A Houston Texas Qualified Subchapter-S Trust for the Benefit of a Child with a Crummy Trust Agreement is a specific type of trust arrangement designed to provide financial security for a child in the event of a parent's incapacity or death. This trust incorporates the benefits of a Qualified Subchapter-S Trust (SST) structure, which allows for the tax-efficient management of assets, along with the flexibility of a Crummy Trust Agreement, which permits the transfer of assets to the trust while taking advantage of the annual gift tax exclusion. The Houston Texas Qualified Subchapter-S Trust for the Benefit of a Child with a Crummy Trust Agreement offers several advantages for both the granter (the person establishing the trust) and the beneficiary (the child). Firstly, by utilizing the SST structure, the trust can own shares of the granter's subchapter S corporation, providing potential tax benefits. An SST is a specific type of trust that meets certain requirements outlined by the Internal Revenue Code, and it allows the trust income to be taxed at the beneficiary's individual tax rate, potentially resulting in lower overall tax liability. Additionally, the Crummy Trust Agreement component of this trust allows the granter to gift assets to the trust each year up to the maximum amount allowed by the annual gift tax exclusion, currently set at $15,000 per individual. By making use of the annual gift tax exclusion, the granter can transfer assets while minimizing or potentially eliminating any gift tax liability. The Crummy Trust Agreement achieves this by giving the beneficiary the right to withdraw gifted funds for a specific period, typically 30 days, after which the funds become part of the trust. There may be different variations of the Houston Texas Qualified Subchapter-S Trust for the Benefit of a Child with a Crummy Trust Agreement, depending on the specific goals, needs, and circumstances of the granter and beneficiary. These variations may include provisions for the management and distribution of trust assets, such as discretionary distributions for the child's education, healthcare, and overall well-being. The trust may also specify the age or conditions under which the child will have control over the trust assets upon reaching adulthood. The Houston Texas Qualified Subchapter-S Trust for the Benefit of a Child with a Crummy Trust Agreement is a unique estate planning tool that allows for tax-efficient wealth transfer while providing financial security for a child. It combines the benefits of an SST and a Crummy Trust Agreement, allowing for flexibility and maximizing tax advantages. As with any legal and financial arrangement, it is highly recommended consulting with a qualified estate planning attorney or financial advisor to ensure compliance with applicable laws and to tailor the trust to meet individual needs.

Houston Texas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

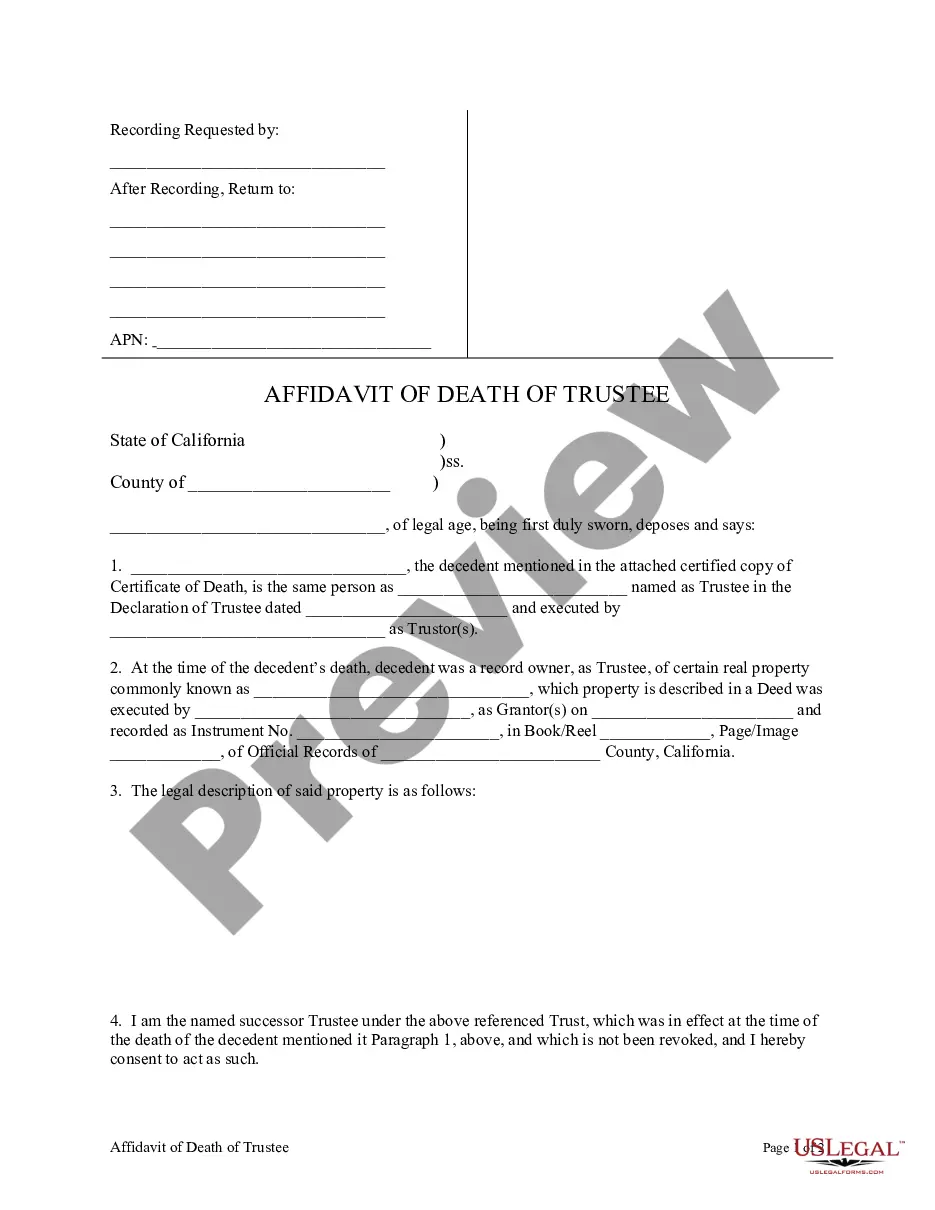

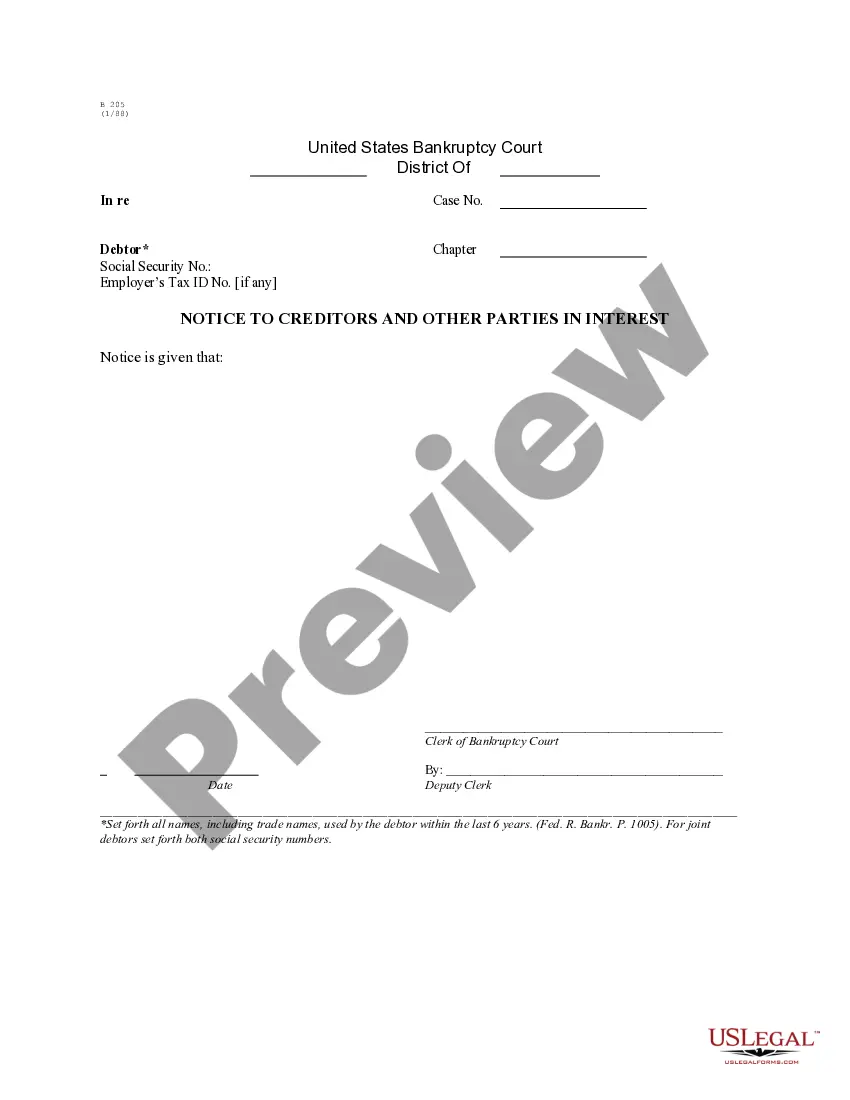

How to fill out Houston Texas Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

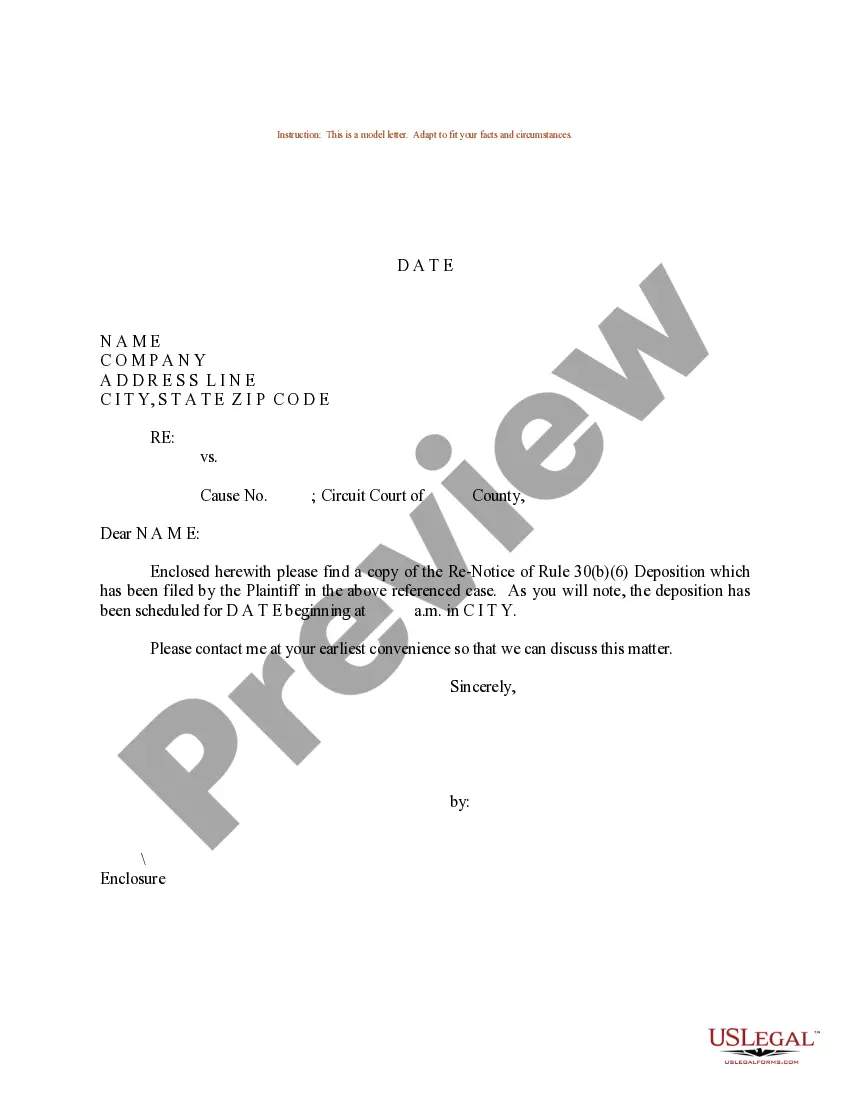

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Houston Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the Houston Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement. Follow the guide below:

- Make certain the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Houston Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

For a QSST, a Form 1041 must be filed each year. Also, regardless of the reporting method used (i.e., a Form 1041 or one of the alternative methods), the grantor tax information letter must be sent to each deemed owner.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Each QSST is a grantor-type trust under Internal Revenue Code § 678. Although each QSST will file a federal fiduciary income tax return, the income from Company will not be reported on the federal return.

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.

To qualify as a QSST, the trust must require that all of the net income be distributed to a single beneficiary. While principal of the QSST may also be distributed to the beneficiary in the discretion of the Trustee, the QSST cannot provide for multiple beneficiaries.

The assets contained in an irrevocable trust are managed by a trustee that controls the disbursements to the beneficiaries. An irrevocable trust that is setup as a grantor trust, qualified subchapter S trust or as an electing small business trust may own shares of an S corporation.

A qualified subchapter S trust has one current income beneficiary, distributes any corpus during the life of the beneficiary to the income beneficiary, terminates the income interest upon the earlier of the death of the beneficiary or the termination of the trust, and upon termination of the trust, distributes all of

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

To obtain relief, the trustee of an ESBT or current income beneficiary of a QSST must sign and file the appropriate election form and include the following statements: A statement from the trustee or beneficiary that includes the information required by Regs. Sec. 1.1361-1(m)(2)(ii) (ESBT) or Regs.