Cuyahoga Ohio Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

Laws and guidelines in every region differ across the nation.

If you are not a legal professional, it can be challenging to navigate the different standards when drafting legal documents.

To prevent costly legal fees when preparing the Cuyahoga Provision in Testamentary Trust with a Bequest to Charity for a Specific Charitable Purpose, you require a validated template appropriate for your jurisdiction. This is where the US Legal Forms platform proves to be extremely advantageous.

Follow this process to effortlessly and affordably acquire current templates for any legal situations. Discover them with just a few clicks and manage your documentation efficiently with US Legal Forms!

- US Legal Forms is a reliable online repository utilized by millions, containing over 85,000 state-specific legal templates.

- It offers an excellent solution for professionals and individuals seeking DIY templates for various personal and business situations.

- All documents can be reused: once you acquire a template, it remains accessible in your account for future needs.

- Therefore, if you have an account with an active subscription, you can simply Log In and re-download the Cuyahoga Provision in Testamentary Trust with Bequest to Charity for a Specific Charitable Purpose from the My documents section.

- For new users, it's essential to follow a few additional steps to obtain the Cuyahoga Provision in Testamentary Trust with Bequest to Charity for a Specific Charitable Purpose.

- Review the page details to ensure you have located the correct template.

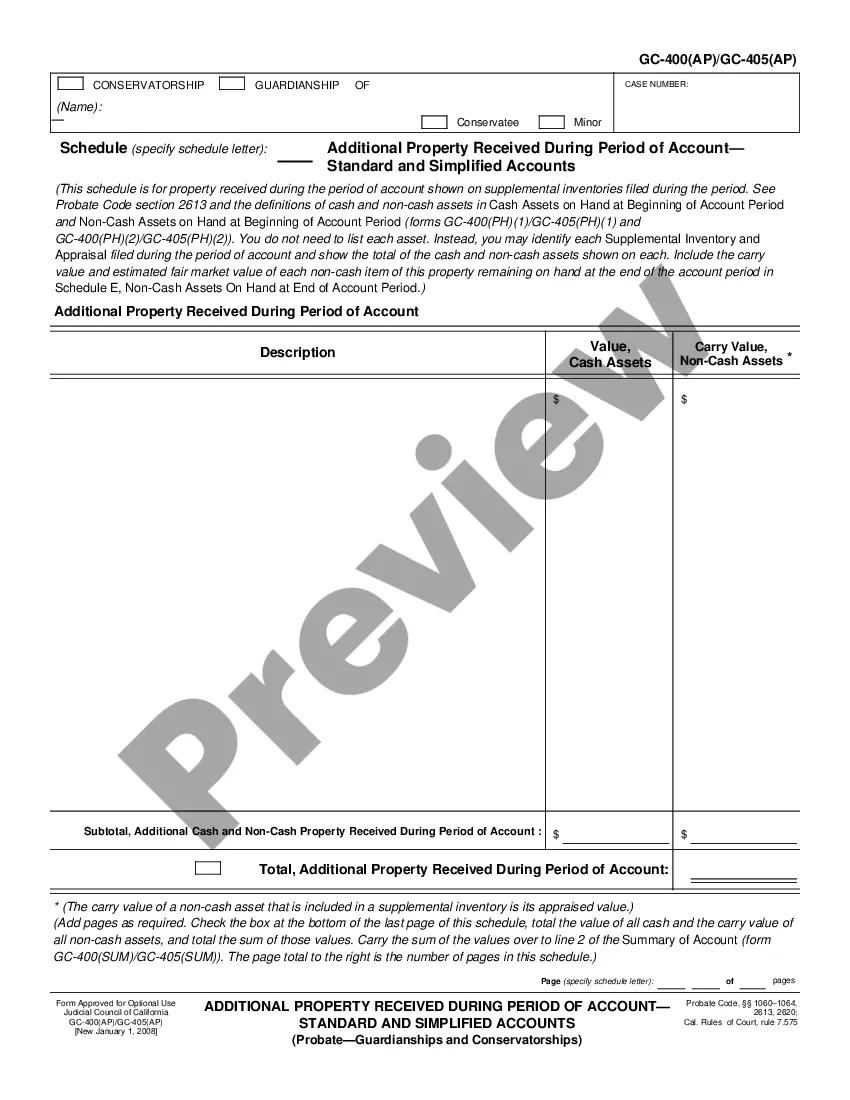

- Utilize the Preview feature or peruse the form description if available.

- Search for an alternative document if there are any discrepancies with your requirements.

Form popularity

FAQ

Testamentary Gifts by Trust Testamentary trusts are frequently used to provide for minor children or individuals with special needs. And in the realm of charitable giving, these trusts allow the donor to support meaningful charities while offsetting some or all of any applicable estate tax.

A bequest is a gift, but a gift is not necessarily a bequest. A bequest describes the act of leaving a gift to a loved one through a Will. For example, you could simply state something like I bequest my red Corvette to my son in a Will. On the other hand, a gift can be made outside of a Will.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts. Revocable Trusts. Irrevocable Trusts. Testamentary Trusts.

Some possible disadvantages are: There is no actual benefit for you, the will maker, although there may be benefits for your beneficiaries. Cost testamentary trusts are often more complex, they generally cost more to produce and they generally involve ongoing accountancy and other fees during their operation.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

Testamentary gift is a gift made by will. Such gifts do not become effective until the death of the donor. The ownership of the gift is transferred to the donee only after the testator's death. There are two terms used to refer testamentary gifts, a devise and a bequest.

Testamentary Charitable Gift Annuity A charitable gift annuity is an arrangement whereby assets are given to a charity in return for the charity's promise to make payments of a fixed amount to the beneficiary designated by the donor.

How (and Why) to Make a Charitable Bequest Choose an organization to receive your bequest.Decide what type of bequest you will give.Decide what you will give in your bequest.Add the bequest to your will and tell people about it.Pat yourself on the back while you think about the benefits of making a charitable bequest.