A Mecklenburg County, North Carolina Provision in Testamentary Trust is a crucial component of estate planning that allows individuals to leave a bequest to a charitable organization or because they hold dear. This provision enables those with significant assets to support the community and make a lasting impact even after their passing. Testamentary trusts are established through a person's will and become effective upon their death. There are various types of Mecklenburg County, North Carolina Provisions in Testamentary Trusts with Bequests to Charity for a Stated Charitable Purpose. Here are three common examples: 1. Charitable Remainder Trust (CRT): A CRT allows individuals to provide income to a non-profit organization during their lifetime while designating the remaining trust assets to other beneficiaries or charitable entities. This arrangement can benefit both the individual and the charity, as it may have potential tax advantages during the donor's lifetime. 2. Charitable Lead Trust (CLT): In a CLT, income is provided to a charitable organization for a specific period, after which the remaining trust assets pass on to non-charitable beneficiaries. This type of trust can be beneficial for individuals wishing to support a charity for a set duration while ensuring their loved ones receive assets afterward. 3. Designated Charitable Purpose Trust: This type of provision allows individuals to establish a trust to support a specific charitable purpose, such as medical research, education, or the arts. The funds allocated to the charitable purpose are distributed according to the terms outlined in the trust document, ensuring the benefactor's philanthropic goals are met in perpetuity. By incorporating a Mecklenburg County, North Carolina Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose, individuals can leave a lasting legacy, promote their values, and support causes they are passionate about. It is vital to consult with an experienced estate planning attorney to navigate the intricacies of establishing the trust and ensure compliance with local laws and regulations. Keywords: Mecklenburg County, North Carolina Provision, Testamentary Trust, Bequest to Charity, Stated Charitable Purpose, Charitable Remainder Trust, Charitable Lead Trust, Designated Charitable Purpose Trust, estate planning, bequest, lasting legacy, philanthropic goals, estate planning attorney.

Mecklenburg North Carolina Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out Mecklenburg North Carolina Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Mecklenburg Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Mecklenburg Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Mecklenburg Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose:

- Check the content of the page you’re on.

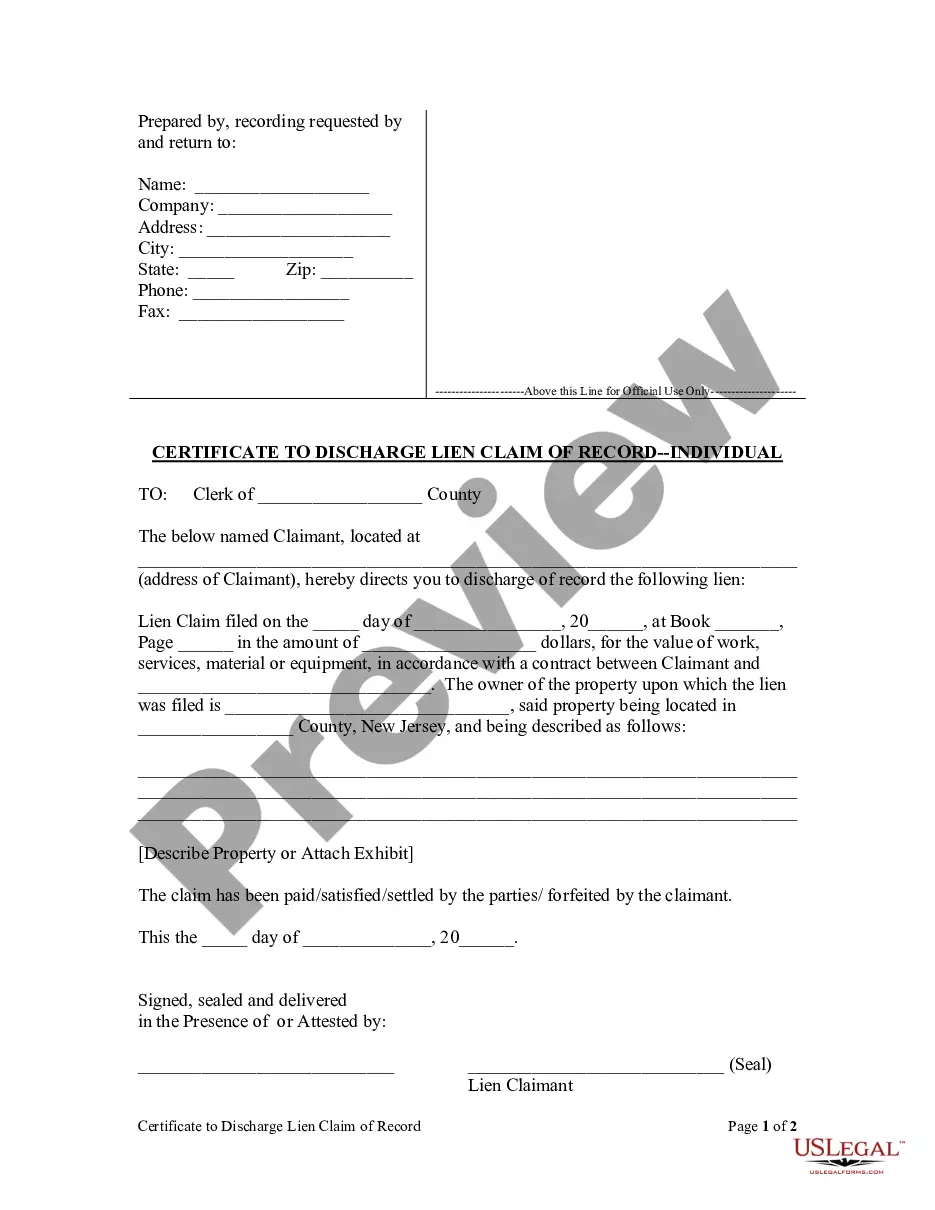

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Mecklenburg Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!