Franklin, Ohio Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose A Franklin, Ohio provision in a testamentary trust with a bequest to charity for a stated charitable purpose is a legal term referring to a specific type of charitable arrangement in estate planning. It allows individuals to leave a bequest to a designated charitable organization or cause in their will, creating a trust that outlines how the funds are to be managed and used for the stated purpose. Keywords: Franklin, Ohio provision, testamentary trust, bequest, charity, stated charitable purpose, estate planning, trust management, charitable organization, funds. In Franklin, Ohio, there can be different types of provisions in a testamentary trust with a bequest to charity for a stated charitable purpose. These provisions may include: 1. Specific Charitable Purpose: The testator can specify a particular charitable purpose to which the bequest should be used. For example, it could be for the advancement of education, medical research, alleviating poverty, or supporting cultural institutions. 2. Restricted Use: The provision may restrict the use of the funds solely for the stated charitable purpose. This ensures that the bequest is utilized in a manner that aligns with the testator's intentions. 3. Trustee Appointment: The provision may designate a trustee responsible for managing the trust and ensuring its compliance with the stated charitable purpose. The trustee is typically someone with financial expertise or a representative from the chosen charitable organization. 4. Investment Guidelines: The provision may provide guidelines on how the trust funds should be invested to generate income while preserving the principal. This ensures that the trust can continue supporting the stated charitable purpose in the long run. 5. Reporting Requirements: The provision may require periodic reports from the trustee to the beneficiaries or charitable organization, detailing the trust's financial activities and how the funds are being utilized for the stated purpose. This promotes transparency and accountability. 6. Successor Beneficiaries: In the event that the designated charitable organization ceases to exist or changes its mission, the provision may include contingencies regarding the reassignment of the bequest to an alternative charity with a similar charitable purpose. 7. Tax Benefits: By incorporating a Franklin, Ohio provision in a testamentary trust with a bequest to charity, the testator may benefit from certain tax advantages, such as estate tax deductions or income tax savings. It is important to consult with an experienced estate planning attorney or financial advisor when considering a Franklin, Ohio provision in a testamentary trust with a bequest to charity for a stated charitable purpose. They can provide guidance on drafting the appropriate provisions and help ensure that the testator's charitable goals are effectively accomplished.

Franklin Ohio Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out Franklin Ohio Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

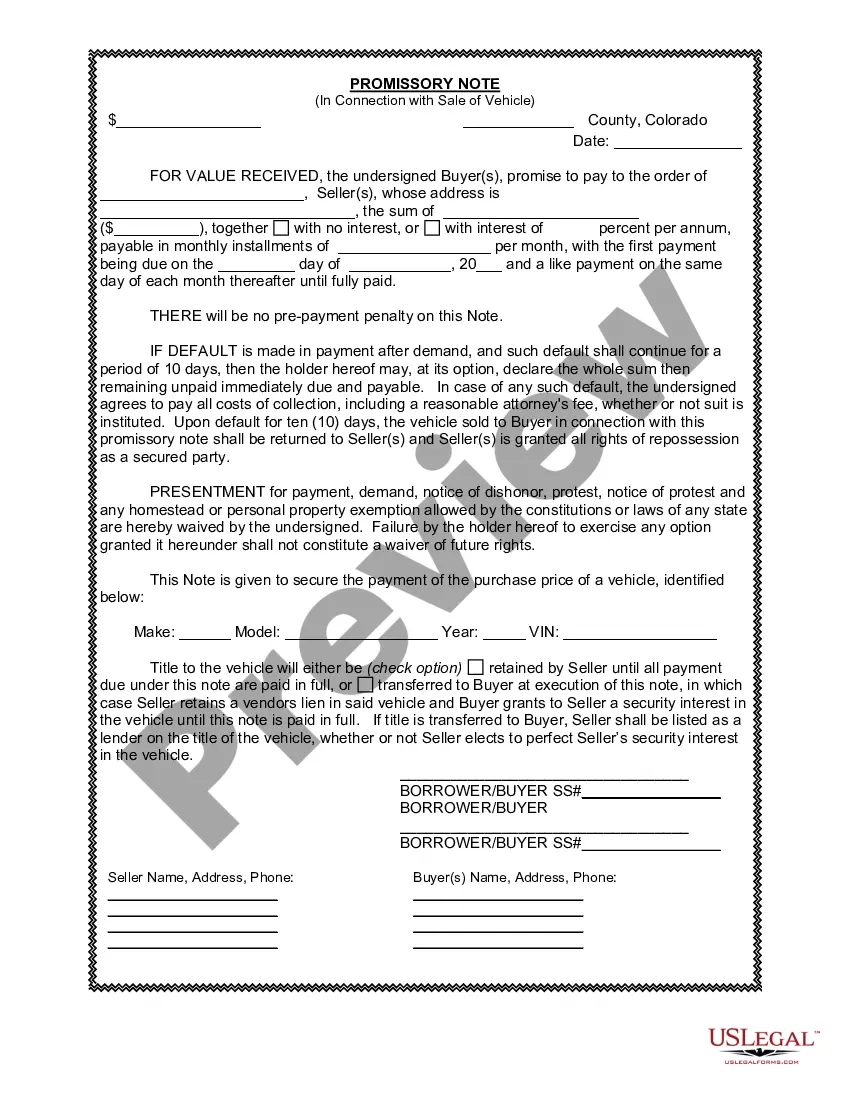

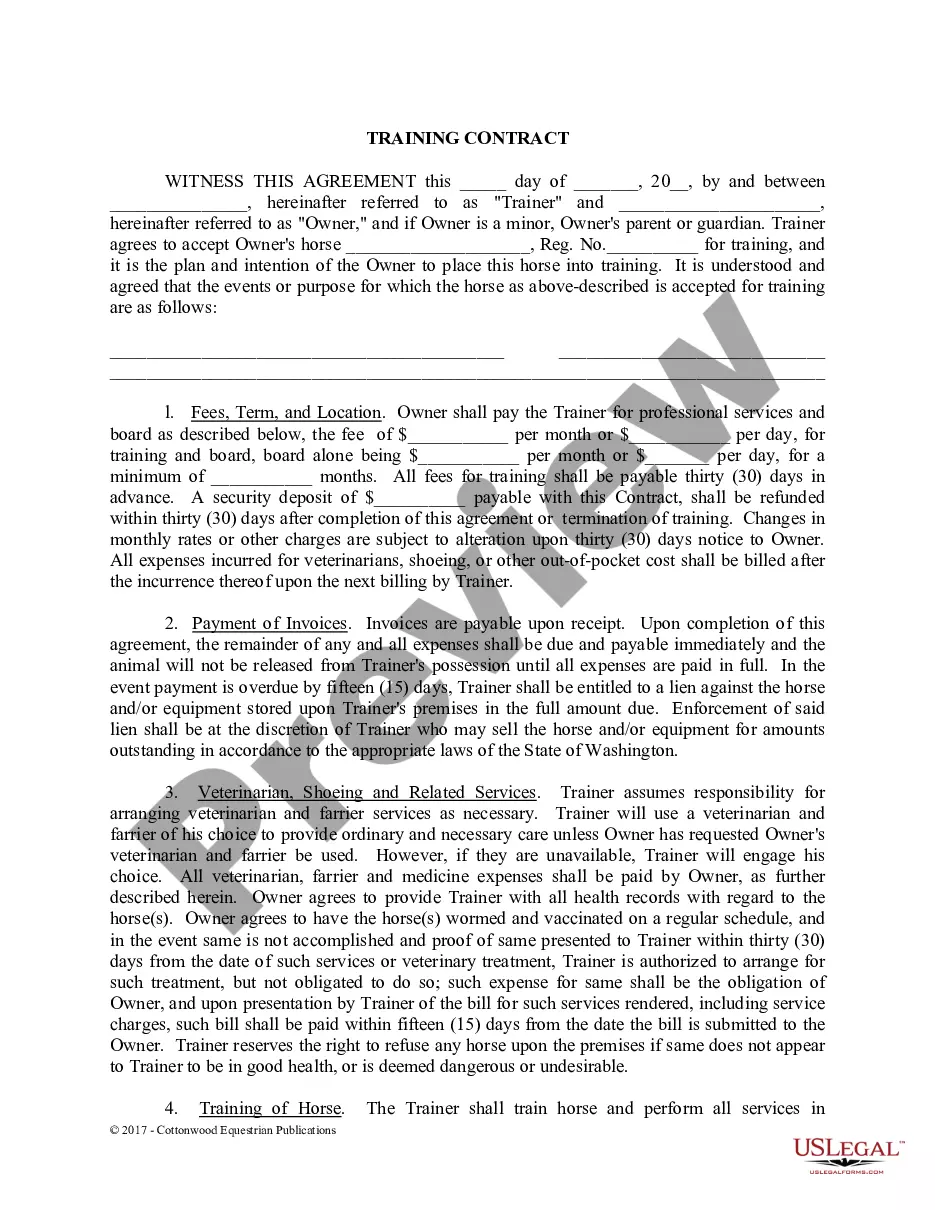

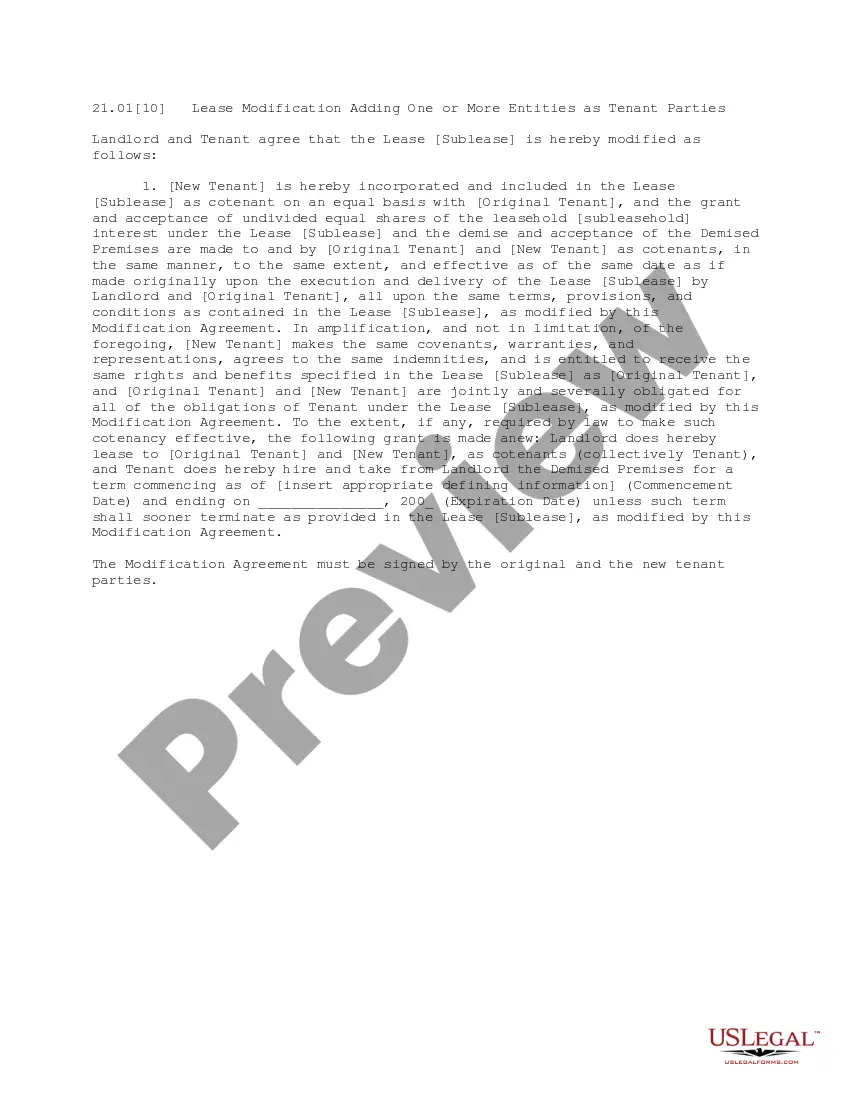

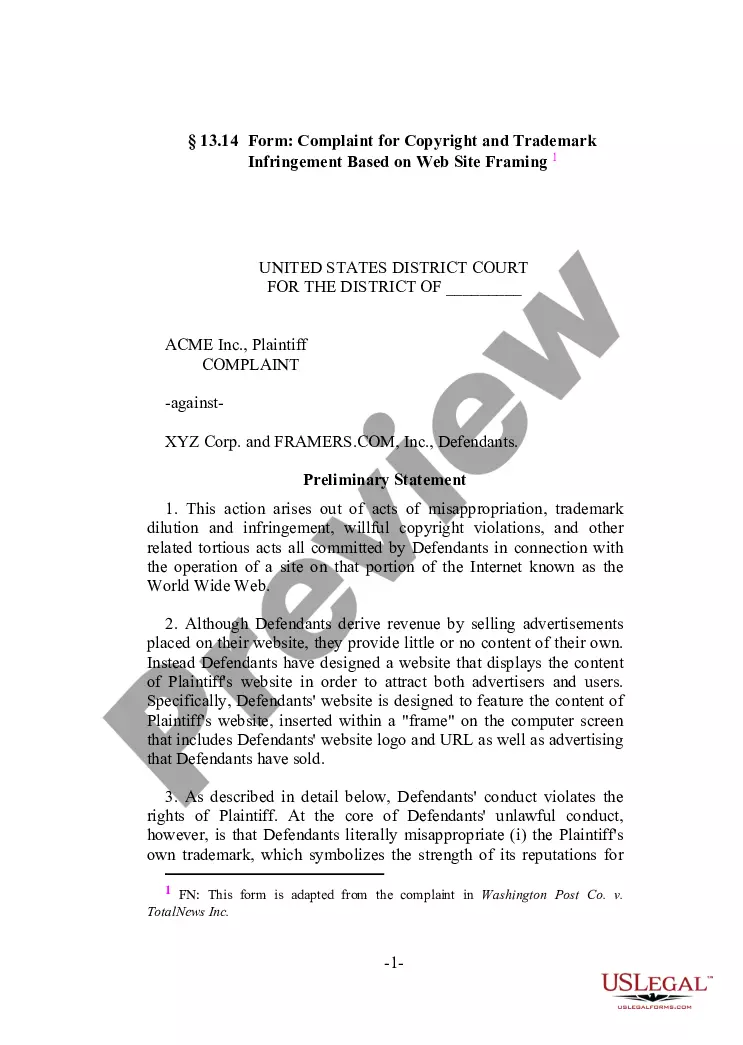

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business objective utilized in your county, including the Franklin Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose.

Locating forms on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Franklin Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Franklin Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose:

- Make sure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Franklin Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

In general, there is an unlimited deduction of charitable bequests against the value of an estate, making it a powerful tool for reducing estate tax. It is possible for an estate to deduct charitable bequests of not only cash, but also property such as real estate, stock, IRAs, autos and other assets.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts. Revocable Trusts. Irrevocable Trusts. Testamentary Trusts.

Because the charitable bequest is not paid from income, no charitable income tax deduction can be taken on the Form 1041, which is the fiduciary income tax return.

Testamentary Gifts by Trust Testamentary trusts are frequently used to provide for minor children or individuals with special needs. And in the realm of charitable giving, these trusts allow the donor to support meaningful charities while offsetting some or all of any applicable estate tax.

You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients (DGRs). To claim a deduction, you must be the person that gives the gift or donation and it must meet the following 4 conditions: It must be made to a DGR.

Testamentary gift is a gift made by will. Such gifts do not become effective until the death of the donor. The ownership of the gift is transferred to the donee only after the testator's death. There are two terms used to refer testamentary gifts, a devise and a bequest.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

How (and Why) to Make a Charitable Bequest Choose an organization to receive your bequest.Decide what type of bequest you will give.Decide what you will give in your bequest.Add the bequest to your will and tell people about it.Pat yourself on the back while you think about the benefits of making a charitable bequest.

Some possible disadvantages are: There is no actual benefit for you, the will maker, although there may be benefits for your beneficiaries. Cost testamentary trusts are often more complex, they generally cost more to produce and they generally involve ongoing accountancy and other fees during their operation.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.