The Cook Illinois Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or is a legal document that provides a framework for the management and distribution of assets for the benefit of a disabled child under Illinois law. This type of trust agreement is designed to ensure that the child with special needs continues to receive financial support and protection even after the parents or guardian are no longer able to provide care. Keywords: Cook Illinois, special needs, irrevocable trust agreement, benefit, disabled child, trust or. This trust agreement is specifically tailored to meet the unique requirements of individuals with special needs, taking into consideration their eligibility for government benefits such as Social Security Disability Insurance (SDI), Supplemental Security Income (SSI), Medicaid, and other assistance programs. By creating this trust, the parents or guardians can address the financial needs of their disabled child while still preserving their eligibility for these vital programs. There are different types of Cook Illinois Special Needs Irrevocable Trust Agreements available, each designed to suit the specific circumstances and desires of the trust or. These may include: 1. Third-Party Cook Illinois Special Needs Irrevocable Trust: This type of trust is established by a non-disabled third party, such as a grandparent or other family member. It ensures that the assets held in the trust are used exclusively for the benefit of the disabled child, while also safeguarding their eligibility for government benefits. 2. Self-Settled Cook Illinois Special Needs Irrevocable Trust: This trust is funded with the assets owned by the disabled child. It is often utilized when the child receives a substantial inheritance, settlement, or judgment. The trust safeguards the received funds, allowing the child to retain government benefits while still enjoying supplemental support from the trust. Both types of Cook Illinois Special Needs Irrevocable Trust Agreements provide a mechanism for the trustee to manage and distribute funds on behalf of the disabled child in a way that maximizes their financial well-being, without jeopardizing their eligibility for government benefits. The trustee has a fiduciary duty to act in the best interest of the beneficiary, ensuring that the trust assets are used for their care, comfort, and quality of life. It is important for parents or guardians of disabled children in Cook Illinois to consult with an experienced attorney specializing in special needs planning to create a Cook Illinois Special Needs Irrevocable Trust Agreement that aligns with their specific goals and circumstances. By doing so, they can provide a consistent and secure financial future for their disabled child, ensuring their well-being even after the parents or guardians have passed away.

Cook Illinois Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

How to fill out Cook Illinois Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

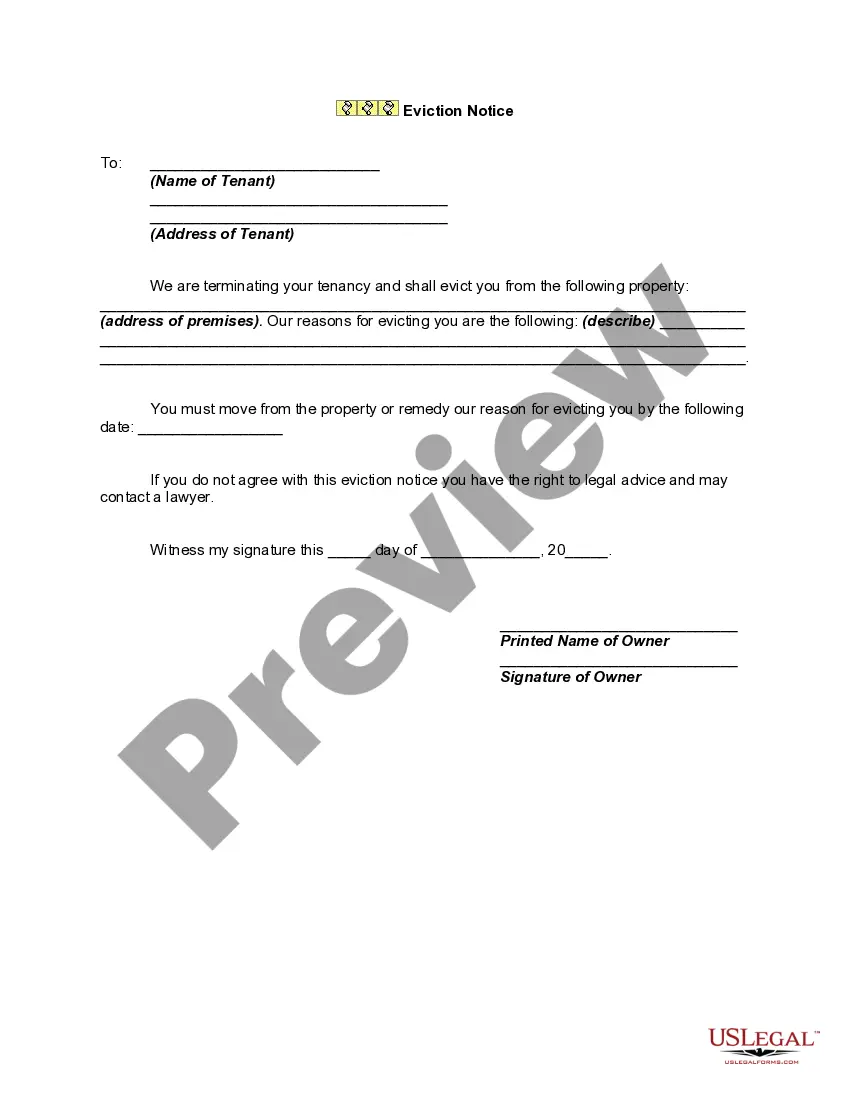

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Cook Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any tasks associated with paperwork completion simple.

Here's how to locate and download Cook Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Examine the related document templates or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase Cook Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Cook Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, log in to your account, and download it. Of course, our website can’t replace a lawyer completely. If you need to deal with an extremely challenging case, we recommend using the services of a lawyer to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant documents with ease!