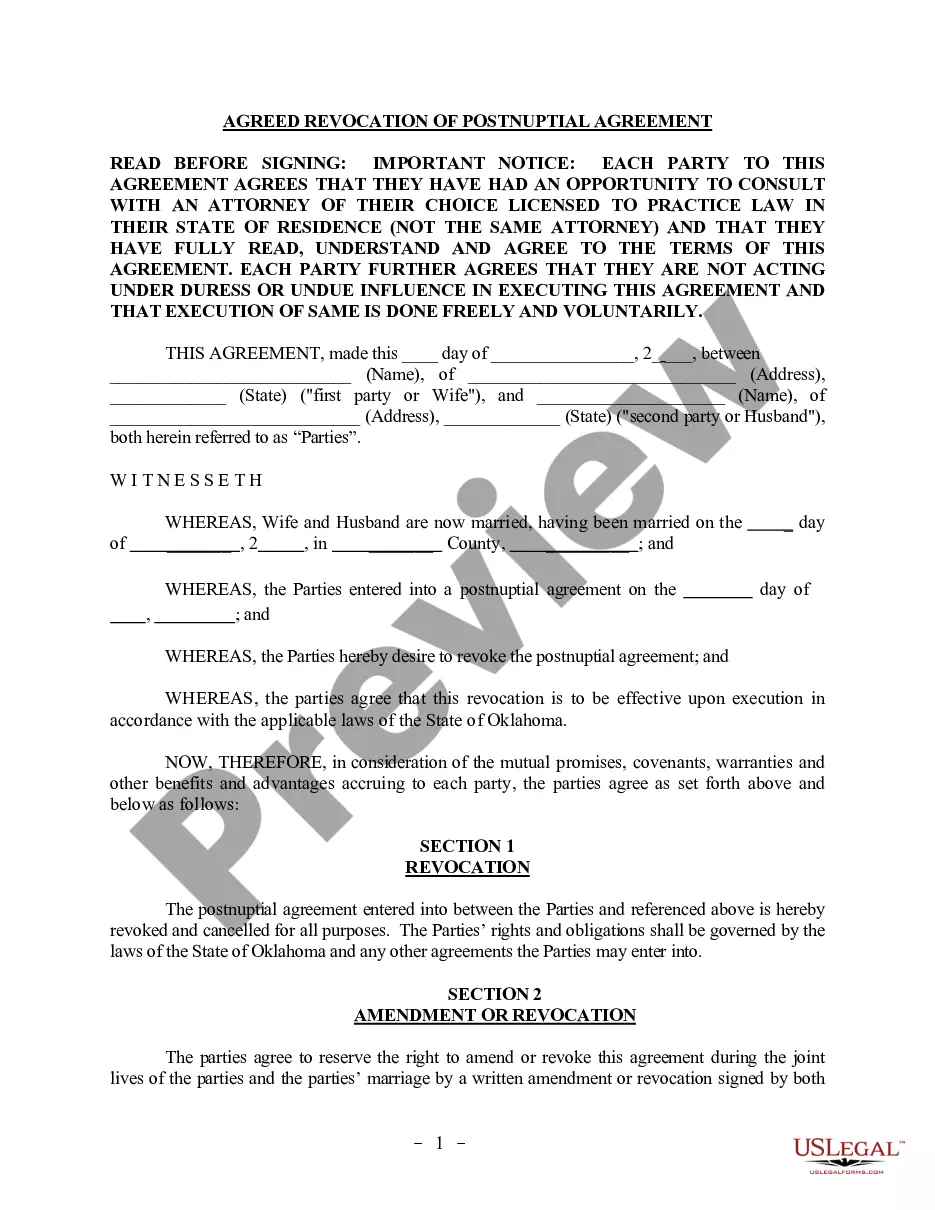

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Suffolk Crummey Trust Agreement for Benefit of Child with Parents as Trustors meeting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. In addition to the Suffolk Crummey Trust Agreement for Benefit of Child with Parents as Trustors, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Suffolk Crummey Trust Agreement for Benefit of Child with Parents as Trustors:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Suffolk Crummey Trust Agreement for Benefit of Child with Parents as Trustors.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!