A Wayne Michigan Provision in a Testamentary Trust with a Bequest to Charity for a Stated Charitable Purpose is a legal provision designed to allocate assets from a deceased individual's estate to charitable organizations or causes that are explicitly mentioned in the trust document. This provision ensures that the testator's philanthropic intentions are fulfilled, even after their passing. There are various types of Wayne Michigan Provisions in Testamentary Trusts with Bequests to Charity for a Stated Charitable Purpose, including: 1. Wayne Michigan Provision for Educational Charities: This type of provision directs a portion of the trust assets to educational institutions such as schools, colleges, or universities. The testator may specify a particular institution or provide general guidelines for selecting suitable educational charities. 2. Wayne Michigan Provision for Medical Research Charities: In this case, the provision aims to support medical research institutions or organizations dedicated to finding cures, advancing medical knowledge, or improving public health. The testator may have a personal connection to a specific medical cause or choose to support broader areas of research. 3. Wayne Michigan Provision for Environmental Conservation Charities: This provision emphasizes the importance of environmental preservation and wildlife conservation. The testator may desire to support organizations engaged in activities such as land preservation, protection of endangered species, or promoting sustainability. 4. Wayne Michigan Provision for Community Development Charities: This type of provision focuses on strengthening local communities and supporting organizations that improve the quality of life for residents. It may include charities involved in affordable housing, community centers, healthcare clinics, or programs addressing poverty and social inequality. 5. Wayne Michigan Provision for Arts and Cultural Charities: This provision aims to nurture artistic and cultural endeavors by directing funds to art museums, theaters, libraries, or arts education programs. The testator may have a passion for a specific art form or prefer to contribute to the general enrichment of society through artistic expression. 6. Wayne Michigan Provision for Humanitarian Charities: This provision ensures support for organizations that provide humanitarian aid, such as disaster relief agencies, food banks, or organizations involved in combating homelessness, poverty, or disease. The testator's intention is to alleviate human suffering and assist the most vulnerable members of society. It is important to consult with an attorney specialized in estate planning to understand the specific requirements and legalities associated with creating a Wayne Michigan Provision in a Testamentary Trust with a Bequest to Charity for a Stated Charitable Purpose. They can guide you in crafting a comprehensive, legally sound trust document that accurately reflects your charitable intentions and ensures their fulfillment in accordance with applicable laws.

Wayne Michigan Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out Wayne Michigan Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Wayne Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Wayne Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Wayne Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose:

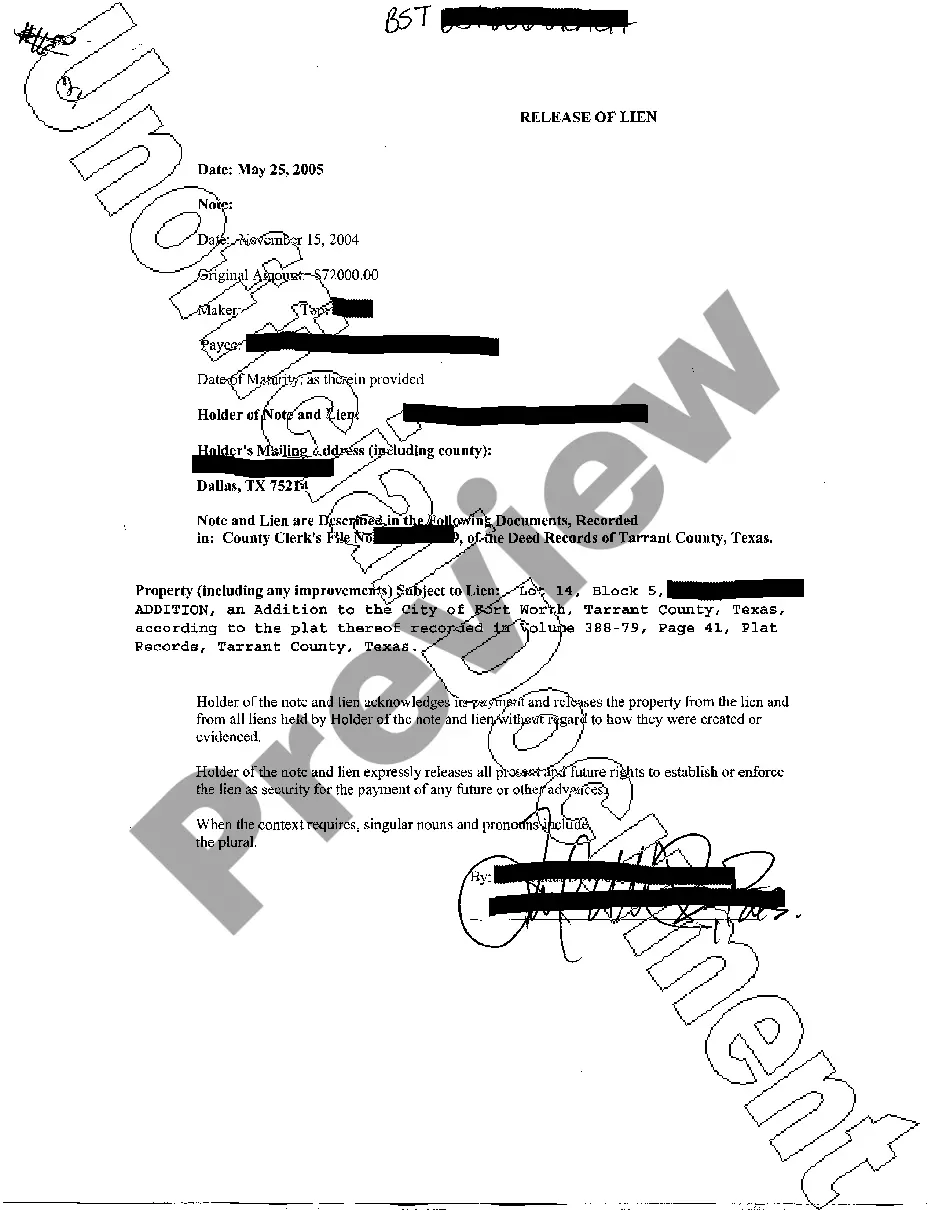

- Take a look at the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!