A Bronx New York Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose is a legal clause incorporated into a testamentary trust document that specifies the distribution of assets to charitable organizations in the Bronx, New York, for a specific charitable purpose. This provision ensures that the testator's philanthropic goals are achieved and that their legacy continues to contribute to the betterment of the Bronx community. There can be different types of Bronx New York provisions in a testamentary trust with bequest to charity for a stated charitable purpose, depending on the testator's intentions and objectives. Some common types are: 1. Educational Enrichment Provision: This provision directs the trustee to distribute funds to charitable organizations in the Bronx that focus on improving educational opportunities and resources for underprivileged students. It may support scholarships, mentorship programs, after-school initiatives, or initiatives aimed at bridging the educational achievement gap. 2. Healthcare and Medical Research Provision: With this type of provision, the testator designates charitable organizations in the Bronx that work towards providing healthcare services, medical research, and promoting public health initiatives. It may include funding for medical facilities, research centers, disease prevention campaigns, or initiatives to enhance access to healthcare for vulnerable populations. 3. Community Development and Poverty Alleviation Provision: This provision aims to support charitable organizations in the Bronx that focus on community development, poverty alleviation, and improving the quality of life for individuals and families in need. It may include funding for affordable housing projects, job training programs, community centers, food banks, or initiatives aimed at combating homelessness. 4. Arts and Culture Provision: For individuals passionate about promoting arts and culture in the Bronx, this provision allows them to leave a bequest to charitable organizations that support arts education, cultural events, public performances, or the preservation of historic landmarks in the community. 5. Environmental Conservation Provision: This provision is ideal for individuals who wish to support efforts that protect and preserve the environment in the Bronx. It allows the allocation of funds to charitable organizations that specialize in environmental conservation, sustainability, recycling initiatives, or projects aimed at enhancing the Bronx's natural resources. In conclusion, a Bronx New York Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose empowers testators to leave a lasting impact on the Bronx community through philanthropic endeavors. By specifying the charitable purpose and organizations, a testamentary trust ensures that the testator's wishes are fulfilled, contributing to the betterment of the Bronx's education, healthcare, community development, arts, culture, and environment.

Bronx New York Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out Bronx New York Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

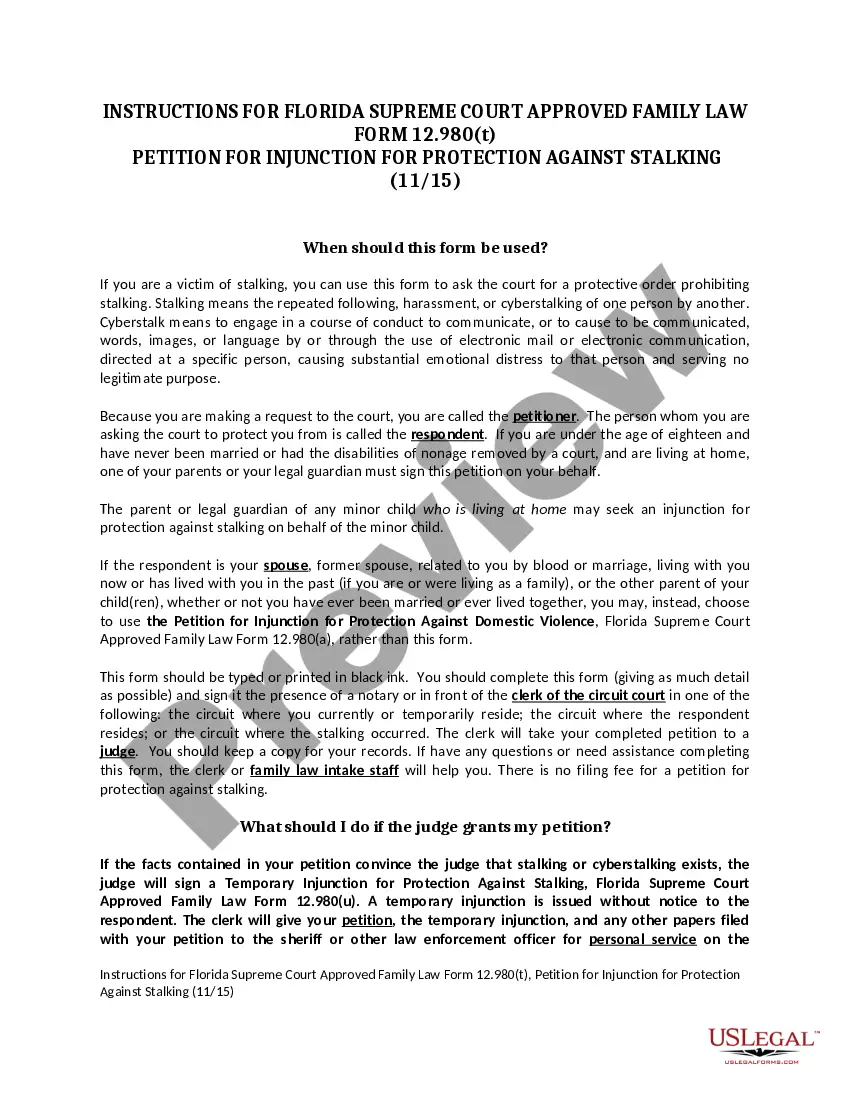

Drafting papers for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Bronx Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Bronx Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step guide below to get the Bronx Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose:

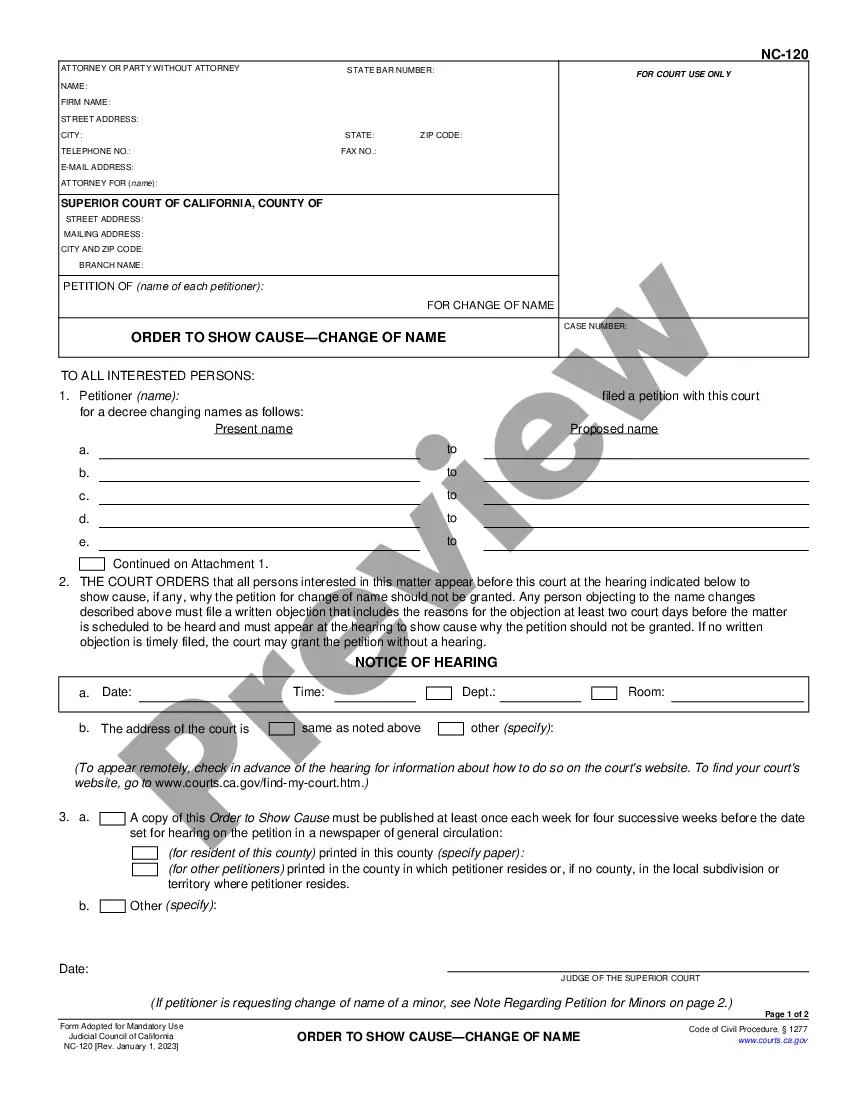

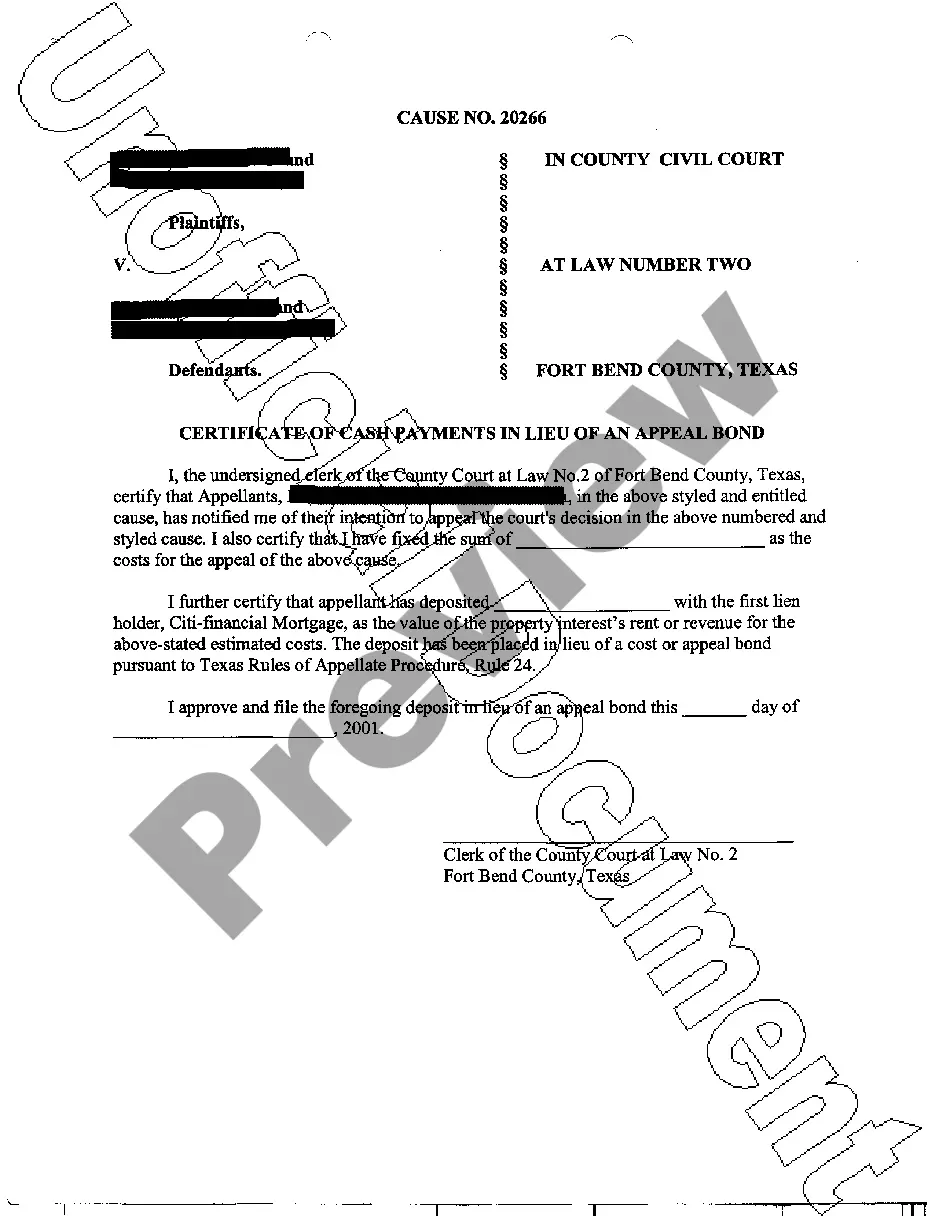

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

How (and Why) to Make a Charitable Bequest Choose an organization to receive your bequest.Decide what type of bequest you will give.Decide what you will give in your bequest.Add the bequest to your will and tell people about it.Pat yourself on the back while you think about the benefits of making a charitable bequest.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

Testamentary Gifts by Trust Testamentary trusts are frequently used to provide for minor children or individuals with special needs. And in the realm of charitable giving, these trusts allow the donor to support meaningful charities while offsetting some or all of any applicable estate tax.

Some possible disadvantages are: There is no actual benefit for you, the will maker, although there may be benefits for your beneficiaries. Cost testamentary trusts are often more complex, they generally cost more to produce and they generally involve ongoing accountancy and other fees during their operation.

Because the charitable bequest is not paid from income, no charitable income tax deduction can be taken on the Form 1041, which is the fiduciary income tax return.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

If the CRT is funded with cash, the donor can use a charitable deduction of up to 60% of Adjusted Gross Income (AGI); if appreciated assets are used to fund the trust, up to 30% of their AGI may be deducted in the current tax year.

In general, there is an unlimited deduction of charitable bequests against the value of an estate, making it a powerful tool for reducing estate tax. It is possible for an estate to deduct charitable bequests of not only cash, but also property such as real estate, stock, IRAs, autos and other assets.

You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients (DGRs). To claim a deduction, you must be the person that gives the gift or donation and it must meet the following 4 conditions: It must be made to a DGR.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts. Revocable Trusts. Irrevocable Trusts. Testamentary Trusts.