The Cook Illinois Irrevocable Life Insurance Trust — Beneficiaries HavCrummyey Right of Withdrawal is a specialized type of life insurance trust that offers unique benefits and features to its beneficiaries. In this type of trust, the beneficiaries are granted the Crummy Right of Withdrawal, giving them the power to withdraw a certain amount of money from the trust each year. This withdrawal right is crucial in ensuring that the trust qualifies for the annual gift tax exclusion. One of the key purposes of the Cook Illinois Irrevocable Life Insurance Trust — Beneficiaries HavCrummyey Right of Withdrawal is to provide a tax-efficient method of passing on life insurance proceeds to beneficiaries. By creating an irrevocable trust, the trust creator, or granter, can remove the life insurance policy from their taxable estate, thus minimizing the estate tax burden on their loved ones upon their passing. The Crummy Right of Withdrawal is a feature unique to this type of trust. It allows the beneficiaries to withdraw a portion of the trust funds for a limited time frame, typically 30 days, after the granter makes a gift to the trust. This withdrawal right makes the gift qualify for the annual gift tax exclusion, which allows the granter to contribute a certain amount of money to the trust each year without incurring gift taxes. The Cook Illinois Irrevocable Life Insurance Trust — Beneficiaries HavCrummyey Right of Withdrawal offers several advantages. Firstly, it provides flexibility to the beneficiaries by allowing them to access trust funds during the withdrawal period. This can be particularly beneficial in emergency situations or when immediate financial needs arise. Secondly, the trust ensures that the life insurance proceeds are protected from estate taxes, as they are held outside the granter's taxable estate. This can result in significant tax savings for the beneficiaries. Lastly, the Cook Illinois Irrevocable Life Insurance Trust — Beneficiaries HavCrummyey Right of Withdrawal can provide a level of control to the granter. While the beneficiaries have the right to withdraw funds, they are often discouraged from exercising this right through various mechanisms such as communication or restrictions outlined in the trust agreement. This control allows the granter to have some influence over how the trust funds are used, ensuring they are utilized for the intended purposes. In summary, the Cook Illinois Irrevocable Life Insurance Trust — Beneficiaries HavCrummyey Right of Withdrawal is a specialized trust that combines the benefits of life insurance protection and tax efficiency. By utilizing the Crummy Right of Withdrawal, the trust creator can maximize the annual gift tax exclusion while providing flexibility and control to the beneficiaries.

Cook Illinois Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

How to fill out Cook Illinois Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right Of Withdrawal?

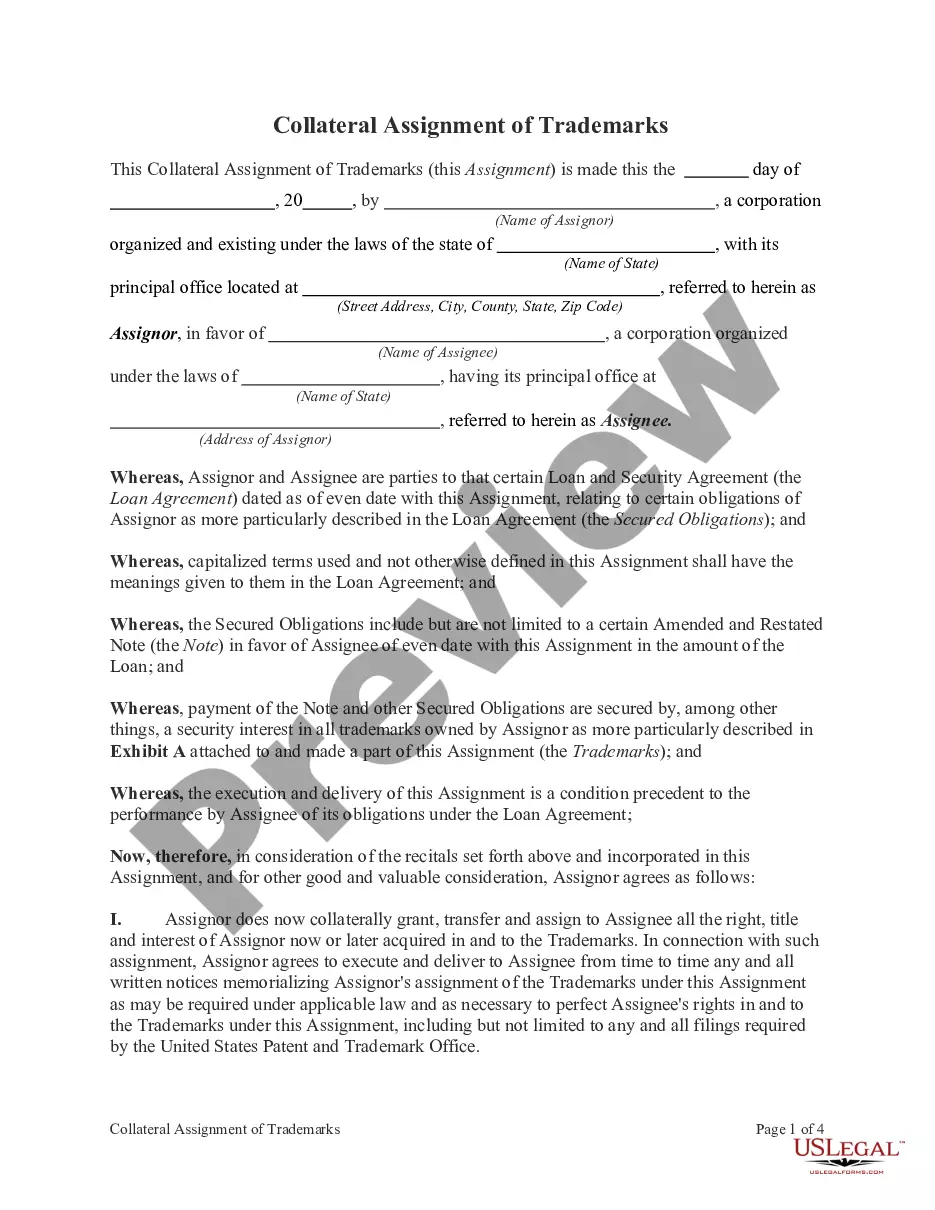

Are you looking to quickly draft a legally-binding Cook Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal or maybe any other form to handle your own or business affairs? You can go with two options: hire a legal advisor to draft a valid document for you or draft it entirely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific form templates, including Cook Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, carefully verify if the Cook Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal is adapted to your state's or county's laws.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the form isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Cook Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the documents we provide are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!