Dallas Texas Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose A Dallas Texas provision in a testamentary trust represents a specific provision that can be included in a trust document to benefit charitable organizations in the Dallas, Texas area. This provision ensures that a certain portion of the trust assets or income will be allocated towards charitable purposes as outlined by the donor. When creating a testamentary trust, individuals can choose to include a bequest to a charitable organization in Dallas, Texas that aligns with their philanthropic interests. This bequest can be in the form of a fixed dollar amount, a percentage of the trust assets, or a specific piece of property. It is crucial for the donor to clearly state their intentions and specify the charitable purpose for which the bequest is intended. The stated charitable purpose can vary depending on the donor's preferences and the organization involved. Common examples of charitable purposes could include funding education scholarships, supporting medical research, promoting the arts, providing assistance to low-income individuals, or aiding environmental conservation efforts in the Dallas, Texas community. There are different types of Dallas Texas provisions in testamentary trusts with bequests to charity for stated charitable purposes, including: 1. Fixed Bequest: This provision entails a specific dollar amount or ownership of a particular asset that is provided to the charitable organization. 2. Residuary Bequest: This provision involves assigning a percentage or the remainder of the trust assets to a charitable organization after other specific bequests are fulfilled. 3. Charitable Lead Trust: This type of provision allows the trust to provide income or assets to a charitable organization for a certain period of time. After that period, the remaining trust assets are distributed to other designated beneficiaries, such as family members or other non-charitable organizations. 4. Donor-Advised Fund Provision: With this provision, the donor can establish a donor-advised fund within the testamentary trust, allowing their specified charitable purpose to be carried out by the fund. The donor or their designated advisors will have the ability to recommend charities to receive distributions from the fund. Including a Dallas Texas provision in a testamentary trust allows individuals to leave a lasting impact on their chosen charitable cause within the local community. By specifying their charitable intentions and naming the charitable organization, donors can ensure that their philanthropic goals are fulfilled even after their passing.

Dallas Texas Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

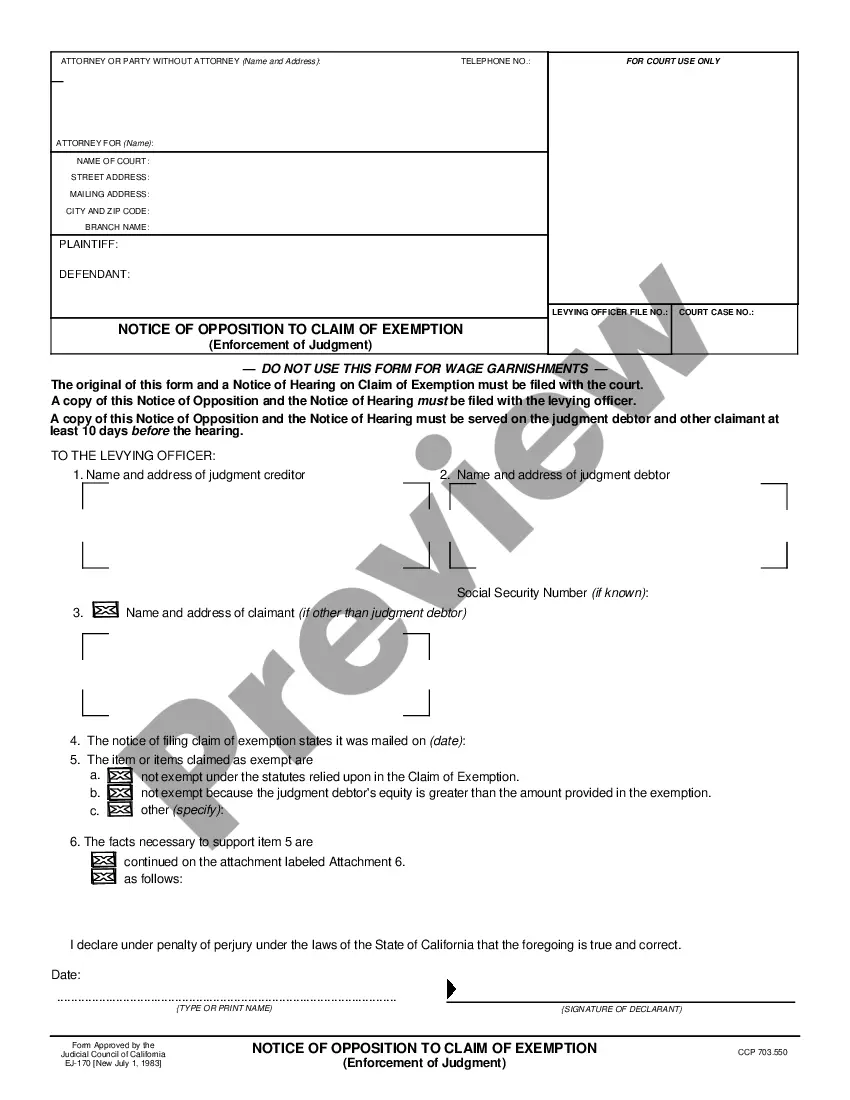

How to fill out Dallas Texas Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

Draftwing forms, like Dallas Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose, to take care of your legal matters is a difficult and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms crafted for a variety of cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Dallas Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Dallas Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose:

- Ensure that your form is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Dallas Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start using our website and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!