Maricopa, Arizona Irrevocable Life Insurance Trust is a legal arrangement that allows individuals to establish a trust for the purpose of holding life insurance policies. The trust is considered "irrevocable" because once it is established, it cannot be changed or revoked without the consent of all involved parties. One significant feature of the Maricopa, Arizona Irrevocable Life Insurance Trust is the inclusion of the Crummy Right of Withdrawal. This right enables the trust beneficiaries to withdraw a limited portion of the trust assets within a specific time frame, usually 30 days, after contributions are made to the trust. By exercising this right, beneficiaries can access funds and utilize them for various purposes, such as paying off debts, funding education, or investing in additional assets. The Crummy Right of Withdrawal serves two primary objectives: first, it ensures the trust qualifies for the gift tax annual exclusion by creating a present interest in the gifted amount, allowing the donor to avoid gift tax liability. Second, it allows beneficiaries to access funds if needed, enhancing flexibility and financial security. Different types of Maricopa, Arizona Irrevocable Life Insurance Trusts with Crummy Right of Withdrawal include: 1. Single Beneficiary Trust: This type of trust includes only one beneficiary who has the Crummy Right of Withdrawal. It is commonly used to establish a life insurance policy for the benefit of a spouse or a child. 2. Multiple Beneficiary Trust: In this case, the trust includes multiple beneficiaries, such as siblings or grandchildren, who are granted the Crummy Right of Withdrawal. It allows for more comprehensive estate planning and distribution of assets among family members. 3. Generation-Skipping Trust: This type of trust allows assets to pass to grandchildren or subsequent generations, avoiding the estate tax that would typically apply to transfers between generation levels. Beneficiaries included in this trust structure also maintain the Crummy Right of Withdrawal. 4. Charitable Remainder Trust: While not specific to the Crummy Right of Withdrawal, this type of trust deserves mention as it involves charitable beneficiaries. It allows individuals to transfer assets into an irrevocable trust, providing an income stream to beneficiaries for a specific period, and then donating the remaining assets to a charitable organization. The Crummy Right of Withdrawal is not applicable when charitable beneficiaries are involved. The Maricopa, Arizona Irrevocable Life Insurance Trust with the Crummy Right of Withdrawal is a valuable estate planning tool that offers both tax benefits and flexibility for beneficiaries. It allows individuals to ensure their life insurance policies provide for their loved ones while minimizing potential tax liabilities. Seeking the advice of experienced estate planning professionals is crucial to establish and manage this trust effectively.

Maricopa Arizona Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

How to fill out Maricopa Arizona Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right Of Withdrawal?

Preparing papers for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Maricopa Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Maricopa Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Maricopa Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal:

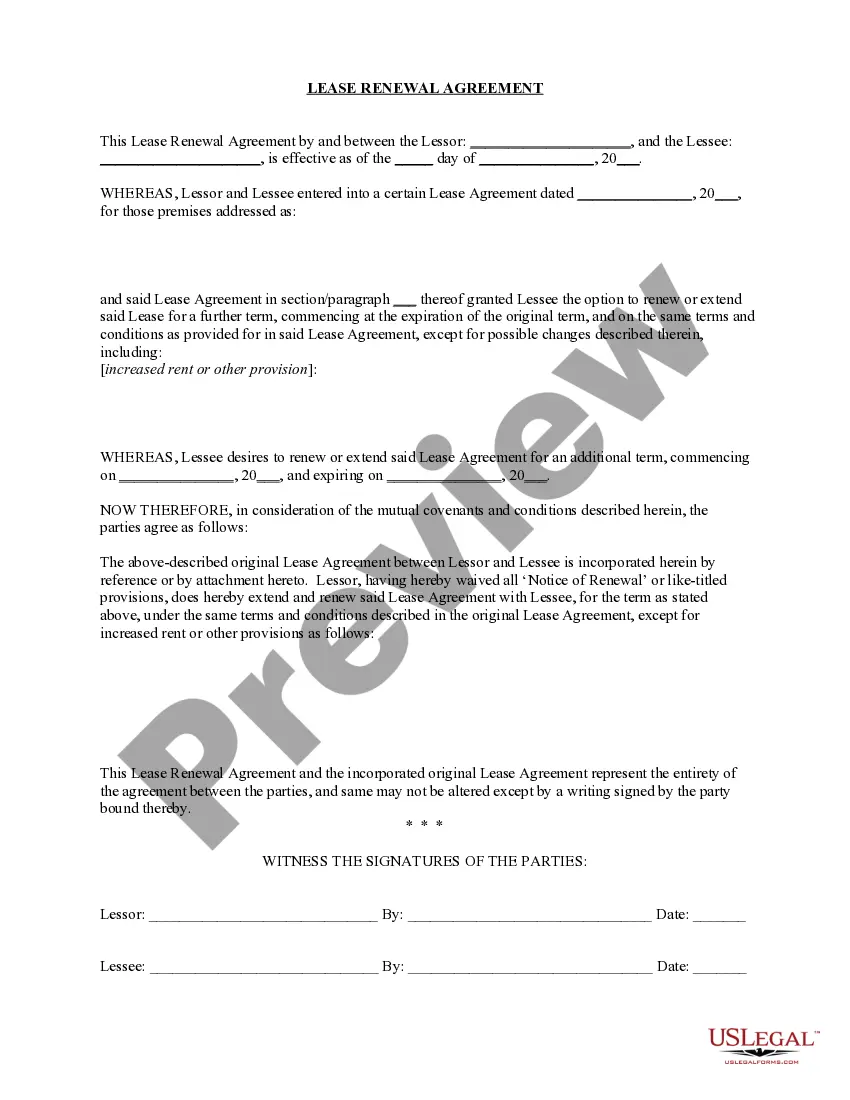

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!