A Phoenix Arizona Qualified Subchapter-S Trust for the Benefit of Child with Crummy Trust Agreement is a legal arrangement that combines the benefits of a Qualified Subchapter-S Trust (SST) and a Crummy Trust to provide financial protection and tax advantages for a child in Phoenix, Arizona. This type of trust is often used to secure a child's financial future or provide support for their education. The Phoenix Arizona Qualified Subchapter-S Trust for the Benefit of Child with Crummy Trust Agreement allows a child to be the beneficiary of the trust while still ensuring compliance with the rules and regulations set forth by the Internal Revenue Service (IRS). By establishing an SST, the trust income can be taxed at the individual level, potentially resulting in significant tax savings. The Crummy Trust component of this arrangement refers to the Crummy withdrawal power, which gives the child the ability to withdraw a portion of the funds from the trust within a specified time period. By incorporating this provision, the trust is deemed a present interest, making any contributions eligible for the annual gift tax exclusion. This allows the trust creator to make contributions to the trust without incurring gift taxes. There are various types of Phoenix Arizona Qualified Subchapter-S Trusts for the Benefit of Child with Crummy Trust Agreement that can be tailored to suit specific needs and circumstances. For example: 1. Education Trust: Designed to fund a child's education expenses, this type of trust ensures that the child has the necessary financial resources to pursue higher education, such as college or vocational training. 2. Special Needs Trust: Intended for children with special needs, this trust is created to protect their government benefits while providing additional financial support for their care, medical expenses, and quality of life. 3. Retirement Trust: This type of trust is established to accumulate funds for a child's retirement years. It offers tax advantages and allows for growth over time, providing a secure financial future. 4. General Support Trust: A trust aimed at providing general support for a child's overall well-being, including living expenses, healthcare costs, and other necessary expenditures. Overall, a Phoenix Arizona Qualified Subchapter-S Trust for the Benefit of Child with Crummy Trust Agreement offers a versatile and tax-efficient solution to secure a child's financial future in Phoenix, Arizona. By combining the benefits of an SST and a Crummy Trust, parents or guardians can establish a structured and tax-efficient plan to ensure their child's financial well-being.

Phoenix Arizona Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

How to fill out Phoenix Arizona Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Phoenix Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Phoenix Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

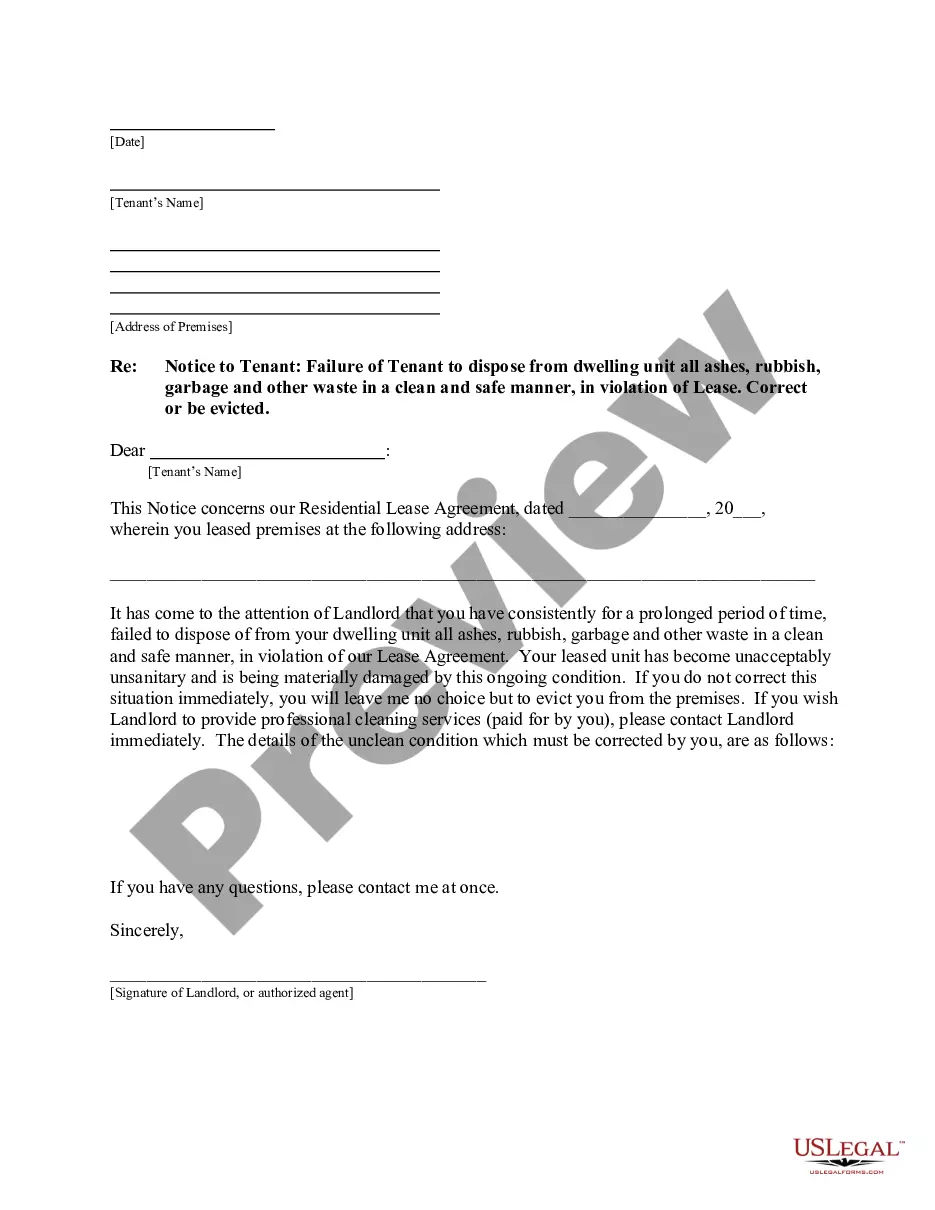

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!