San Antonio, Texas Irrevocable Life Insurance Trusts — Beneficiaries HavCrummyey Right of Withdrawal: In San Antonio, Texas, Irrevocable Life Insurance Trusts (Slits) play a crucial role in estate planning and ensuring financial security for beneficiaries. One specific type of IIT that is prevalent in this region is known as the "Beneficiaries Have Crummy Right of Withdrawal" trust. An Irrevocable Life Insurance Trust is created to hold life insurance policies outside the insured person's estate, thereby minimizing estate taxes. These trusts are established to provide financial protection for beneficiaries when the insured individual passes away, ensuring a smooth transfer of assets. The unique feature of San Antonio's IIT is the inclusion of the "Crummy Right of Withdrawal." This provision allows the trust beneficiaries to withdraw a limited portion of the assets within a specified time frame, usually 30 days, after contributions are made to the trust. By providing this withdrawal right, the IIT qualifies for the annual gift tax exclusion, enabling the granter to make substantial contributions without incurring gift taxes. The Crummy Right of Withdrawal not only offers potential tax advantages but also empowers beneficiaries by providing them with immediate access to funds if needed. However, beneficiaries often choose not to exercise this right, allowing the assets to remain within the trust and grow on their behalf, offering long-term financial security. Besides the standard Crummy Right of Withdrawal IIT, there can be additional variations based on individual preferences and estate planning goals. Some of these variations include: 1. Crummy Power IIT: This IIT grants the beneficiaries the right to withdraw contributions for a specified period, usually annually, but with limited withdrawal powers compared to the standard trust. It offers flexibility while still maintaining the gift tax benefits. 2. Alternate Beneficiary Crummy IIT: This type of IIT designates alternate beneficiaries who gain access to the withdrawal right if the primary beneficiaries choose not to exercise it. It ensures that funds are not lost but redirected to other intended recipients. 3. Charitable Crummy IIT: In this IIT, a charitable organization is included as a named beneficiary alongside individual beneficiaries. Charitable contributions made to the trust generate both tax deductions and fulfill philanthropic objectives while benefiting all parties involved. 4. Dynasty Crummy IIT: A Dynasty IIT aims to extend the trust's benefits across multiple generations by preserving assets and managing estate taxes. It allows granters to allocate Crummy withdrawal rights to individuals throughout the lineage, creating a lasting financial legacy. San Antonio, Texas Irrevocable Life Insurance Trusts — Beneficiaries HavCrummyey Right of Withdrawal provide a powerful tool for estate planning, tax efficiency, and ensuring the financial well-being of loved ones. Customizing the trust's features and incorporating specific beneficiary rights enables individuals to tailor their estate plans to their unique circumstances and long-term goals.

San Antonio Texas Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

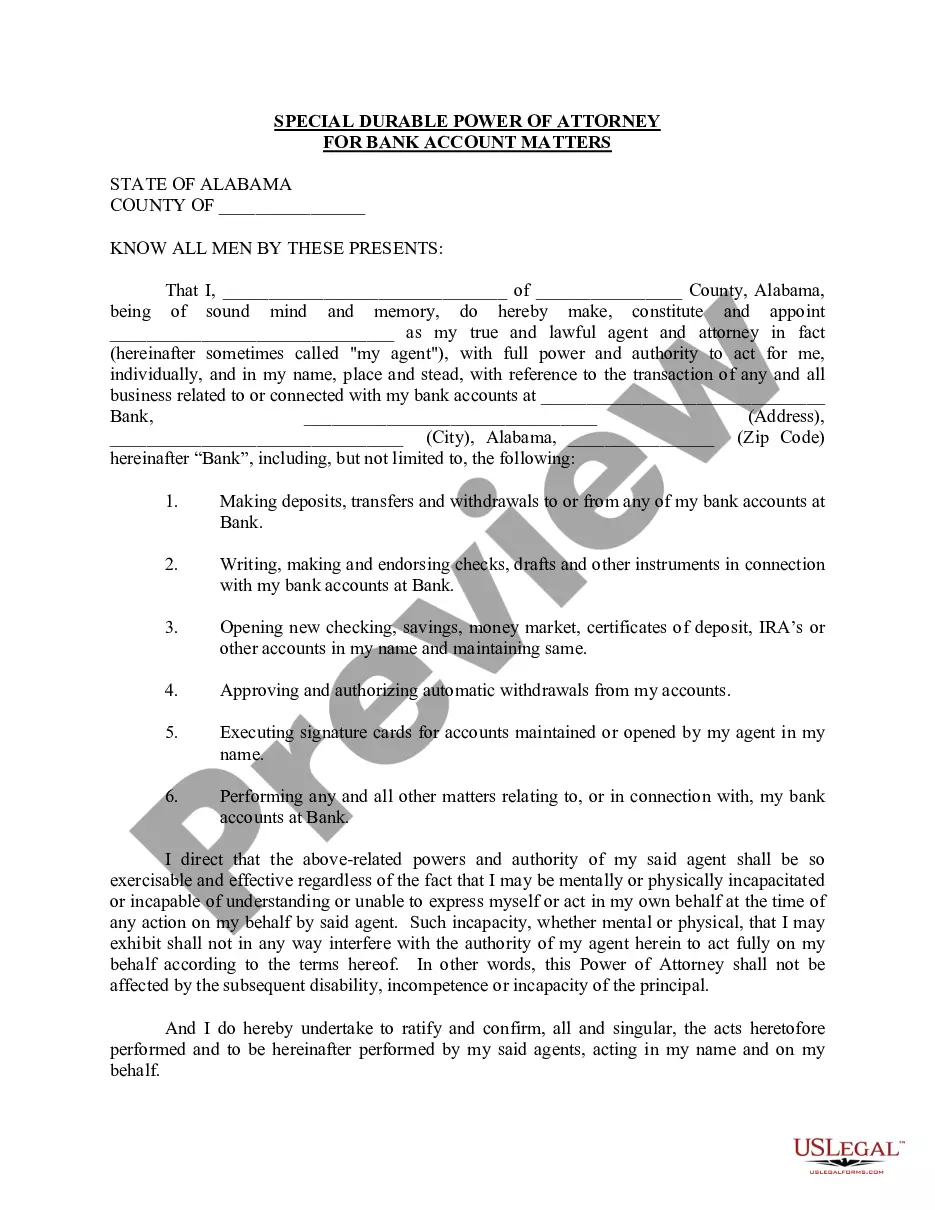

How to fill out San Antonio Texas Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right Of Withdrawal?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like San Antonio Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the San Antonio Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal. Follow the guide below:

- Make certain the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!