San Antonio Texas General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion is a legally binding document that enables individuals to establish a trust for the benefit of a minor while taking advantage of the annual gift tax exclusion limit set by the Internal Revenue Service (IRS). This agreement allows donors to transfer assets to the trust for the minor's benefit without incurring gift taxes up to a certain amount. The San Antonio Texas General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion primarily includes the following details: 1. Parties Involved: The agreement outlines the names and contact information of the individuals involved, including the donor, the trustee(s), and the minor beneficiary. 2. Trust Fund: This section specifies the assets, properties, or funds that the donor wishes to transfer to the trust for the minor's benefit. It may include cash, securities, real estate, and other valuable assets. 3. Trust Terms: This part of the agreement outlines the terms and conditions for the administration, management, and distribution of the trust assets. It may include provisions such as the trustee's responsibilities, investment guidelines, and conditions for distribution to the minor beneficiary. 4. Annual Gift Tax Exclusion: The document explicitly states that the trust is intended to qualify for the annual gift tax exclusion provided by the IRS. This enables the donor to gift a certain amount per year to the trust without being subject to gift taxes. Some variations or types of San Antonio Texas General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion may include: 1. Revocable Trust: This allows the donor to make changes or revoke the trust agreement entirely during their lifetime. It provides flexibility and control over the trust assets. 2. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked once established. It offers additional asset protection and tax advantages but limits the donor's control over the trust assets. 3. Testamentary Trust: This type of trust is created through a will and goes into effect after the donor's passing. It is commonly used to provide for minor children or grandchildren in the event of the donor's death. 4. Supplemental Needs Trust: Also known as a special needs trust, this type of trust is designed to provide for individuals with disabilities without impacting their eligibility for government benefits. It allows for the use of trust assets to enhance the beneficiary's quality of life while preserving their eligibility for assistance programs. In summary, the San Antonio Texas General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion is a legal document that enables individuals to establish a trust for a minor beneficiary while leveraging the annual gift tax exclusion. It offers potential tax benefits while providing for the minor's financial well-being. Various types of this trust agreement exist, including revocable, irrevocable, testamentary, and supplemental needs trusts.

San Antonio Texas General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out San Antonio Texas General Form Of Trust Agreement For Minor Qualifying For Annual Gift Tax Exclusion?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the San Antonio General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the San Antonio General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Antonio General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion:

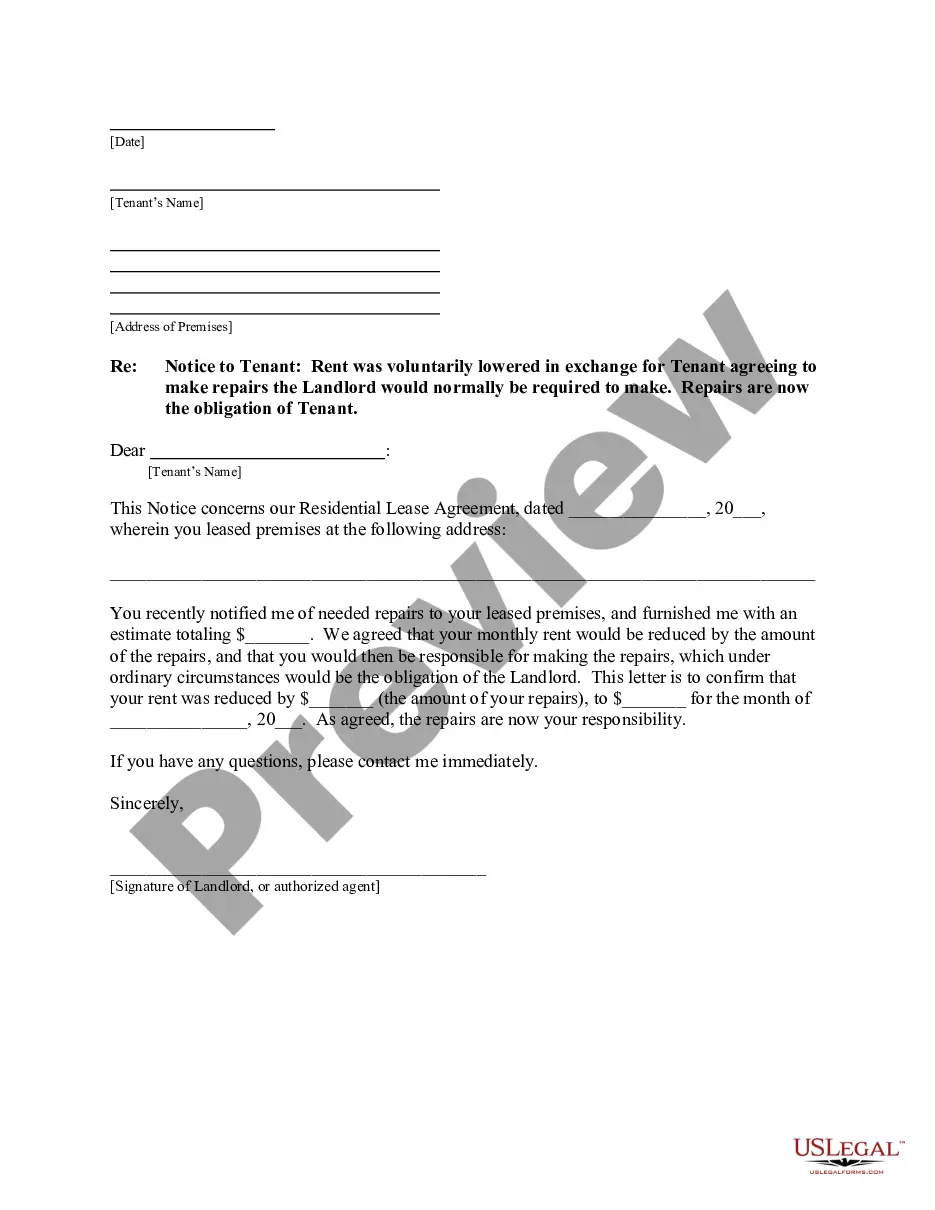

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!