San Jose California Living Trust with Provisions for Disability: A Comprehensive Overview A San Jose California Living Trust with Provisions for Disability is an estate planning tool that safeguards your assets and ensures your financial well-being if you become incapacitated or disabled. It is specifically designed to protect your interests and provide for your needs during these challenging circumstances. A living trust, also known as an inter vivos trust, is a legal document that allows you to transfer ownership of your assets (such as real estate, investments, bank accounts, and personal property) to a trust while retaining control over them as the trustee. This trust becomes effective during your lifetime and contains provisions to address potential disability, ensuring smooth asset management and financial security. By creating a Living Trust with Provisions for Disability in San Jose, California, you can avoid the need for court intervention in case of incapacity, which typically occurs through conservatorship proceedings. Here are some key provisions typically included in San Jose California Living Trusts with Provisions for Disability: 1. Revocable Living Trust: This type of trust allows you to maintain flexibility and control over your assets while still providing for the possibility of disability. It can be modified or revoked entirely if circumstances change. 2. Successor Trustee: In a Living Trust with Provisions for Disability, you appoint a trusted individual or institution as a successor trustee. If you become disabled, this person takes over the management and distribution of your assets, ensuring your financial needs are met. 3. Springing Power of Attorney: This provision allows you to designate someone as your power of attorney, granting them the authority to act on your behalf if you become disabled or incapacitated. This person can make important financial and medical decisions as outlined in the living trust. 4. Medical Directives: San Jose California Living Trusts with Provisions for Disability often include medical directives, such as a healthcare power of attorney or living will, which outline your healthcare preferences and provide guidance to your designated healthcare agent. 5. Asset Protection: These living trusts can also include provisions that protect your assets from creditors or ensure financial support for your dependents during your disability. It's important to note that there can be variations in the terminology and specific provisions within San Jose California Living Trusts with Provisions for Disability, depending on individual circumstances and preferences. Consulting with an experienced estate planning attorney in San Jose is crucial to tailor the trust to your specific needs. In conclusion, a San Jose California Living Trust with Provisions for Disability is a crucial tool for individuals who want to ensure their assets are managed effectively and their financial needs are met if they become disabled or incapacitated. By creating this comprehensive trust, you can have peace of mind knowing that your interests are protected during challenging times.

San Jose California Living Trust with Provisions for Disability

Description

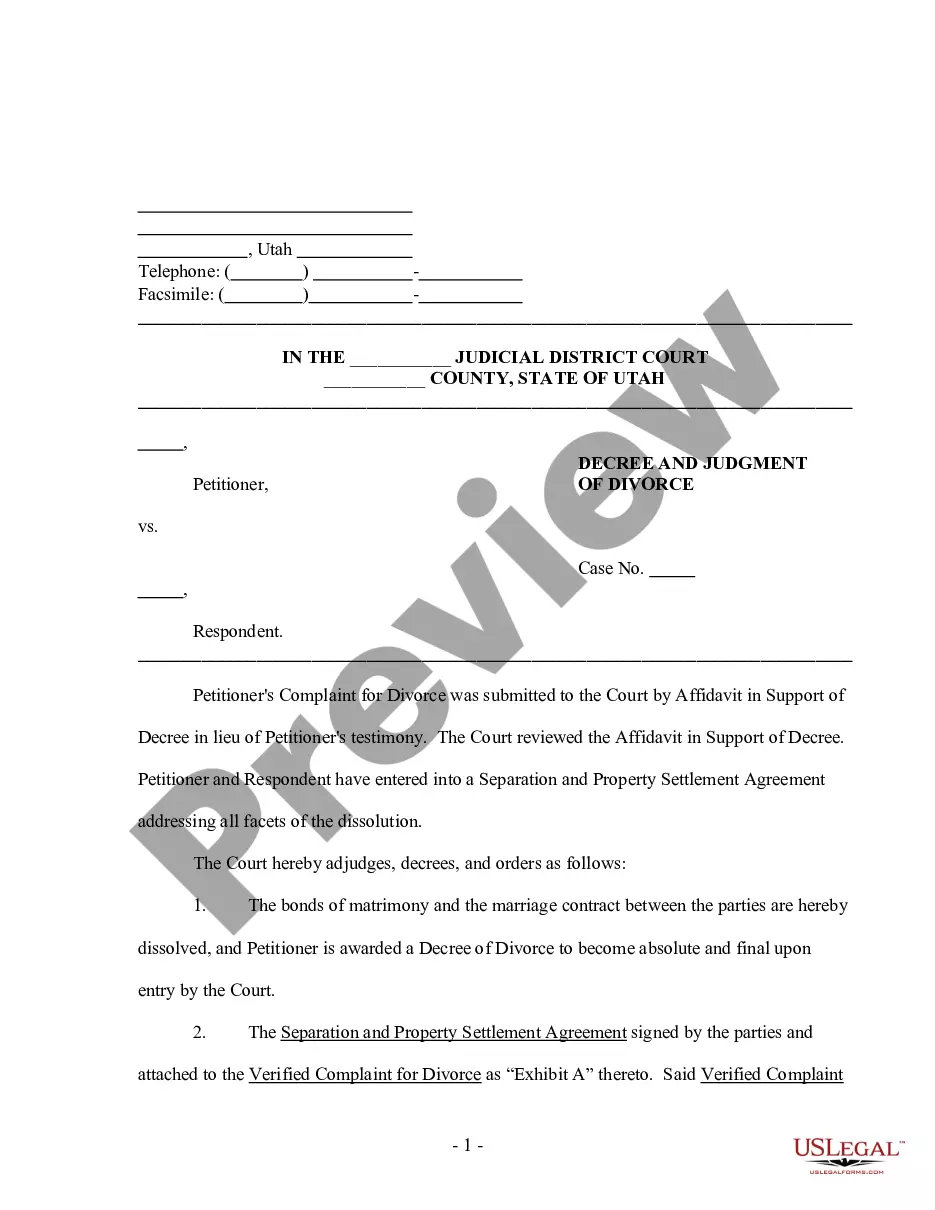

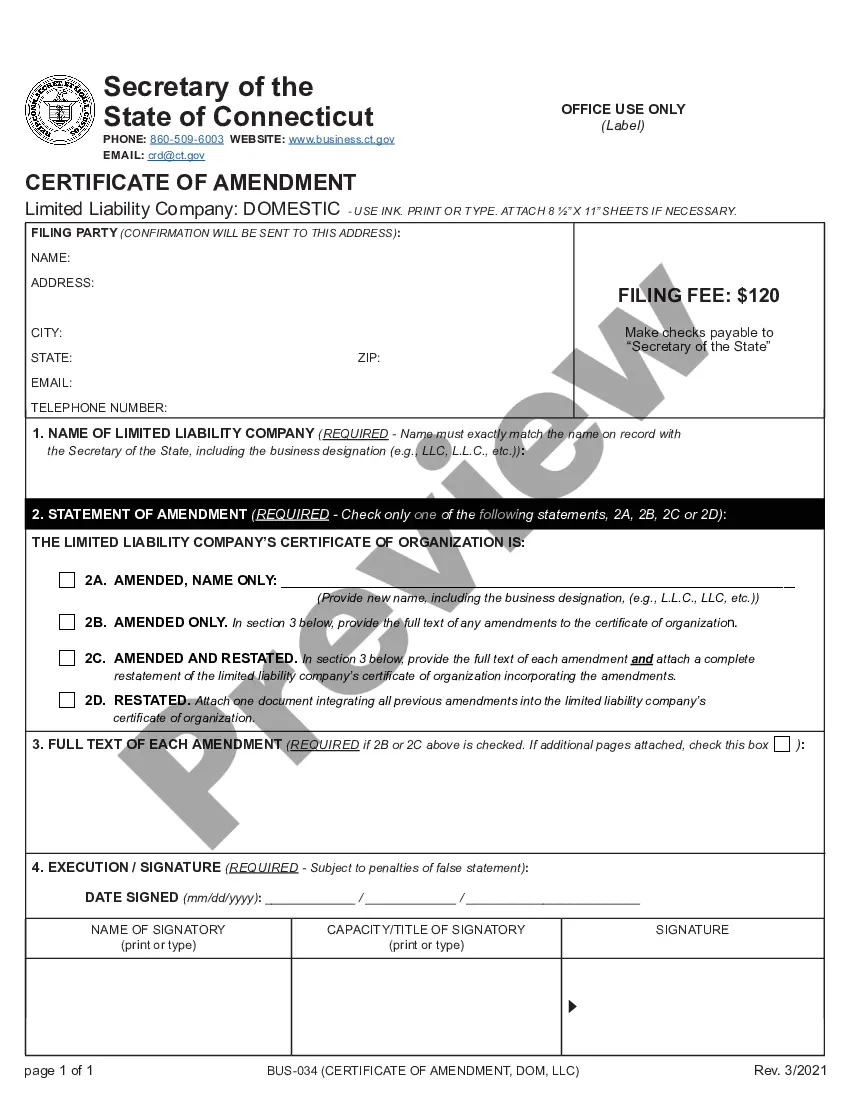

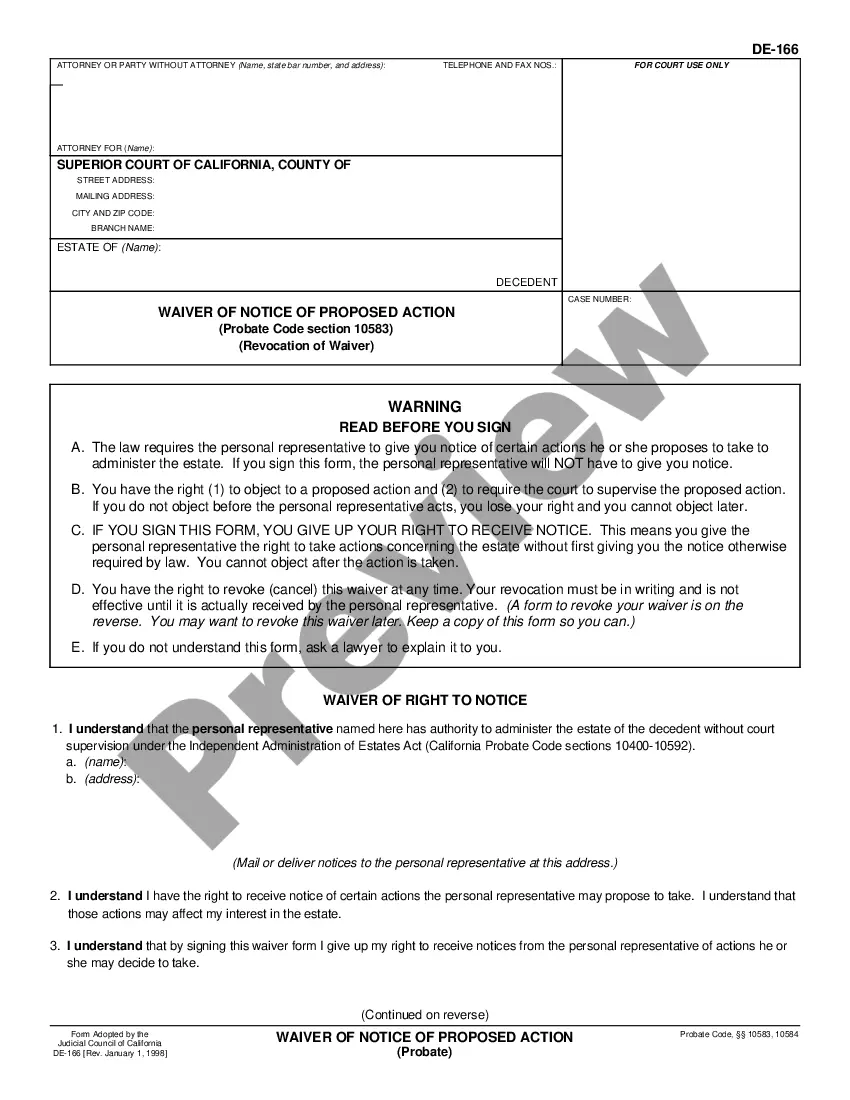

How to fill out San Jose California Living Trust With Provisions For Disability?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like San Jose Living Trust with Provisions for Disability is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to get the San Jose Living Trust with Provisions for Disability. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Living Trust with Provisions for Disability in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Like all trusts, a special needs trust is organized around the people in three roles: a settlor (also called grantor) who creates the trust and provides the money. a beneficiary (the person with the disability), and. a trustee, who manages the money for the sole benefit of the beneficiary.

In California, a special needs trust with assets around $600,000 could cost between $2,000 and $3,000. However, this is just a rough estimate. The actual cost could be less or more, depending on each client's specific situation.

Differences Between Trusts The main difference between trusts is how they were funded. In other words, who owned the assets to create the trust? In a special needs trust, the money came from a person with disabilities. The money can be from an inheritance or personal injury settlement.

Some of the benefits of utilizing an SNT include asset management and maximizing and maintaining government benefits (including Medicaid and Supplemental Security Income). Some possible negatives of utilizing an SNT include lack of control and difficulty or inability to identify an appropriate Trustee.

Disadvantages to SNT Cost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

A special needs trust covers the percentage of a person's financial needs that are not covered by public assistance payments. The assets held in the trust do not count for the purposes of qualifying for public assistance, as long as they are not used for certain food or shelter expenditures.

A Disabled Person's Trust can be a way of ring-fencing assets for the beneficiary so that their means-tested benefits are not affected. A Trust can protect a disabled person who could otherwise be vulnerable to financial abuse or exploitation from others.

A Special Needs Trust (SNT) allows for a disabled person to maintain his or her eligibility for public assistance benefits, despite having assets that would otherwise make the person ineligible for those benefits. There are two types of SNTs: First Party and Third Party funded.

The Special Needs Trust can be used to provide for the needs of a person with a disability and supplement benefits received from various governmental assistance programs, including SSI and Medi-Cal. A trust can hold cash, real property, personal property and can be the beneficiary of life insurance policies.