The Orange California Qualified Domestic Trust Agreement, commonly known as DOT, is a legal arrangement that aims to provide estate tax benefits for non-U.S. citizen spouses. This trust agreement is specifically designed to ensure that assets and properties are passed on to the surviving non-U.S. citizen spouse while still meeting the requirements set by the Internal Revenue Service (IRS). By establishing a DOT, individuals can effectively manage their estate taxes and ensure the financial security of their loved ones. In Orange California, there are two primary types of DOT agreements: 1. Traditional DOT: This type of agreement is the most common and widely used. It allows the surviving non-U.S. citizen spouse to receive income generated by the trust and, in some cases, access to its principal. The traditional DOT provides flexibility, as long as the surviving spouse does not sell or distribute assets from the trust without meeting specific IRS requirements. 2. Estate Tax DOT: This type of DOT agreement is primarily created to address potential estate tax issues. It allows for the deferral of estate taxes until the death of the surviving spouse, with the condition that the assets remain in the DOT. The estate tax DOT aims to maximize estate tax savings by reducing the tax burden on the estate. Both types of DOT agreements require compliance with strict eligibility criteria and documentation, which include selecting a qualified trustee and providing adequate funding for the trust. It is essential to seek professional guidance from an experienced estate planning attorney in Orange California when considering establishing a DOT. In conclusion, an Orange California Qualified Domestic Trust Agreement (DOT) is a legal tool that focuses on providing estate tax benefits to non-U.S. citizen spouses. By setting up a DOT, individuals can ensure their assets and properties transfer to their non-U.S. citizen spouse while following IRS regulations. The two main types of DOT agreements in Orange California are the traditional DOT, providing income and principal access, and the estate tax DOT, deferring estate taxes until the surviving spouse's death. Consulting an estate planning attorney is crucial to effectively establish a DOT and navigate the complexities of estate taxation laws.

Orange California Qualified Domestic Trust Agreement

Description

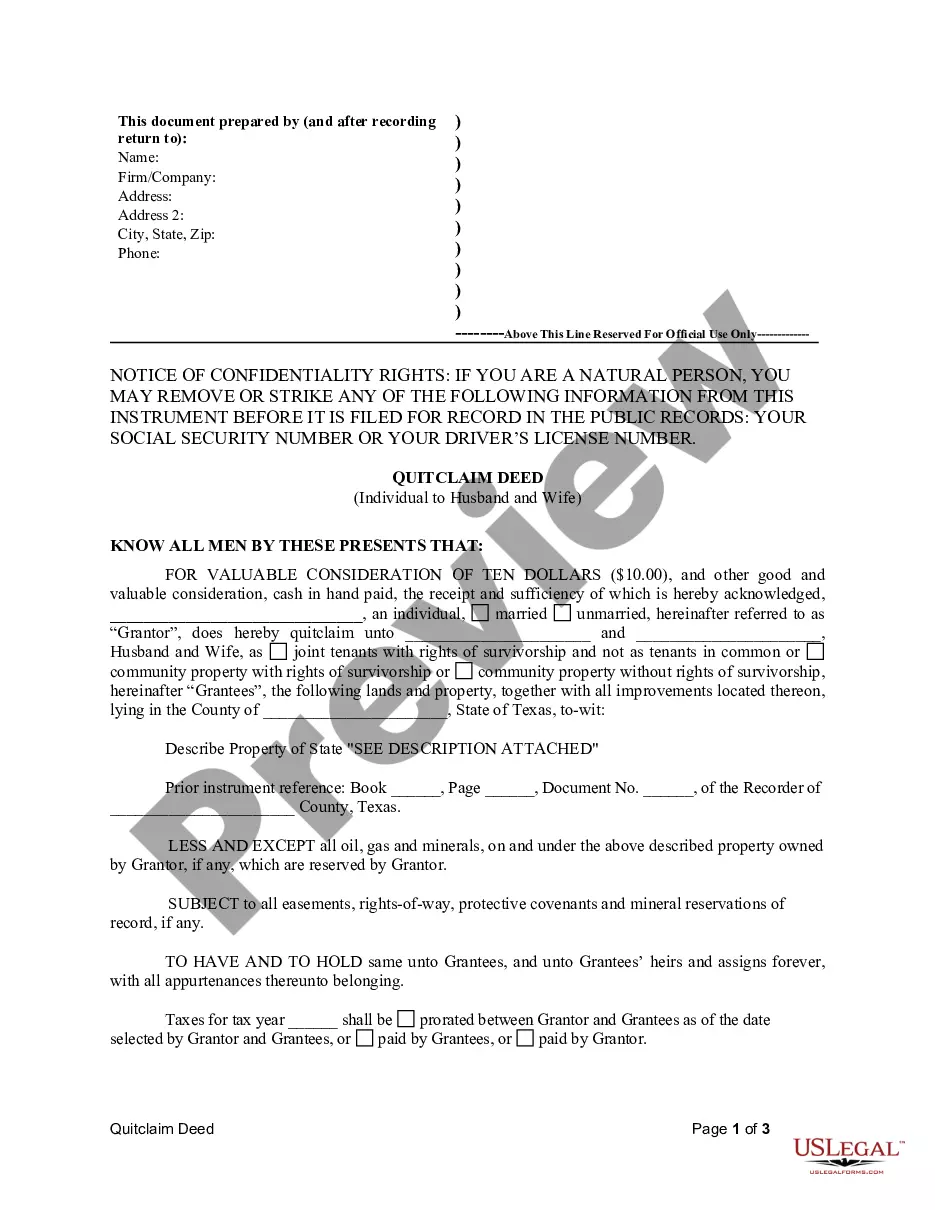

How to fill out Orange California Qualified Domestic Trust Agreement?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Orange Qualified Domestic Trust Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various types varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any activities associated with document execution straightforward.

Here's how you can purchase and download Orange Qualified Domestic Trust Agreement.

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the validity of some records.

- Check the related forms or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Orange Qualified Domestic Trust Agreement.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Orange Qualified Domestic Trust Agreement, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you have to cope with an exceptionally complicated situation, we recommend using the services of an attorney to review your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-compliant paperwork with ease!

Form popularity

FAQ

A QDOT need not be created in the decedent's will (or in a revocable living trust); it may be created by the surviving non-citizen spouse provided it is funded prior to the due date for the federal estate tax return.

A large QDOT requires: At least one of the trustees must be a U.S. bank or a trust company; or. The U.S. trustee (an individual trustee) must furnish a bond or letter of credit equal to 65 percent of the fair market value of the assets in the trust.

It allows for assets to be distributed to a surviving spouse and grow without estate and gift tax liabilities. The taxes only apply when the surviving spouse dies. Unfortunately, this wealth-friendly provision applies only if the surviving spouse is an American.

An experienced trust lawyer can help set up a QDOT that is fully compliant with the set rules for the trust's efficiency as an estate planning tool.

A qualified terminable interest property trust ("QTIP trust") allows a spouse to give a life estate in property to his or her spouse without incurring the federal gift tax. The donee (recipient) spouse has an income interest in the trust and does not have a power of appointment over the principal.

A QDOT need not be created in the decedent's will (or in a revocable living trust); it may be created by the surviving non-citizen spouse provided it is funded prior to the due date for the federal estate tax return.

Legally, to qualify as a QTIP trust, the trust is required to pay all of its income to the spouse beneficiary, and there can't be any other beneficiaries during that spouse's lifetime. This allows couples to ensure that a spouse is taken care of financially.

The main disadvantage of a QTIP trust is conflicts it can generate between the remainder beneficiaries and the surviving spouse. These conflicts can relate to tax strategy, investment decisions, and overall trust administration.

This is called "making a QDOT election" and is irrevocable. The return must be filed nine months after the death. The surviving spouse is entitled to receive any income earned by trust assets, and typically, all income is distributed to the survivor at least annually.

This is called "making a QDOT election" and is irrevocable. The return must be filed nine months after the death. The surviving spouse is entitled to receive any income earned by trust assets, and typically, all income is distributed to the survivor at least annually.