Kings New York Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

How to fill out Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

Do you require to swiftly compose a legally-enforceable Kings Qualified Subchapter-S Trust for the Advantage of Child with Crummey Trust Agreement or perhaps another document to manage your personal or business affairs.

You have two choices: reach out to a legal professional to draft a legitimate document for you or create it completely on your own. Fortunately, there’s another option - US Legal Forms. It will assist you in receiving well-crafted legal documents without incurring exorbitant fees for legal assistance.

Initiate the search process again if the template isn’t what you were looking for by utilizing the search box in the header.

Select the subscription that meets your requirements and continue with the payment. Choose the format in which you wish to receive your document and download it. Print it, complete it, and sign where indicated. If you have already established an account, you can easily Log In, find the Kings Qualified Subchapter-S Trust for the Advantage of Child with Crummey Trust Agreement template, and download it. To re-download the form, simply navigate to the My documents tab. It’s simple to discover and download legal forms when you utilize our services. Moreover, the paperwork we provide is updated by industry professionals, ensuring you greater reassurance when handling legal issues. Try US Legal Forms today and experience it for yourself!

- US Legal Forms offers an extensive selection of over 85,000 state-specific document templates, encompassing Kings Qualified Subchapter-S Trust for the Advantage of Child with Crummey Trust Agreement and form packages.

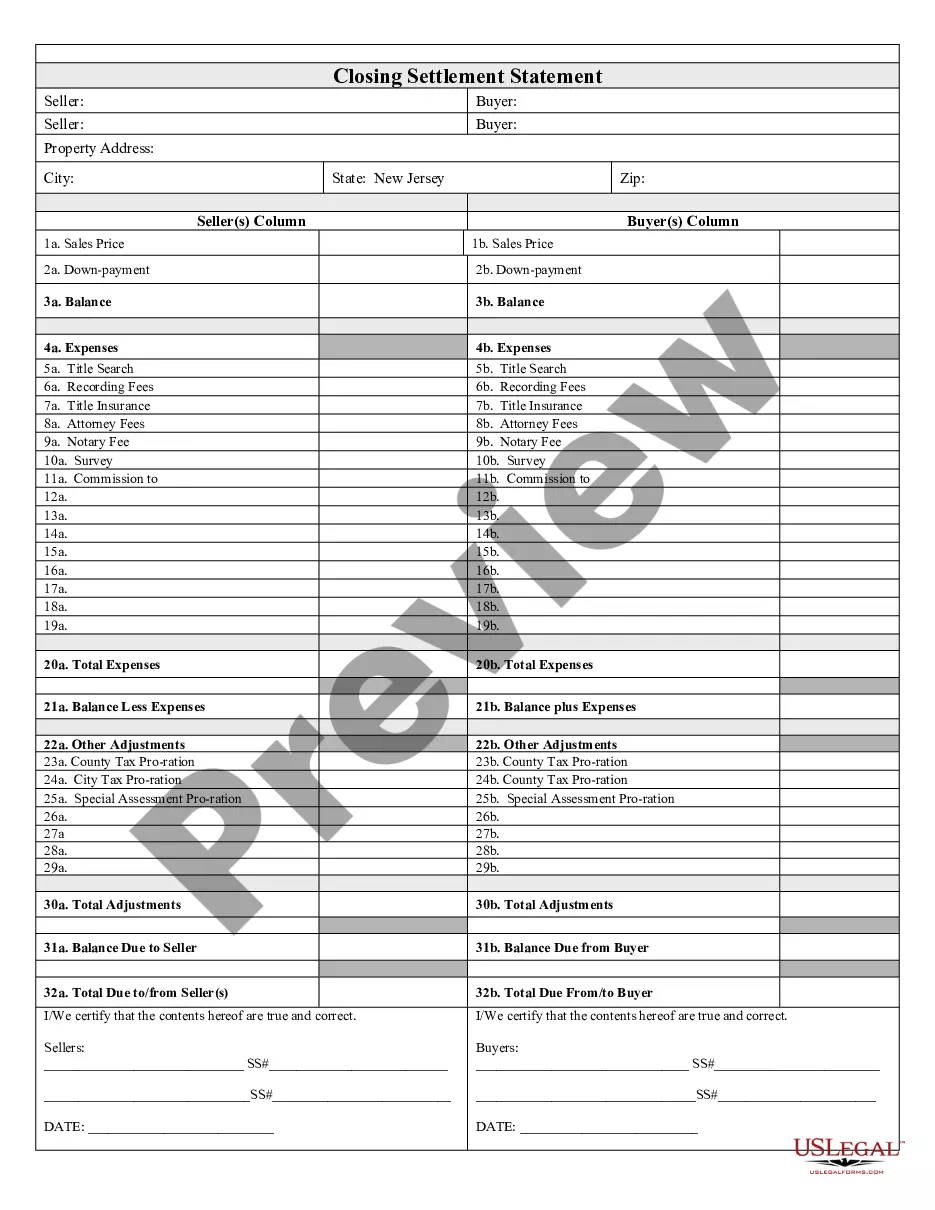

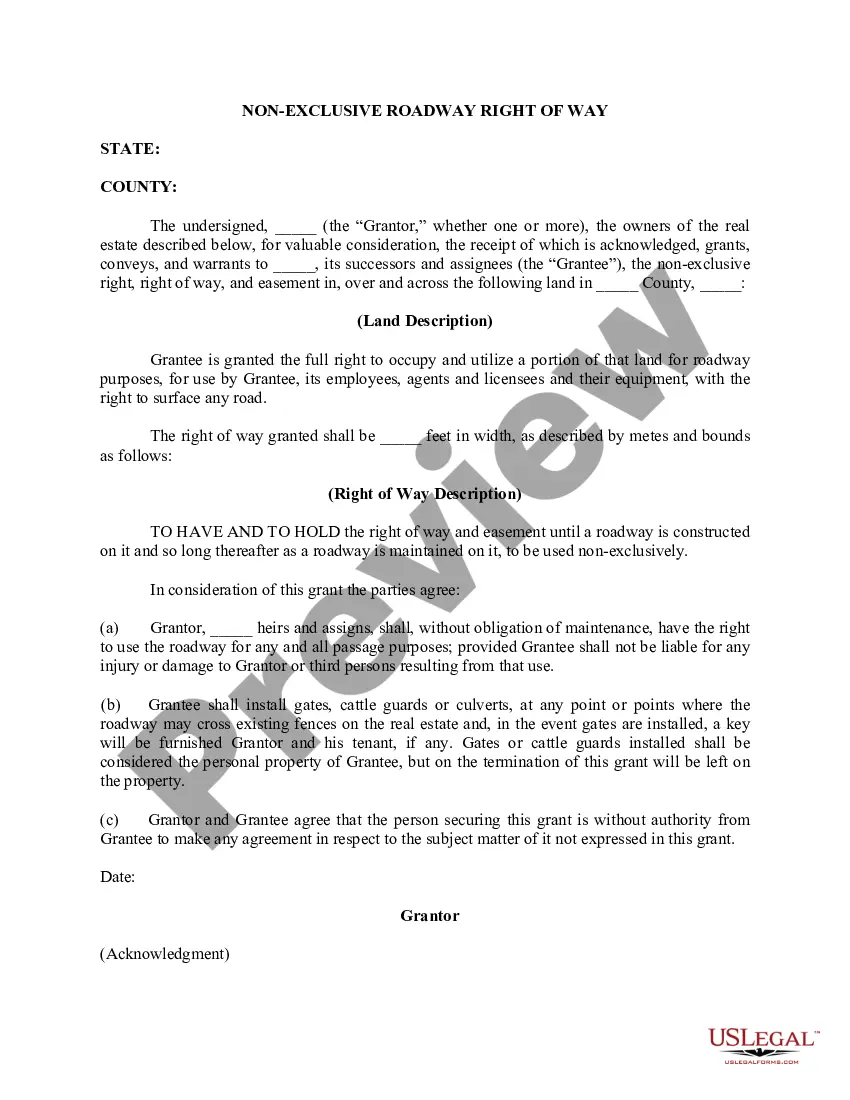

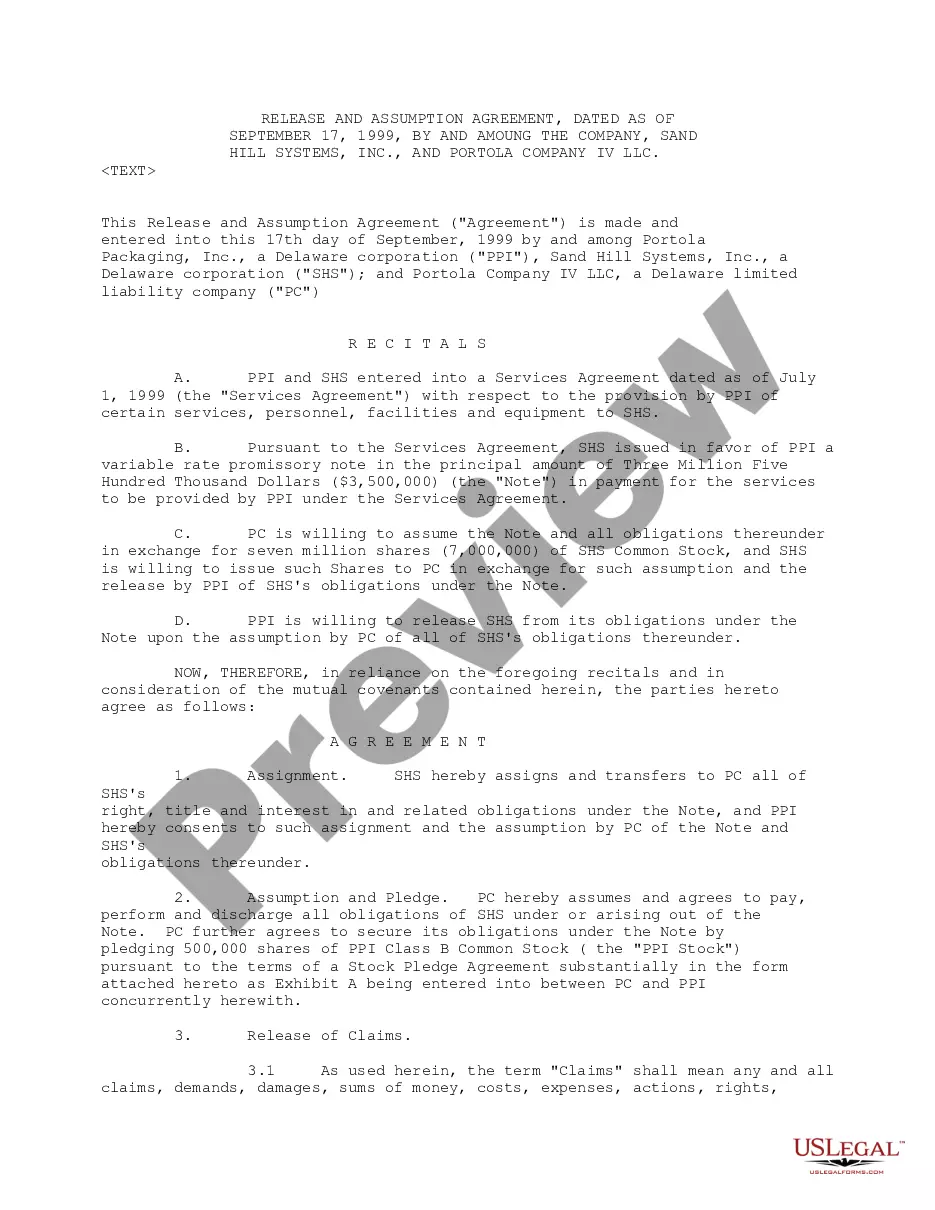

- We provide documents for countless situations: from divorce forms to real estate contracts.

- We’ve been in operation for over 25 years and have established an impeccable reputation among our clients.

- Here’s how you can join them and acquire the necessary template without any hassle.

- To begin, ensure that the Kings Qualified Subchapter-S Trust for the Advantage of Child with Crummey Trust Agreement complies with your state’s or county’s regulations.

- If the form includes a description, verify its intended use.

Form popularity

FAQ

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Crummey power allows a person to receive a gift that is not eligible for a gift-tax exclusion and then effectively transform the status of that gift into one that is eligible for a gift-tax exclusion. For Crummey power to work, individuals must stipulate that the gift is part of the trust when it is drafted.

This trust type is established by your will. It's an eligible S corporation shareholder for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

6 Potential Tax Consequences of a Crummey Trust Your irrevocable trust may be responsible for paying income taxes. This is true if the trust earns more than a certain amount each year. Depending on how the trust is drafted, the trust may need to obtain its own tax ID number.

Tax Treatment: The trust is usually a Complex Trust; IRC §2642(a) for Crummey notice. Definition: A trust that pays income to designated person during the Grantor's lifetime. Upon Grantor's death, remaining trust property distributed to specified charity.

Therefore, an ESBT pays tax directly at the trust level on its S corporation income, and that income isn't passed through to the beneficiaries except for the amount taxed to the owner of the grantor trust portion. The deemed owner of the grantor trust portion is treated as a PCB of the ESBT.

Understanding Crummey Trusts Crummey trusts are typically used by parents to provide their children with lifetime gifts while sheltering their money from gift taxes as long as the gift's value is equal to or less than the permitted annual exclusion amount.

In a nutshell, Crummey trusts can give you control of trust assets and when they're distributed to your beneficiaries, while also yielding tax benefits. Both can be helpful if you're looking for another option beyond custodial accounts or 529 college savings accounts to plan for your child's financial future.

A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.