Santa Clara California Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children is a legal provision that allows individuals to create a trust after their death to benefit a charitable institution focused on the care and treatment of disabled children. This provision ensures that the assets and funds designated for the trust are used exclusively for the designated charitable purposes. The trust can be established in various forms, each with its own distinct features. Some possible classifications or types of the Santa Clara California Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children may include: 1. Revocable Testamentary Charitable Trust: This type of trust provides the flexibility for the creator to make changes or revoke the trust during their lifetime. It becomes operational only upon the creator's death, ensuring that disabled children benefit from the charitable institution's support. 2. Irrevocable Testamentary Charitable Trust: This trust type cannot be altered or revoked once created. It guarantees that the assets allocated to the trust will be maintained and utilized for the charitable institution serving disabled children. 3. Individual-Based Testamentary Charitable Trust: This form of trust may involve designating specific individuals as beneficiaries, perhaps disabled children within a certain age range or individuals with specific disabilities. It ensures that resources are directed to meet the needs of these designated beneficiaries. 4. General Testamentary Charitable Trust: This type of trust establishes broader charitable provisions, focusing on the welfare and treatment of all disabled children served by the charitable institution. It aims to provide comprehensive care and support to a wider range of beneficiaries. The Santa Clara California Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children demonstrates the commitment of individuals to make a lasting impact on the lives of disabled children even after their passing. By setting up such a trust, they ensure that the charitable institution receives the necessary financial support to continue its mission, providing care, treatment, and support to disabled children in Santa Clara, California.

Santa Clara California Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children

Description

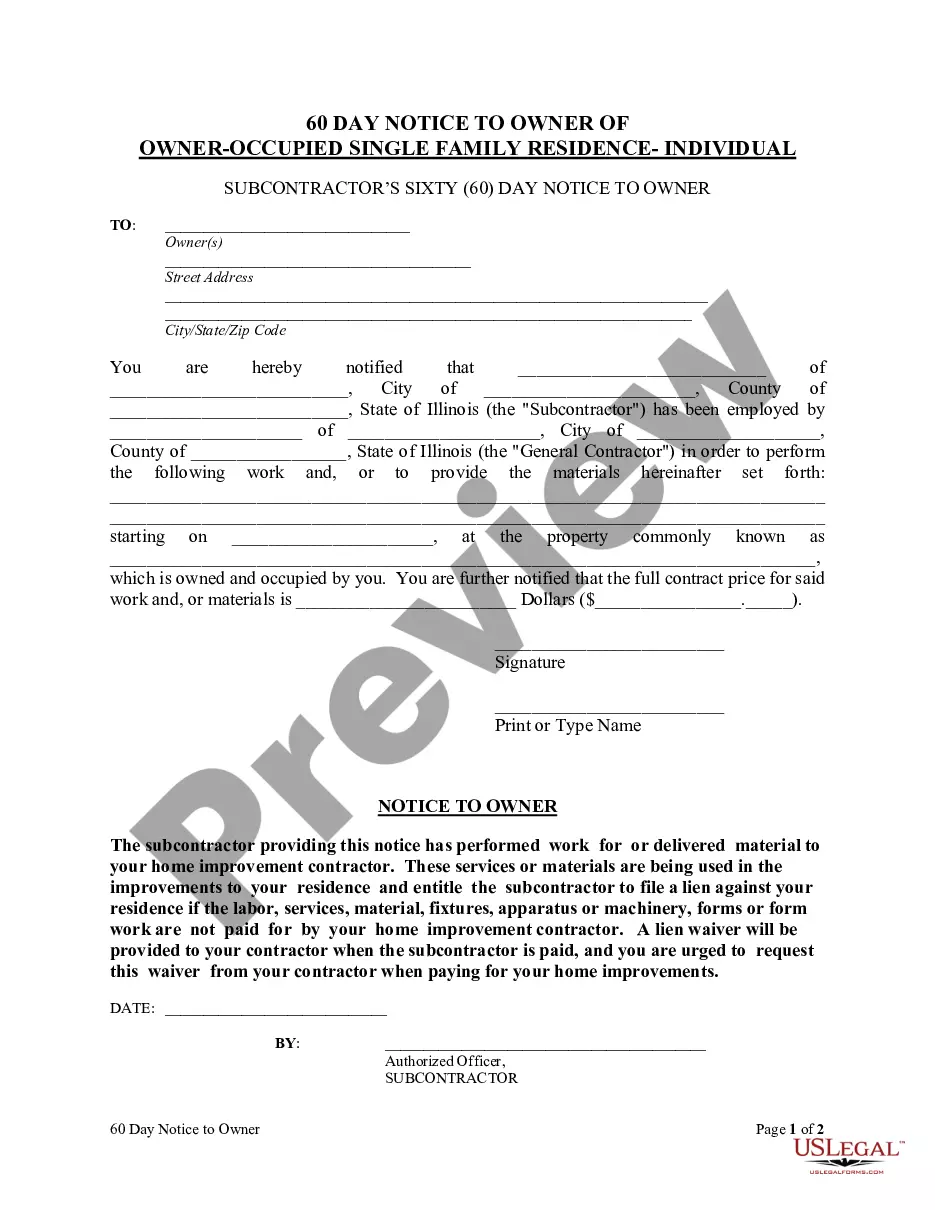

How to fill out Santa Clara California Testamentary Trust Provision For The Establishment Of A Trust For A Charitable Institution For The Care And Treatment Of Disabled Children?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Santa Clara Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Santa Clara Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children from the My Forms tab.

For new users, it's necessary to make some more steps to get the Santa Clara Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children:

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

How to Set up a Charitable Remainder Trust Create a Charitable Remainder Trust. Check with the IRS that the charity you want to benefit is approved. Transfer assets into the Trust. Name the charity as Trustee. Create a provision that states who the lead beneficiary is - remember, this can be yourself or someone else.

interest trust other than an IRC Section 664 charitable remainder trust must file Form 1041 with Form 5227 if it has $600 of gross income or any taxable income during the year. Charities often promote splitinterest trusts with the charity serving as the trustee, however this isn't a requirement.

With a CRT, the donor must pay tax on the income stream, which is categorized into four tiers: (1) Ordinary income and qualified dividends, (2) capital gains (short-term, personal property, depreciation, long-term gain), (3) other tax-exempt income; and (4) return of principal.

Some possible disadvantages are: There is no actual benefit for you, the will maker, although there may be benefits for your beneficiaries. Cost testamentary trusts are often more complex, they generally cost more to produce and they generally involve ongoing accountancy and other fees during their operation.

To create a testamentary trust, the settlor must designate a trustee (and possibly successor trustees) as well as beneficiaries of the trust. The document that creates the trust should also state which assets will enter the trust real estate, life insurance proceeds, bank accounts, all assets of the estate, etc.

To create a testamentary trust, the settlor first must select the trustee and the beneficiary and specify the assets that are to be placed in trust. The settlor also has the ability to specify when and how to disburse the trust to the beneficiary. The last will and testament should detail all of this information.

CRTs are exempt from income tax. The CRT assumes the grantor's adjusted cost basis and holding period in the property. If the CRT sells appreciated property, neither the grantor nor the CRT will pay immediate income tax on the sales.

Use Schedule A of Form 5227 to report: Accumulations of income for charitable remainder trusts, Distributions to noncharitable beneficiaries/recipients, and. Information about donors and assets contributed during the year.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts. Revocable Trusts. Irrevocable Trusts. Testamentary Trusts.

IRS Form 8282, Donee Information Return This form is required to be filed if the charitable remainder trust sells an unmarketable asset within three years of the contribution date and the donor files Form 8283, Non-cash Charitable Contributions with his or her individual income tax return.