Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Laws and statutes in every domain differ from one jurisdiction to another.

If you're not a lawyer, it's simple to become disoriented by various standards when it comes to creating legal documents.

To evade costly legal support when drafting the Phoenix Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trustor, you require a validated template that is acceptable for your county.

That's the simplest and most cost-effective method to secure current templates for any legal purposes. Find them all with just a few clicks and maintain your paperwork organized with US Legal Forms!

- That's where utilizing the US Legal Forms platform proves to be beneficial.

- US Legal Forms is a reliable online repository trusted by millions, featuring over 85,000 specific legal templates for each state.

- It's a fantastic resource for both experts and individuals seeking do-it-yourself templates for various personal and business situations.

- All documents can be reused: once you acquire a sample, it remains available in your profile for future access.

- Thus, if you possess an account with an active subscription, you can simply Log In and redownload the Phoenix Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor from the My documents tab.

- For new users, you must follow a few additional steps to acquire the Phoenix Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor.

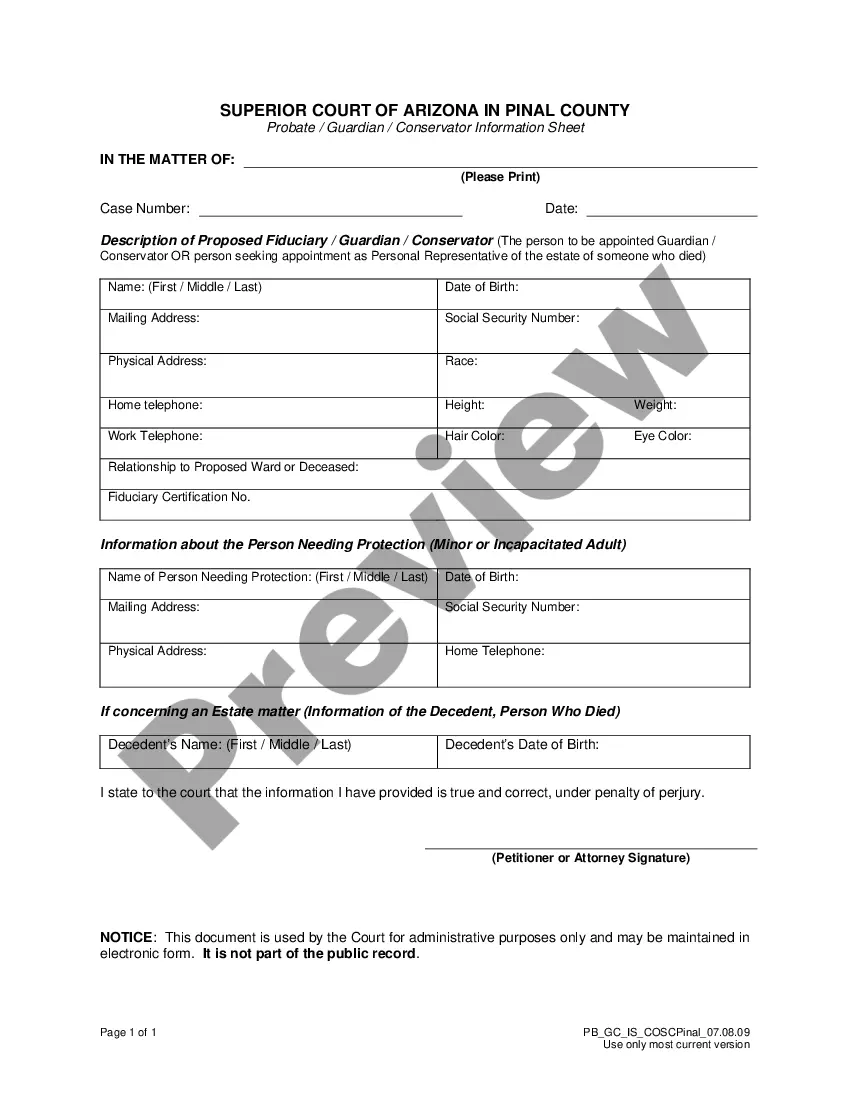

- Review the page content to confirm you have located the correct sample.

- Use the Preview option or read the form description if available.

Form popularity

FAQ

The lookback period for an irrevocable trust is generally five years, during which any transfers made could be scrutinized for Medicaid eligibility. This applies to the Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor as well. Proper planning and timely establishment of the trust can help ensure your child maintains access to necessary support without complications.

To avoid the 5-year lookback rule, families should consider establishing a Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor as early as possible. This proactive approach can protect your child's assets and secure government benefits when they are needed. Consulting with a legal expert can guide you in effective strategies to maintain compliance.

The best trust for a disabled person is often a special needs trust, which includes a Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor. This type of trust allows your child to receive funds without jeopardizing their eligibility for government assistance programs. By choosing this option, you can protect your child’s financial future while ensuring they receive vital benefits.

One significant mistake parents make when setting up a trust fund is failing to clearly define the terms and beneficiaries, particularly when it comes to a Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor. Without clear terms, there can be confusion about how funds can be used, which can jeopardize your child's financial support and benefits. Comprehensive planning ensures the trust effectively serves its intended purpose.

The 5-year rule for an irrevocable trust refers to the period during which any assets transferred into the trust may still be subject to the government's lookback period for Medicaid eligibility. If you create a Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, it's essential to understand that assets transferred within five years of applying for Medicaid can impact your child's eligibility. This means planning ahead is crucial to minimize any potential penalties.

To set up a trust fund for a special needs child, you should begin by consulting a legal expert familiar with special needs planning. You can create a Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor through platforms like USLegalForms, which provide easy access to customizable templates and legal advice. This process typically involves defining the trust terms, choosing a trustee, and transferring assets into the trust.

The best trust for a disabled child is often a special needs trust, specifically a Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor. This type of trust allows you to provide for your child's needs without jeopardizing their eligibility for government assistance programs. It's crucial to select a trust that meets your child's unique requirements and ensures financial security.

Yes, a special needs trust can be irrevocable. This means that once you create it, you cannot change or revoke it without the consent of the beneficiaries. Establishing a Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor helps to safeguard assets for your child while allowing them to continue receiving government benefits. It's an essential tool for providing long-term financial support.

A Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor is an ideal option for parents of disabled children. This type of trust allows you to set aside assets specifically for your child's benefit while preserving their eligibility for government assistance programs. By establishing this trust, you ensure your child receives essential financial support without jeopardizing their access to public benefits. Utilizing a reputable platform like uslegalforms can help you create a compliant and effective trust that meets your family’s unique needs.

Yes, a special needs trust can qualify as a qualified disability trust under certain conditions. It allows families to provide financial support for their disabled loved ones without jeopardizing their eligibility for government benefits. By establishing a Phoenix Arizona Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, you can ensure that your child receives the necessary resources while still qualifying for public assistance programs. This approach not only protects your child's financial future but also gives you peace of mind.