Nassau New York Qualified Subchapter-S Trust for Benefit of Child with Crummy Trust Agreement is a legal arrangement that provides a framework for managing and distributing assets to a child beneficiary. This type of trust is specifically tailored to take advantage of the tax benefits and protections provided by the Qualified Subchapter-S Trust (SST) under the Internal Revenue Code. A Qualified Subchapter-S Trust for the Benefit of Child with Crummy Trust Agreement in Nassau, New York, is designed to ensure that the child beneficiary receives the maximum benefits while minimizing tax liabilities. The SST status allows the trust to be treated as an eligible shareholder in a Subchapter S Corporation (commonly known as an S Corporation), reducing tax burdens that would otherwise be imposed on the trust. One of the key features of this trust is the Crummy Trust Agreement. This agreement incorporates the "Crummy power," named after the landmark legal case Crummy v. Commissioner. It enables the trust to make annual contributions to an Irrevocable Life Insurance Trust (IIT) on behalf of the child beneficiary, while still qualifying for gift tax exemptions. The Crummy power grants the child beneficiary the right to withdraw a portion of the contributed funds for a limited period, typically 30 days, after receiving notice of the contribution. If the beneficiary chooses not to exercise this withdrawal right, the funds remain in the trust and are shielded from taxation. This mechanism ensures compliance with the annual gift tax exclusion rules without jeopardizing the trust's tax advantages. Different types of Nassau New York Qualified Subchapter-S Trusts for the Benefit of Child with Crummy Trust Agreement may include variations in terms of the trust's duration, disbursement conditions, and investment options. These trusts can be customized to meet the specific needs and goals of the settler, the person creating the trust. In summary, a Nassau New York Qualified Subchapter-S Trust for Benefit of Child with Crummy Trust Agreement is an effective tool for wealthy individuals to transfer assets to their children while minimizing tax liabilities. By utilizing the SST status and integrating a Crummy power provision, this trust structure offers tax advantages and flexibility in managing assets for the benefit of the child beneficiary.

Nassau New York Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

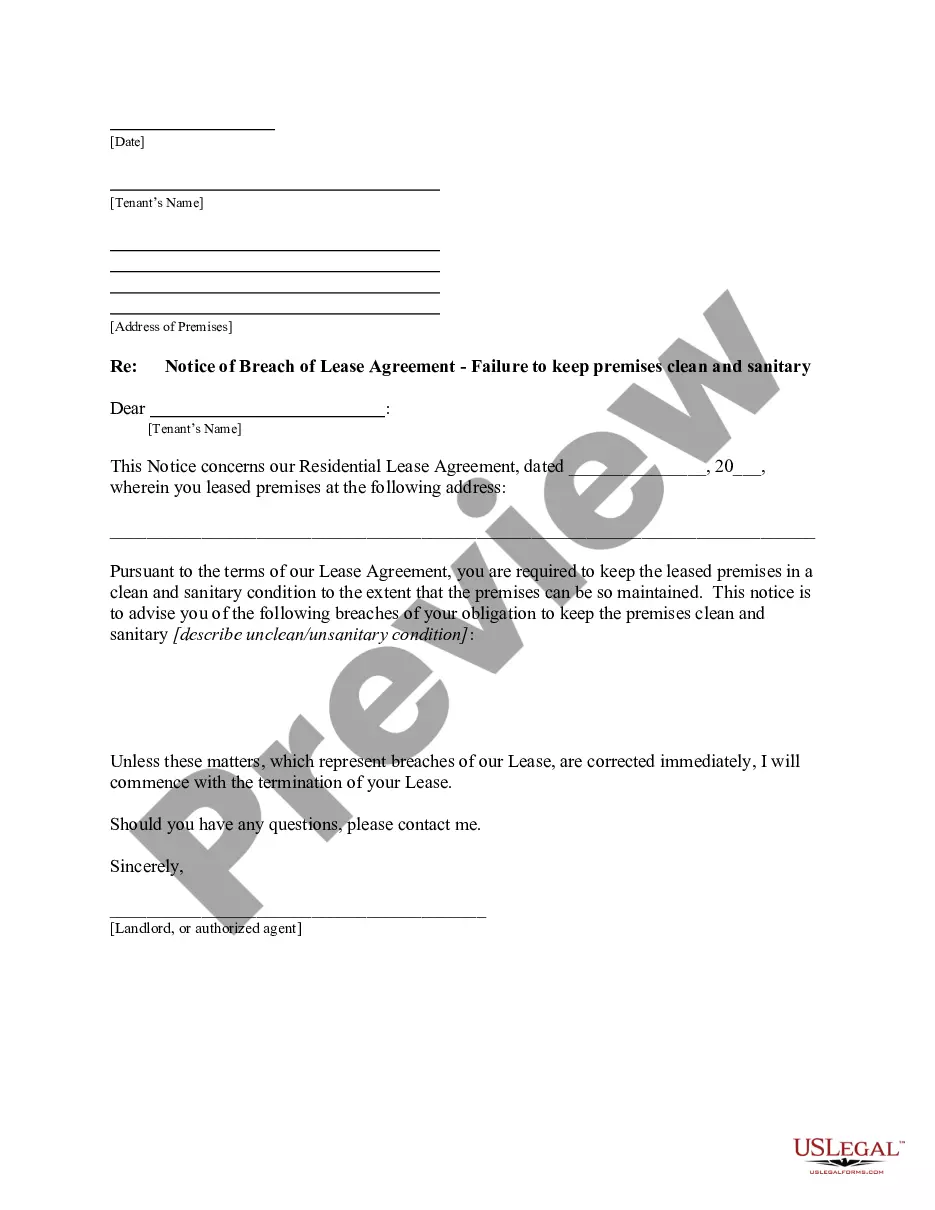

How to fill out Nassau New York Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Nassau Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Nassau Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Nassau Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement:

- Ensure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Nassau Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.

Crummey power allows a person to receive a gift that is not eligible for a gift-tax exclusion and then effectively transform the status of that gift into one that is eligible for a gift-tax exclusion. For Crummey power to work, individuals must stipulate that the gift is part of the trust when it is drafted.

This trust type is established by your will. It's an eligible S corporation shareholder for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

Therefore, an ESBT pays tax directly at the trust level on its S corporation income, and that income isn't passed through to the beneficiaries except for the amount taxed to the owner of the grantor trust portion. The deemed owner of the grantor trust portion is treated as a PCB of the ESBT.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.

Tax Treatment: The trust is usually a Complex Trust; IRC §2642(a) for Crummey notice. Definition: A trust that pays income to designated person during the Grantor's lifetime. Upon Grantor's death, remaining trust property distributed to specified charity.

An irrevocable trust that is setup as a grantor trust, qualified subchapter S trust or as an electing small business trust may own shares of an S corporation.

Understanding Crummey Trusts Crummey trusts are typically used by parents to provide their children with lifetime gifts while sheltering their money from gift taxes as long as the gift's value is equal to or less than the permitted annual exclusion amount.

In a nutshell, Crummey trusts can give you control of trust assets and when they're distributed to your beneficiaries, while also yielding tax benefits. Both can be helpful if you're looking for another option beyond custodial accounts or 529 college savings accounts to plan for your child's financial future.