The Riverside California Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner is a legal document that outlines the terms and conditions regarding the transfer of ownership of a business's property to a business partner in the event of the owner's death or incapacitation. This agreement ensures that the business partner receives the agreed-upon property rights and protects the interests of both parties involved. This agreement covers various aspects of the property transfer, such as the identification and description of the specific property being transferred. It also includes provisions for any outstanding debts or liabilities associated with the business property and how they will be handled. There are different types of Riverside California Agreements to Devise or Bequeath Property of a Business Transferred to Business Partner, depending on the specific circumstances and intentions of the parties involved. These may include: 1. Absolute Assignment Agreement: This type of agreement involves the complete transfer of ownership rights of the business property to the business partner without any conditions or limitations. 2. Conditional Assignment Agreement: In this type of agreement, certain conditions or requirements must be met for the business partner to receive the ownership rights of the transferred property. These conditions may include achieving specific business targets or meeting financial obligations. 3. Limited Partnership Agreement: If the transfer of property involves a limited partnership, this agreement regulates the transfer of ownership rights and outlines the roles and responsibilities of both the general and limited partners. 4. Joint Venture Agreement: In the case of a business transfer where the partnership takes the form of a joint venture, this agreement defines the terms of the partnership and the transfer of property rights between the partners. It is important to consult a legal professional to draft a Riverside California Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner that specifically addresses the unique requirements and considerations of the involved parties.

Riverside California Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Riverside California Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

Whether you plan to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Riverside Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Riverside Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner. Follow the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

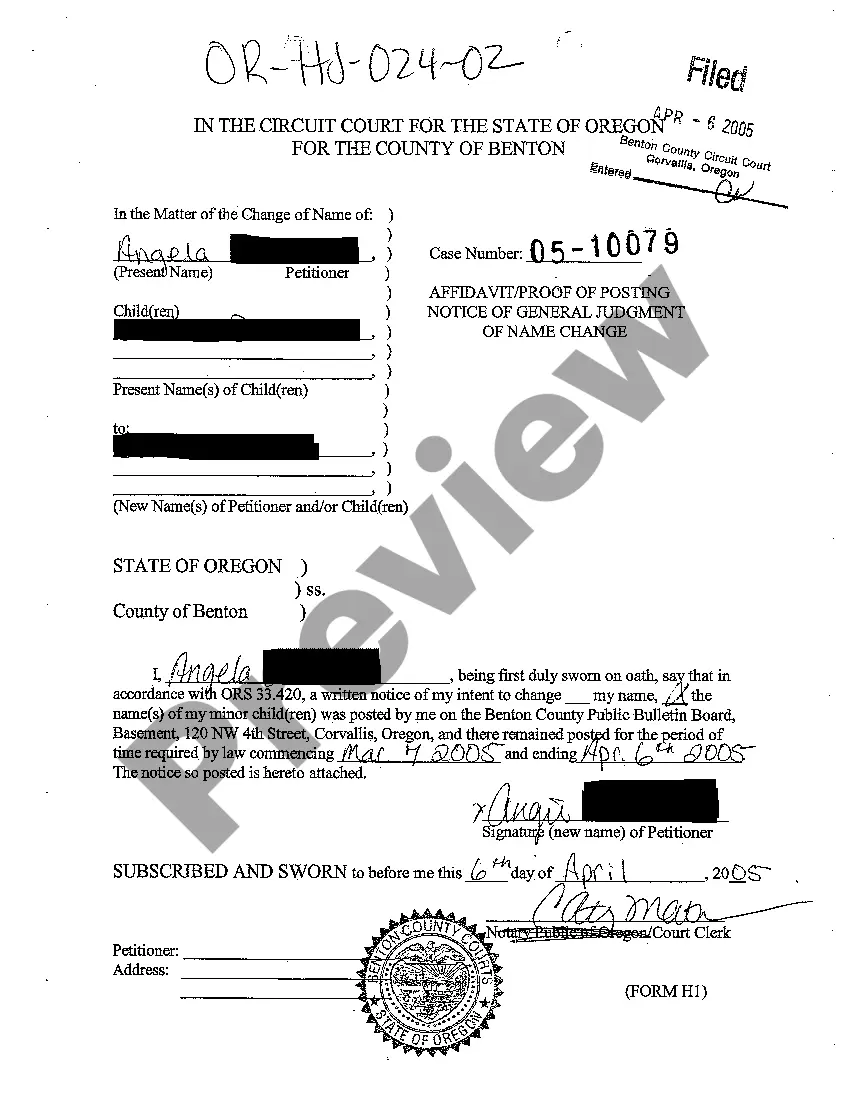

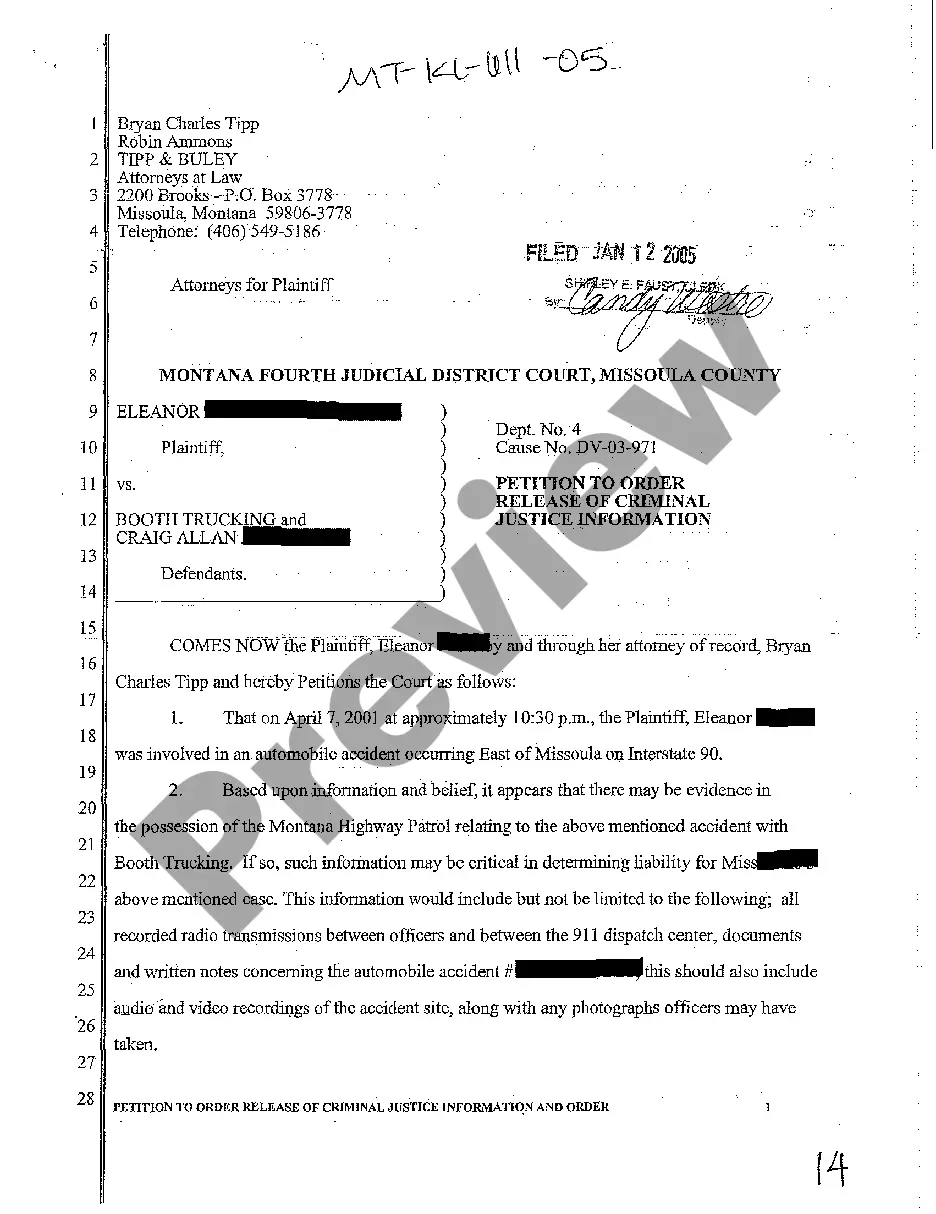

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Riverside Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Another business transfer method is gifting the company to your children. Most small businesses can be transferred to the next generation and avoid gift taxes.

This article discusses three common options: Sell your business outright. One way to transfer your family business to your children is through selling them your interest in the business, outright.Use a buy-sell agreement.Transfer through a living trust.

Yes, a business can be transferred to another person, by sale, reapportionment of multiowner businesses or lease-purchase. A business owner can also transfer a business to a person through gradual cash gifts or by bequeathing the business.

Here's an overview of what those steps entail: Review your Operating Agreement and Articles of Organization.Establish What Your Buyer Wants to Buy.Draw Up a Buy-Sell Agreement with the New Buyer.Record the Sale with the State Business Registration Agency.

To maximize financial gain upon retirement, owners will benefit from a well-planned transition strategy. There are four common paths for changing ownership of a business: employee stock ownership plan (ESOP), sale to a third party, initial public offering and transition to family members or an existing management team.

There are two common ways to transfer LLC ownership in California. You can either sell the entire LLC to a third party or conduct a partial sale (also known as a buyout).

Here's an overview of what those steps entail: Review your Operating Agreement and Articles of Organization.Establish What Your Buyer Wants to Buy.Draw Up a Buy-Sell Agreement with the New Buyer.Record the Sale with the State Business Registration Agency.

Consider transferring the business as a gift and drawing an income from the new owners. The lifetime federal gift tax exemption can change annually. The latest information can be found in our Annual Limits Guide. This gives business owners considerable latitude to transfer part or all of the company as a gift.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

A gift of an ownership stake in your company is the simplest approach. This could be accomplished with a direct gift or a gift to an irrevocable trust, which would allow you to have more control over the shares after the gift and provide potential liability/divorce protection for the gift recipient.

Interesting Questions

More info

It Is Impossible to Prove that The Business Is Not A Money Laundering Business. PA. Firearms dealers must be licensed by law. All licensed firearms dealers are required to report on time all sales of handguns, rifles or shotguns over .22 caliber. Pennsylvania does not regulate the sale of firearms to dealers by individuals. The State and National Firearms Acts should be followed when applying for a new or renewal of a firearms' dealer license or an additional Pennsylvania Firearms Dealer License. PA. Licensing. PA. Firearms dealers are not required to maintain records of their transactions. They must report all gun sales immediately upon notification. There is no requirement that licensed dealers keep records of any transactions that involve minors, fugitives, people with mental health problems, and/or minors who have criminal histories. Fingerprinting is not mandatory and fingerprinting fees are not assessed; but it is suggested. PA.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.