Salt Lake City in Utah is home to various provisions for a Testamentary Charitable Remainder Unit rust for One Life. These provisions are designed to benefit individuals who wish to support charitable organizations while also providing for their loved ones after their passing. A Testamentary Charitable Remainder Unit rust (CUT) is a charitable trust that takes effect after the donor's death, with the goal of generating income for a specified period of time or for the life of a named individual (the income beneficiary). Upon the death of the income beneficiary or the end of the specified period, the remaining assets in the trust are distributed to one or more charitable organizations. Salt Lake City offers several types of provisions for Testamentary Charitable Remainder Unit rusts for One Life, including: 1. Charitable Remainder Annuity Trust (CAT): In this type of trust, a fixed annual payment (annuity) is paid to the income beneficiary for life or for a specific term. The remaining trust assets are then distributed to charitable organizations after the income beneficiary's death or the specified term. 2. Charitable Remainder Unit rust (CUT): Unlike a CAT, a CUT distributes a fixed percentage of the trust assets each year to the income beneficiary. As the value of the trust assets fluctuates, the annual income payment adjusts accordingly. After the income beneficiary's death or the specified term, the remaining trust assets are distributed to charitable organizations. 3. Net Income Unit rust (TIMEOUT): This type of CUT allows the income beneficiary to receive either the trust's actual income or a fixed percentage (whichever is lower) each year. Any remaining income is then added to the trust's principal. The distributions to the income beneficiary may increase in the future if the trust experiences higher income levels. After the income beneficiary's death or the specified term, the remaining trust assets are transferred to charitable organizations. 4. Flip CUT: A flip CUT starts as a net income unit rust but "flips" into a standard unit rust after a triggering event, such as the sale of an illiquid asset. This type of provision is particularly useful when a significant asset needs to be sold, allowing for potential growth and flexibility in generating income before the flip occurs. By incorporating these provisions in a Testamentary Charitable Remainder Unit rust for One Life, individuals in Salt Lake City can fulfill their philanthropic goals, ensure the financial well-being of their loved ones, and enjoy potential tax benefits.

Salt Lake Utah Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

How to fill out Salt Lake Utah Provisions For Testamentary Charitable Remainder Unitrust For One Life?

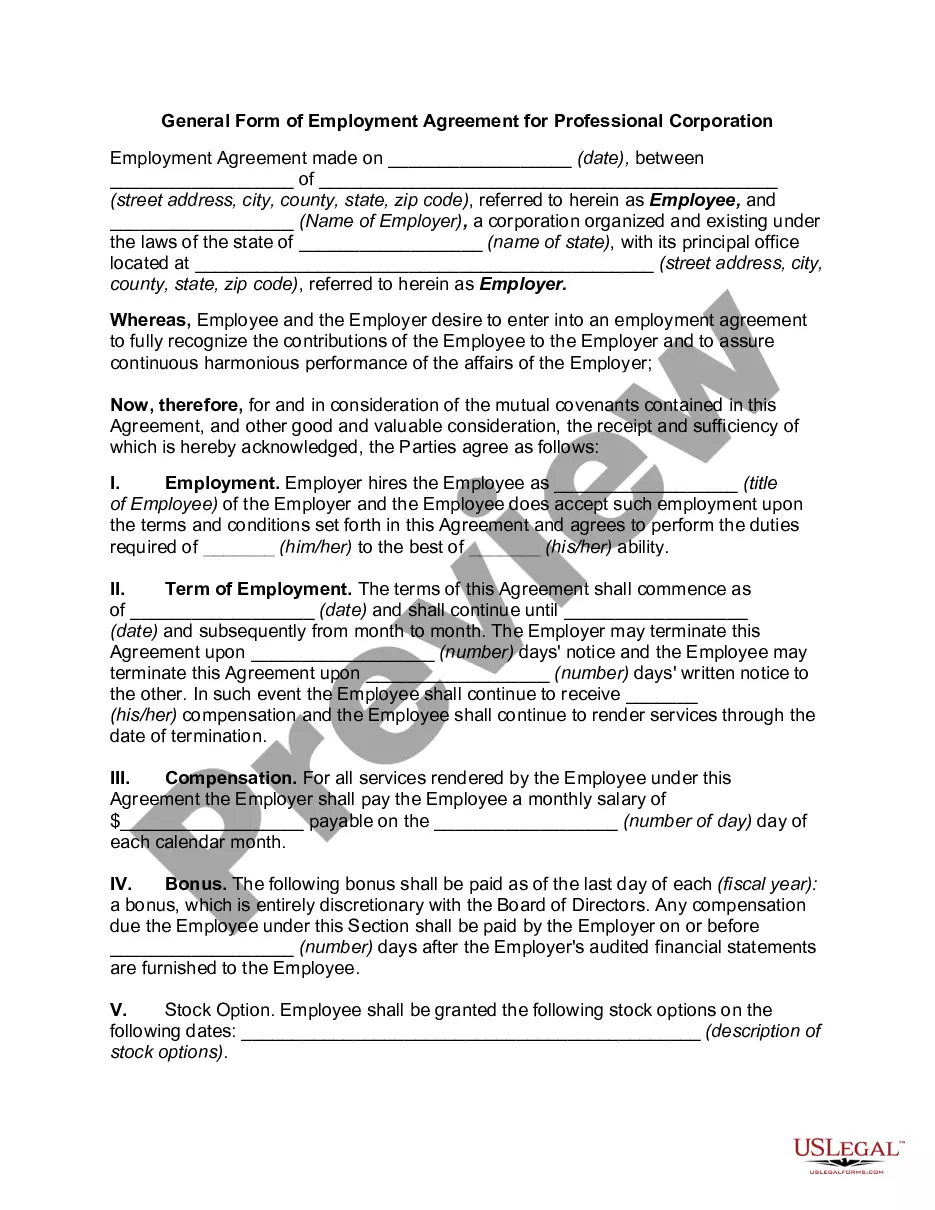

Creating forms, like Salt Lake Provisions for Testamentary Charitable Remainder Unitrust for One Life, to manage your legal matters is a challenging and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms created for a variety of scenarios and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Salt Lake Provisions for Testamentary Charitable Remainder Unitrust for One Life form. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Salt Lake Provisions for Testamentary Charitable Remainder Unitrust for One Life:

- Ensure that your form is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Salt Lake Provisions for Testamentary Charitable Remainder Unitrust for One Life isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and get the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!