Alameda, California is a vibrant city located in the San Francisco Bay Area. Known for its beautiful parks, tree-lined streets, and diverse community, it is a popular place for families and individuals alike. When it comes to estate planning, one important document to consider is the Alameda California General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion. This trust agreement allows parents or guardians to establish a trust for a minor child that qualifies for the annual gift tax exclusion. This trust agreement is designed to provide a secure financial future for minors while also offering tax benefits. By utilizing the annual gift tax exclusion, individuals can gift up to a certain amount each year without incurring gift tax. In 2021, this exclusion amount is $15,000 per donor. The Alameda California General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion provides a legal framework for managing assets and property on behalf of a minor beneficiary. It outlines the trustee's responsibilities, the rules for distributions, and the conditions under which the trust can be terminated. There are different types of Alameda California General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion, based on the specific needs and preferences of the granter. Some common variations include: 1. Revocable Trust Agreement: This trust agreement can be altered or revoked by the granter during their lifetime, providing flexibility and control over the trust assets. 2. Irrevocable Trust Agreement: Once established, this trust agreement cannot be changed or revoked without the consent of the beneficiaries. It offers greater asset protection and potential tax advantages. 3. Testamentary Trust Agreement: Created as part of a will, this trust agreement goes into effect after the granter's death and allows them to designate assets for the minor beneficiary. It can be subject to probate. 4. Special Needs Trust Agreement: Specifically designed for individuals with special needs, this trust agreement allows parents or guardians to provide financial support without affecting their eligibility for government assistance programs. In conclusion, the Alameda California General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion is a crucial document in estate planning. It offers a way to provide for a minor's financial future while minimizing tax implications. Depending on individual circumstances, there are variations of this trust agreement that can be tailored to meet specific needs, such as revocable or irrevocable trust agreements and special needs trust agreements.

Alameda California General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out Alameda California General Form Of Trust Agreement For Minor Qualifying For Annual Gift Tax Exclusion?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Alameda General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Alameda General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Alameda General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion:

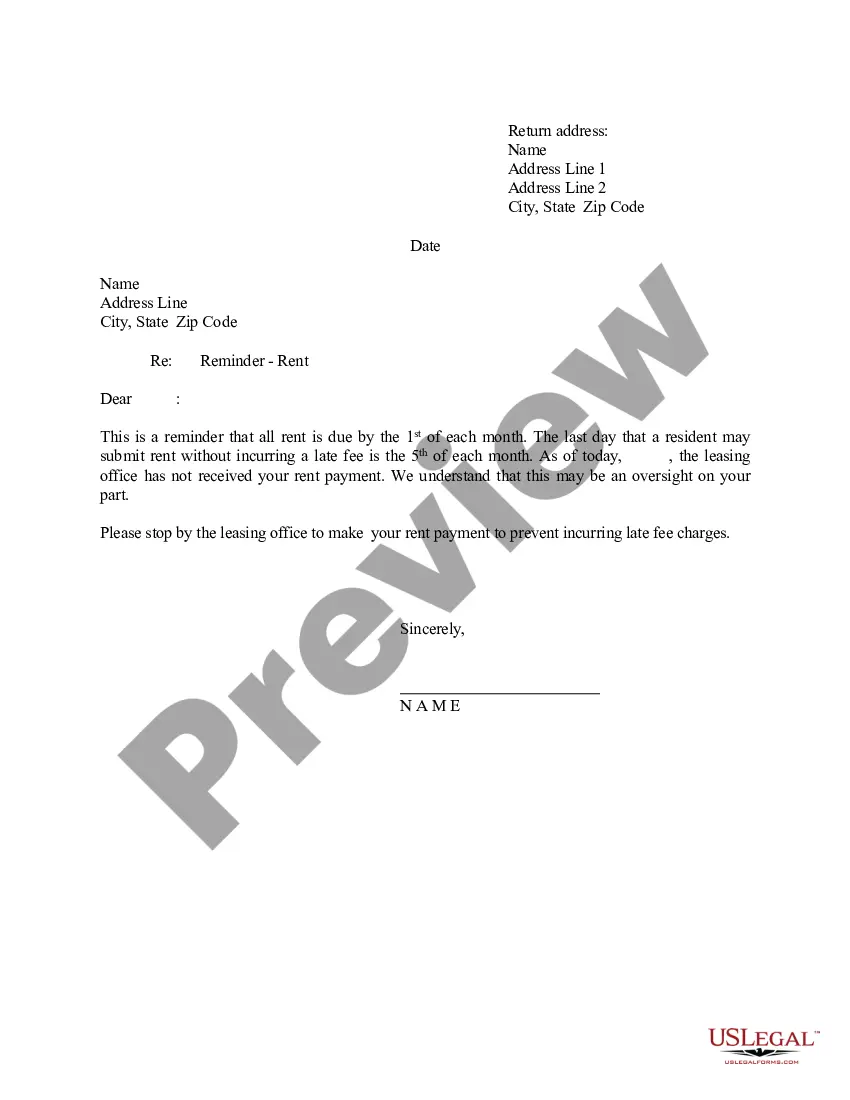

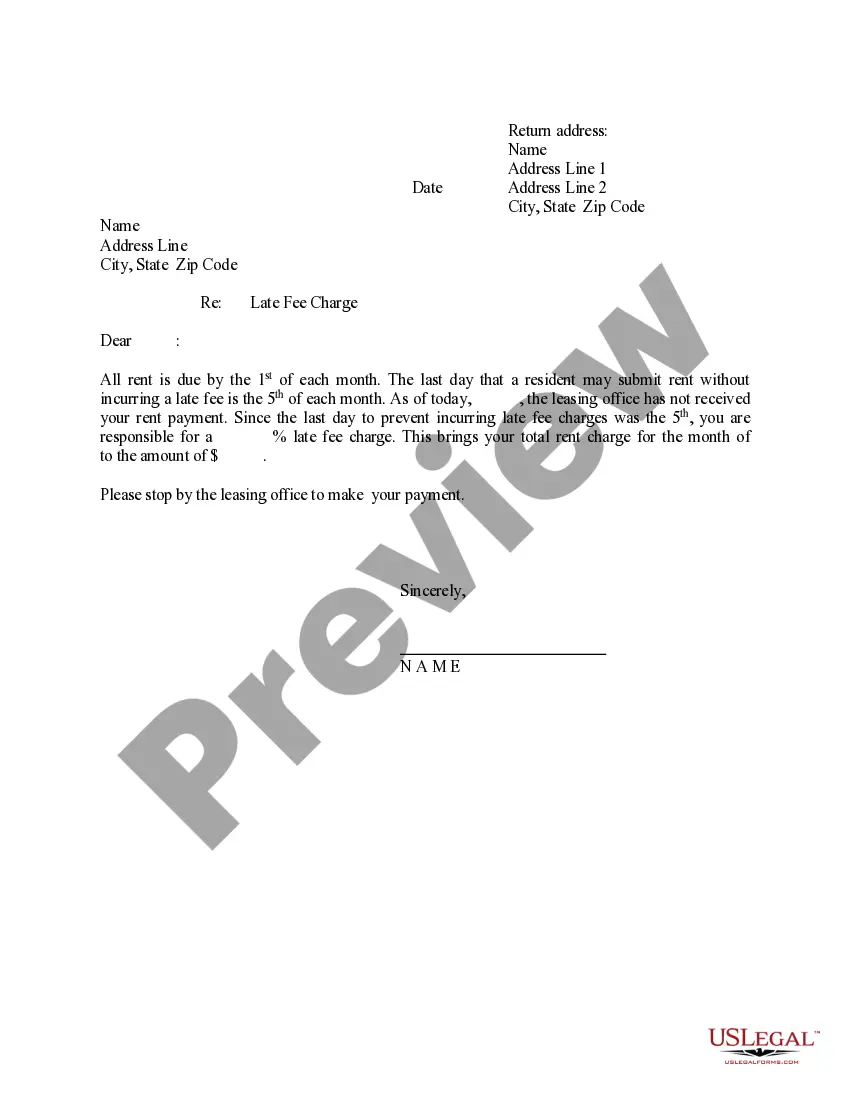

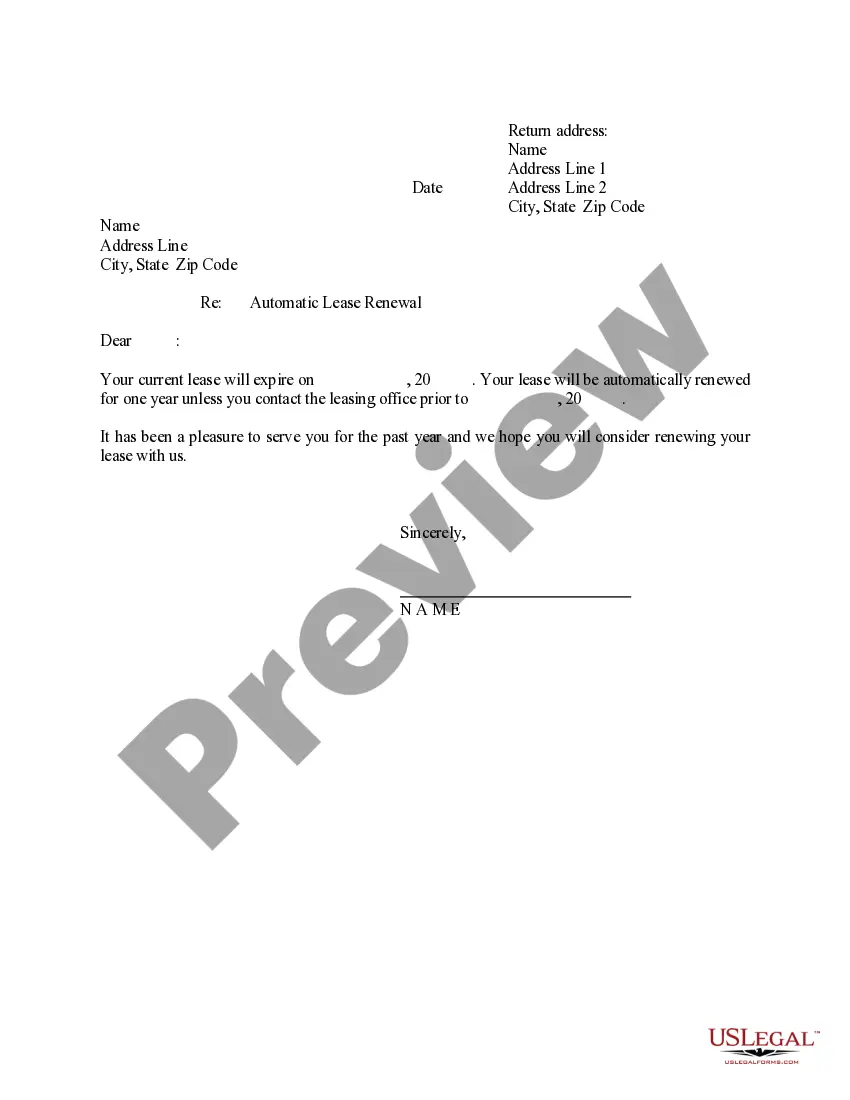

- Examine the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!