Suffolk New York Contract with Independent Contractor — Contractor has Employees: A Comprehensive Overview Introduction: In Suffolk County, New York, businesses often enter into contracts with independent contractors who have employees. These contractual agreements establish a legal framework and outline the obligations and responsibilities of both parties involved. Such contracts are essential to safeguard the rights and interests of all parties, ensuring smooth operations and fostering a transparent working relationship. Key Keywords: Suffolk New York, contract, independent contractor, employees. Types of Suffolk New York Contracts with Independent Contractors: 1. Standard Independent Contractor Contract: This type of contract is the most common and establishes a relationship between a business entity (the contractor) and an individual or company (the independent contractor). The contract defines the scope of work, payment terms, project timelines, and the legal relationship between the contractor and independent contractor. 2. Employee-Leasing Independent Contractor Contract: Employee-leasing arrangements refer to a unique type of contract wherein the independent contractor is responsible for providing employees to a business entity for a specific project or period. This contract outlines the roles and responsibilities of the independent contractor in supplying and managing employees, while the hiring business typically maintains control over the project's aspects. 3. Joint Employer Independent Contractor Contract: Sometimes, multiple companies may collaborate on a project and engage an independent contractor who has employees. In such cases, a joint employer independent contractor contract is established. This contract clarifies the responsibilities and liabilities of each participating business in relation to the independent contractor and their employees. 4. Multi-Contractor Collaboration Contract: When multiple independent contractors with employees are required to work together on a project, a multi-contractor collaboration contract is utilized. This contract outlines the roles, responsibilities, and coordination mechanisms between all the contractors involved, ensuring seamless collaboration and project completion. Key Components of a Suffolk New York Contract with Independent Contractor — Contractor has Employees: 1. Scope of Work: The contract should explicitly define the services the independent contractor and their employees will provide. This section must outline the project goals, deliverables, timelines, any specific requirements, and expectations regarding the quality of work. 2. Payment Terms: The contract should clearly state the agreed-upon payment structure, including the amount, payment frequency, and any additional expenses or reimbursements. It is crucial to establish how payment will be made and any penalties for late or incomplete work. 3. Legal Relationship: To ensure compliance with employment laws and regulations, it is important to distinguish the independent contractor from regular employees. The contract must establish the independent contractor's status as a non-employee and clarify that the contractor is responsible for all payroll taxes, insurance, and related obligations. 4. Confidentiality and Non-Disclosure: In many cases, the nature of the work may require the independent contractor and their employees to have access to sensitive information. To protect the business's intellectual property, clients, or trade secrets, a confidentiality and non-disclosure clause should be included in the contract. 5. Termination and Dispute Resolution: The contract should outline the circumstances under which either party may terminate the agreement and the associated procedures. Additionally, provisions for handling disputes or disagreements should be included, such as mediation or arbitration, to facilitate amicable resolutions. Conclusion: Suffolk New York contracts with independent contractors who have employees are essential legal documents that establish the working relationship between businesses and contractors. These agreements encompass various types of contracts, each tailored to specific scenarios. By clearly defining the expectations, responsibilities, and legal aspects, these contracts ensure a transparent and mutually beneficial relationship between both parties involved.

Suffolk New York Contract with Independent Contractor - Contractor has Employees

Description

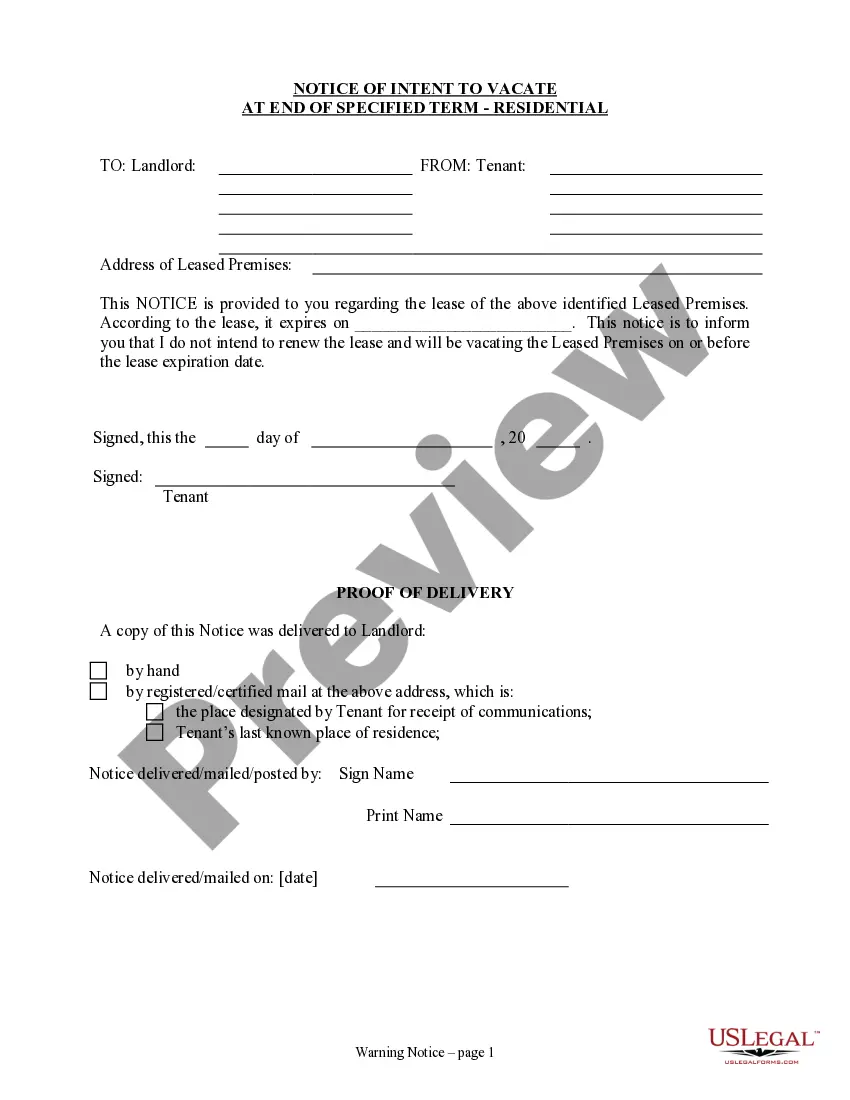

How to fill out Suffolk New York Contract With Independent Contractor - Contractor Has Employees?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Suffolk Contract with Independent Contractor - Contractor has Employees, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any tasks associated with document completion straightforward.

Here's how you can locate and download Suffolk Contract with Independent Contractor - Contractor has Employees.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the similar forms or start the search over to locate the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Suffolk Contract with Independent Contractor - Contractor has Employees.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Suffolk Contract with Independent Contractor - Contractor has Employees, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you have to deal with an exceptionally difficult situation, we recommend getting an attorney to examine your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork effortlessly!