Harris County, Texas is a major county located in the southeastern part of the state. It is the third most populous county in the United States and encompasses the city of Houston, which is the county seat. Known for its diverse population and vibrant economy, Harris County is also renowned for its extensive network of parks, cultural attractions, and educational institutions. When it comes to closing an estate in Harris County, Texas, a sample letter for a petition to close the estate can be a helpful tool. This letter is typically addressed to the probate court or the judge overseeing the estate and provides all the necessary information and legal documentation required to initiate the estate's closure process. It is important to include relevant keywords in the letter to ensure its effectiveness and disseminate the needed information to the recipient. Some relevant keywords to include in a Harris Texas Sample Letter for Petition to Close Estate are: 1. Harris County: Highlighting the specific jurisdiction ensures that the judge or probate court recognizes the county in question and handles the letter accordingly. 2. Probate Division: Mentioning the probate division or court is crucial to ensure the correct authority receives the letter and proceeds with the estate's closure. 3. Petition for Closing Estate: Utilizing this keyword clarifies the purpose of the letter, indicating that the petitioner is seeking to finalize and close the estate. 4. Legal Documentation: Mentioning the need for the required legal documents in the letter helps establish that the petitioner has followed all necessary legal proceedings. 5. Executor or Administrator: Including the term "executor" or "administrator" emphasizes the individual responsible for administering the estate and their role in the closing process. 6. Assets and Liabilities: Describing the estate's assets and liabilities provides a comprehensive overview, ensuring that the court is aware of the estate's financial situation. 7. Creditors and Beneficiaries: Outlining any outstanding debts or obligations to creditors, as well as identifying beneficiaries, helps the court understand the individuals involved in the estate closure. 8. Tax Documents: Mentioning the submission of required tax documents ensures that the estate is compliant with tax obligations, which is an essential part of closing the estate. 9. Request for Order: Including a clear request for the court to issue an order to close the estate streamlines the process and demonstrates the petitioner's intent. 10. Assigned Case Number: Referencing the case number if one has already been assigned helps the court locate and identify the specific estate for closure. Overall, a Harris Texas Sample Letter for Petition to Close Estate should incorporate these relevant keywords to provide a detailed and instructive document that enables the court or judge to understand the petitioner's request and initiate the appropriate steps to finalize the estate closure. Different types of such letters may vary depending on the specific circumstances of the estate, such as uncontested or contested closures, and may require additional information or supporting documents.

Harris Texas Sample Letter for Petition to Close Estate

Description

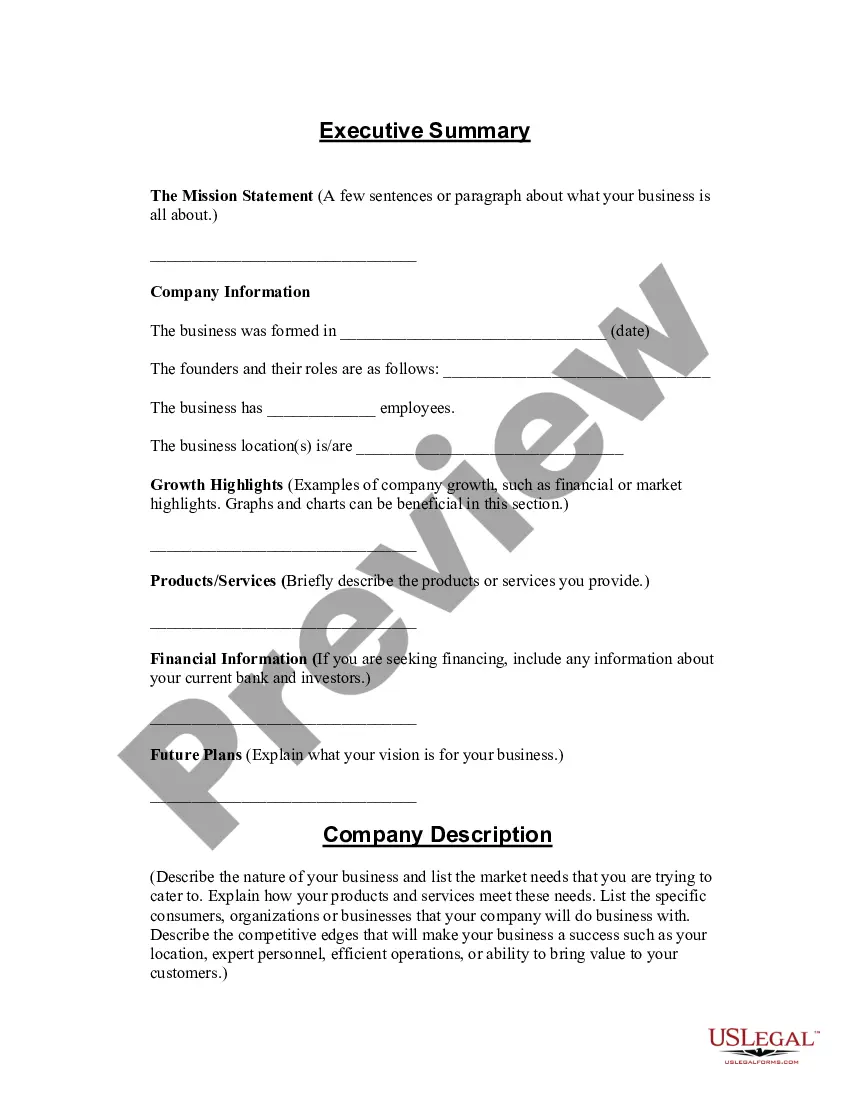

How to fill out Harris Texas Sample Letter For Petition To Close Estate?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Harris Sample Letter for Petition to Close Estate.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Harris Sample Letter for Petition to Close Estate will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Harris Sample Letter for Petition to Close Estate:

- Make sure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Harris Sample Letter for Petition to Close Estate on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!