A Phoenix Arizona Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or is a legally binding agreement established to secure the financial future and well-being of a disabled child in the Phoenix, Arizona area. This type of trust is designed specifically for families with disabled children who may require ongoing medical care, assistance, or government benefits. The main purpose of establishing this trust is to protect the child's eligibility for government benefits, such as Medicaid and Supplemental Security Income (SSI), while providing supplemental financial support for additional needs and quality of life improvements. The Phoenix Arizona Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or ensures that any assets or funds set aside for the child's care are not considered as countable resources when determining eligibility for government assistance. By making the trust irrevocable (meaning it cannot be altered or revoked after creation), it guarantees that the child's eligibility for benefits remains intact. There are different types of Phoenix Arizona Special Needs Irrevocable Trust Agreements for the Benefit of Disabled Child of Trust or, depending on the specific needs and circumstances of the disabled child and their family. Some common types include: 1. First-Party Special Needs Trust: This type of trust is funded with assets belonging to the disabled child, such as a personal injury settlement, inheritance, or back payment of benefits. It allows the child to retain eligibility for government benefits while utilizing the trust funds for supplemental expenses beyond what public assistance provides. 2. Third-Party Special Needs Trust: Unlike the first-party trust, this type of trust is funded with assets owned by someone other than the disabled child, typically a parent or grandparent. It allows the family to contribute funds for the child's benefit without affecting their eligibility for government benefits. 3. Pooled Special Needs Trust: This type of trust is managed by a nonprofit organization, often an established disability advocacy group. Multiple families can pool their resources into a single trust, providing cost-effective administration and investment management. Each beneficiary's share is maintained separately, ensuring the funds are used exclusively for their benefit. 4. Testamentary Special Needs Trust: This trust is established through the Trust or's will and only comes into effect upon their death. It allows the Trust or to provide for a disabled child's future care while ensuring eligibility for government benefits is maintained. Creating a Phoenix Arizona Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or requires careful consideration of state and federal laws, as well as consultation with an experienced estate planning attorney who specializes in special needs trusts. It is essential to tailor the trust to meet the specific needs and circumstances of the disabled child and their family, ensuring the trust provides maximum protection and financial security for the child's lifelong care.

Benefits Of A Irrevocable Trust

Description

How to fill out Phoenix Arizona Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Phoenix Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Phoenix Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Phoenix Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor:

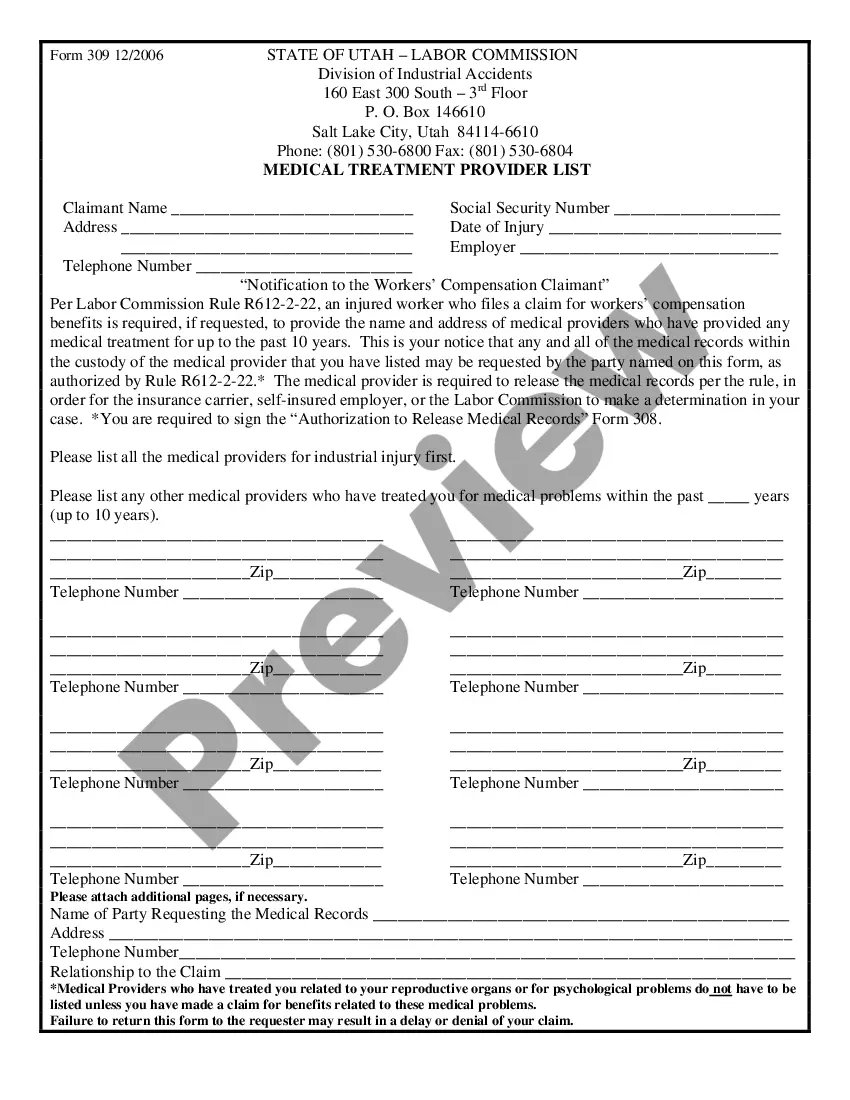

- Take a look at the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!