Cook Illinois Provisions for Testamentary Charitable Remainder Unit rust for One Life is a legal arrangement that allows individuals to establish a charitable remainder trust to benefit a chosen charitable organization while providing tax advantages and potential income for the donor or their designated beneficiary. A testamentary charitable remainder unit rust (CUT) is created through the provisions outlined in the testament of an individual, typically in their last will and testament. This type of trust becomes effective upon the individual's passing and can be structured to provide ongoing income for a specified period or for the lifetime of a designated beneficiary, known as the income recipient. The Cook Illinois provisions specifically cater to residents of the state of Illinois who wish to contribute to philanthropic causes while enjoying tax benefits. By utilizing this trust, individuals can support charitable organizations within and outside the state of Illinois, aligning with their personal values and interests. Keywords related to Cook Illinois Provisions for Testamentary Charitable Remainder Unit rust for One Life include: 1. Testamentary trust: This refers to a trust established through the provisions laid out in an individual's will. 2. Charitable remainder trust: A trust set up to support a charitable cause while providing income to the donor or designated beneficiary. 3. Unit rust: A type of charitable remainder trust where the income paid to the beneficiary is based on a fixed percentage of the trust's value, reevaluated annually. 4. Tax benefits: The trust offers potential tax advantages, such as an income tax deduction in the year of the charitable contribution, capital gains tax deferral, and potential reduction of the donor's taxable estate. 5. Philanthropic giving: The trust enables donors to contribute to charitable organizations of their choice, helping them make a lasting impact on causes they care about. 6. Lifetime income: The trust can provide a steady income stream for the designated beneficiary for their entire life, ensuring financial security. 7. Residual charitable benefit: Upon the death of the income recipient, the remaining trust assets are transferred to the chosen charitable organization(s), allowing for a charitable legacy. 8. Illinois residents: The Cook Illinois provisions are specifically designed for residents of the state, providing them with a streamlined process and local charitable options. 9. Diversification: The provisions allow donors to support both local and non-local charitable organizations, ensuring their philanthropic efforts extend beyond the borders of Illinois. Different types of Cook Illinois Provisions for Testamentary Charitable Remainder Unit rust for One Life may include various options for income distribution, such as fixed percentage payments or annuity payments, as well as variations in the selection of charitable beneficiaries. It is essential for individuals seeking to establish such a trust to consult with an attorney or estate planner to discuss their specific goals and objectives to determine the best structure for their Cook Illinois Provisions for Testamentary Charitable Remainder Unit rust for One Life.

Cook Illinois Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

How to fill out Cook Illinois Provisions For Testamentary Charitable Remainder Unitrust For One Life?

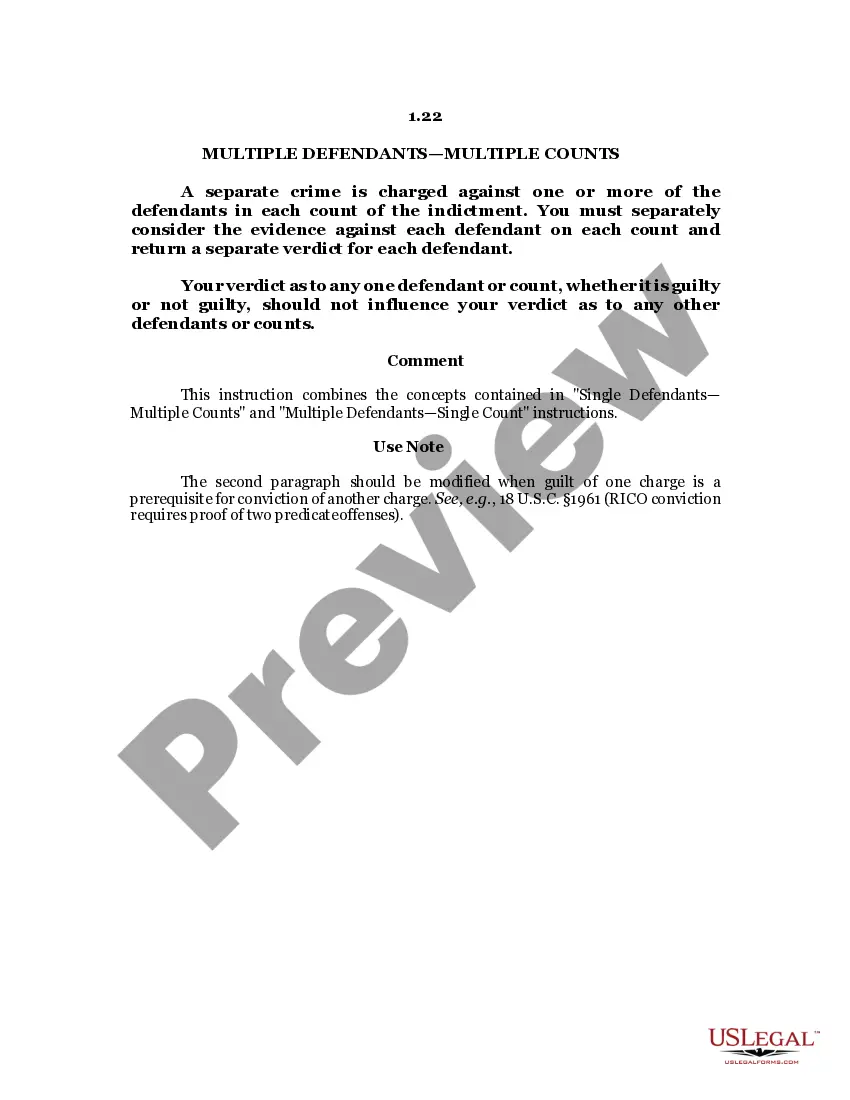

Do you need to quickly create a legally-binding Cook Provisions for Testamentary Charitable Remainder Unitrust for One Life or maybe any other form to take control of your personal or corporate matters? You can go with two options: hire a professional to write a valid paper for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant form templates, including Cook Provisions for Testamentary Charitable Remainder Unitrust for One Life and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, carefully verify if the Cook Provisions for Testamentary Charitable Remainder Unitrust for One Life is adapted to your state's or county's regulations.

- If the document has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Cook Provisions for Testamentary Charitable Remainder Unitrust for One Life template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the paperwork we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!