Maricopa Arizona LLC Operating Statement is a financial document that provides a comprehensive overview of the financial activities and performance of a Professional Limited Liability Company (LLC) operating in the city of Maricopa, Arizona. This statement is crucial for LLC owners, investors, and stakeholders as it helps in analyzing the company's profitability, liquidity, and financial health. The Maricopa Arizona LLC Operating Statement typically includes various important components. Firstly, it includes a revenue section, which lists the LLC's total income generated from the delivery of professional services, such as legal, medical, or engineering, within Maricopa. It may also incorporate income from any investments or non-professional services provided by the LLC. Additionally, the operating statement includes a cost of goods sold (COGS) section, which outlines the direct expenses associated with delivering professional services. This includes costs incurred for equipment, supplies, software, and any other materials essential for the LLC's operations. Tracking COGS is vital in determining the LLC's gross profit margin. Operating expenses are also detailed in the Maricopa Arizona LLC Operating Statement, encompassing various fixed and variable expenses encountered during regular business operations. These may include rent, utilities, salaries, employee benefits, marketing costs, and professional fees paid to consultants or contractors. It is essential to analyze these expenses to assess the LLC's operational efficiency and identify potential areas for cost reduction. Moreover, the statement usually includes a provision for income taxes in accordance with the applicable tax laws and regulations. Taxes are determined based on the LLC's taxable income, which is calculated by deducting expenses from revenue. Accurate tax planning and compliance are crucial to ensuring appropriate financial management within Maricopa's legal framework. The Maricopa Arizona LLC Operating Statement may also present other relevant financial metrics such as net profit, profit margins, and earnings per share (EPS) if applicable. These key measurements help assess the LLC's financial performance over a specific period and facilitate comparison with industry benchmarks or prior years' results. It is important to note that the specific types of Maricopa Arizona LLC Operating Statements may vary based on the industry, LLC structure, and compliance requirements. For example, an LLC operating in the healthcare sector may have additional sections to accommodate billing and reimbursement information. Similarly, an LLC operating in the legal industry may emphasize billable hours and client fees. In summary, the Maricopa Arizona LLC Operating Statement represents a detailed financial snapshot of a Professional Limited Liability Company operating in Maricopa, Arizona. It encompasses various components such as revenue, COGS, operating expenses, taxes, and other financial metrics. By examining this statement, LLC owners and stakeholders can gain a comprehensive understanding of the LLC's financial performance and make informed decisions to drive growth and profitability.

Maricopa Arizona PLLC Operating Statement

Description

How to fill out Maricopa Arizona PLLC Operating Statement?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Maricopa PLLC Operating Statement is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Maricopa PLLC Operating Statement. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law requirements.

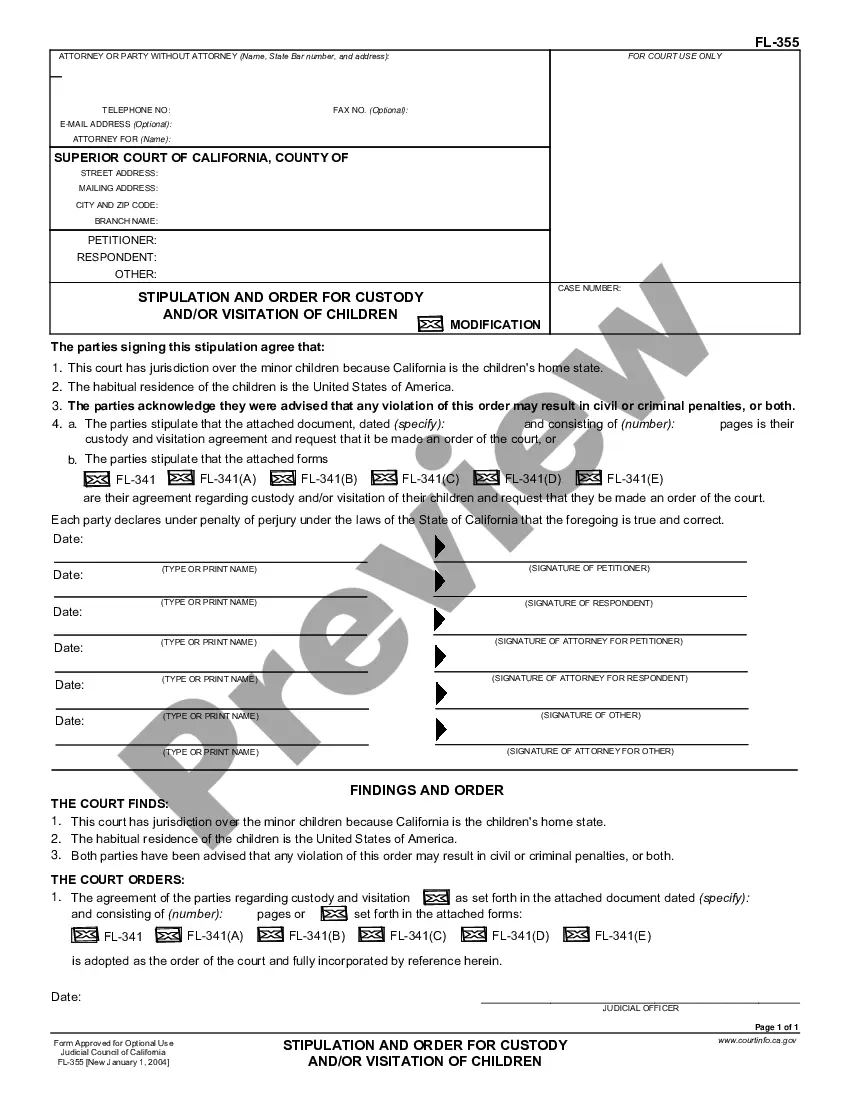

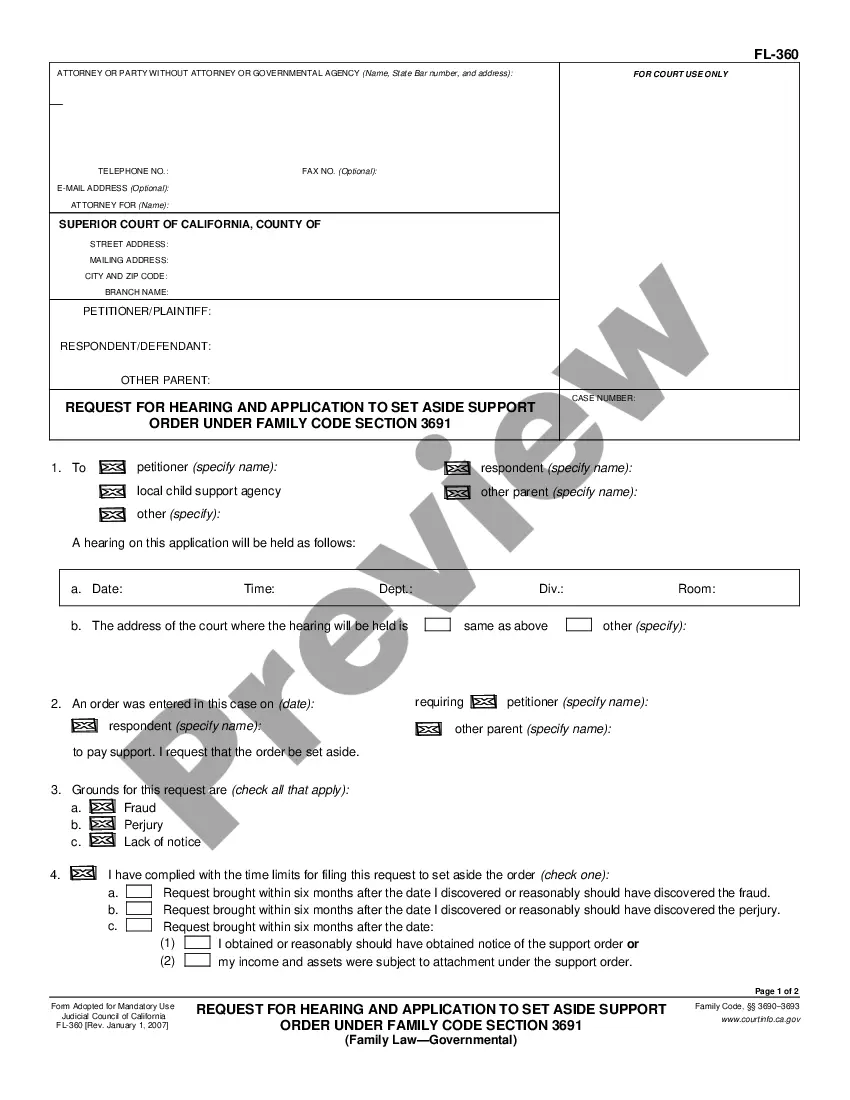

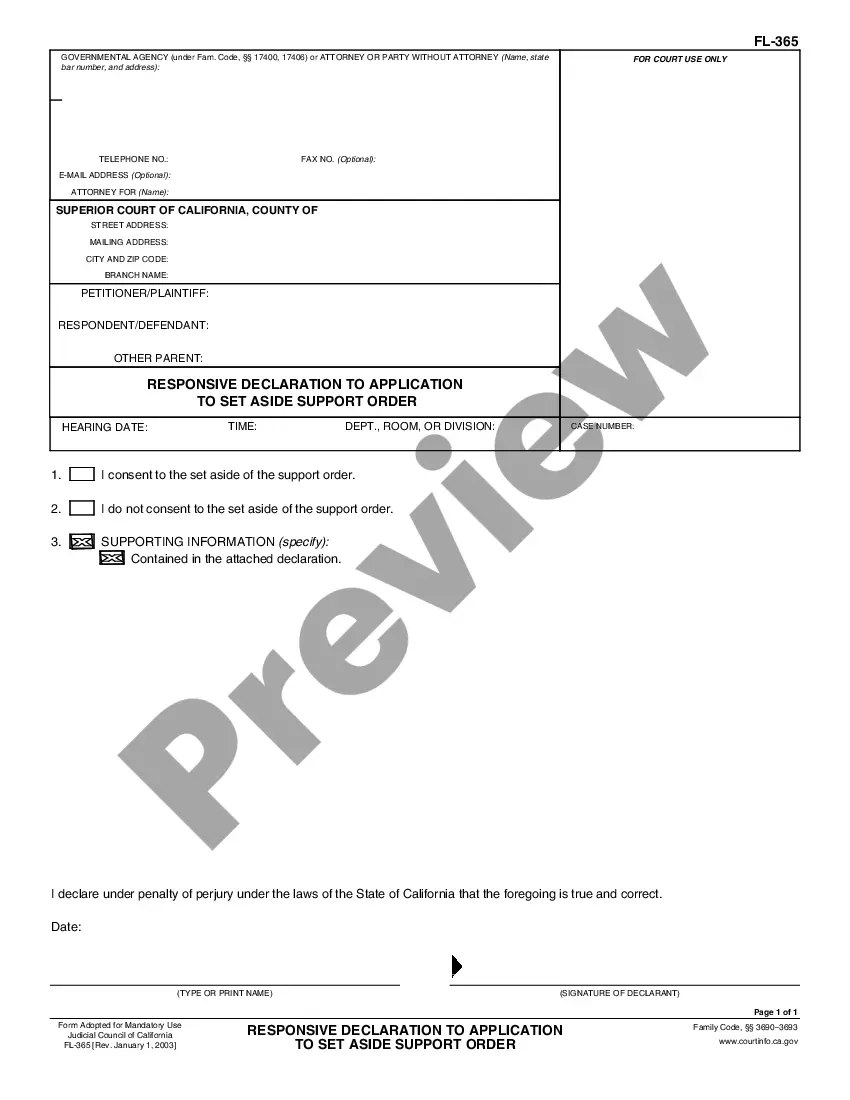

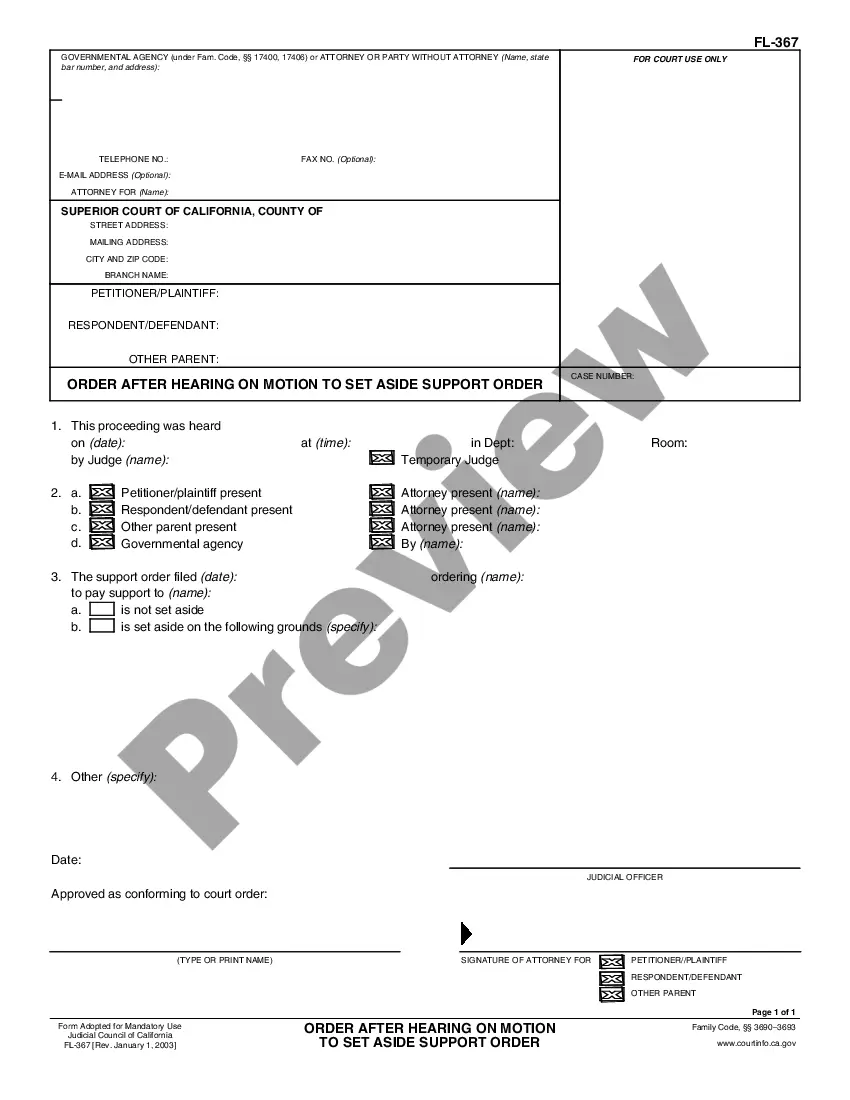

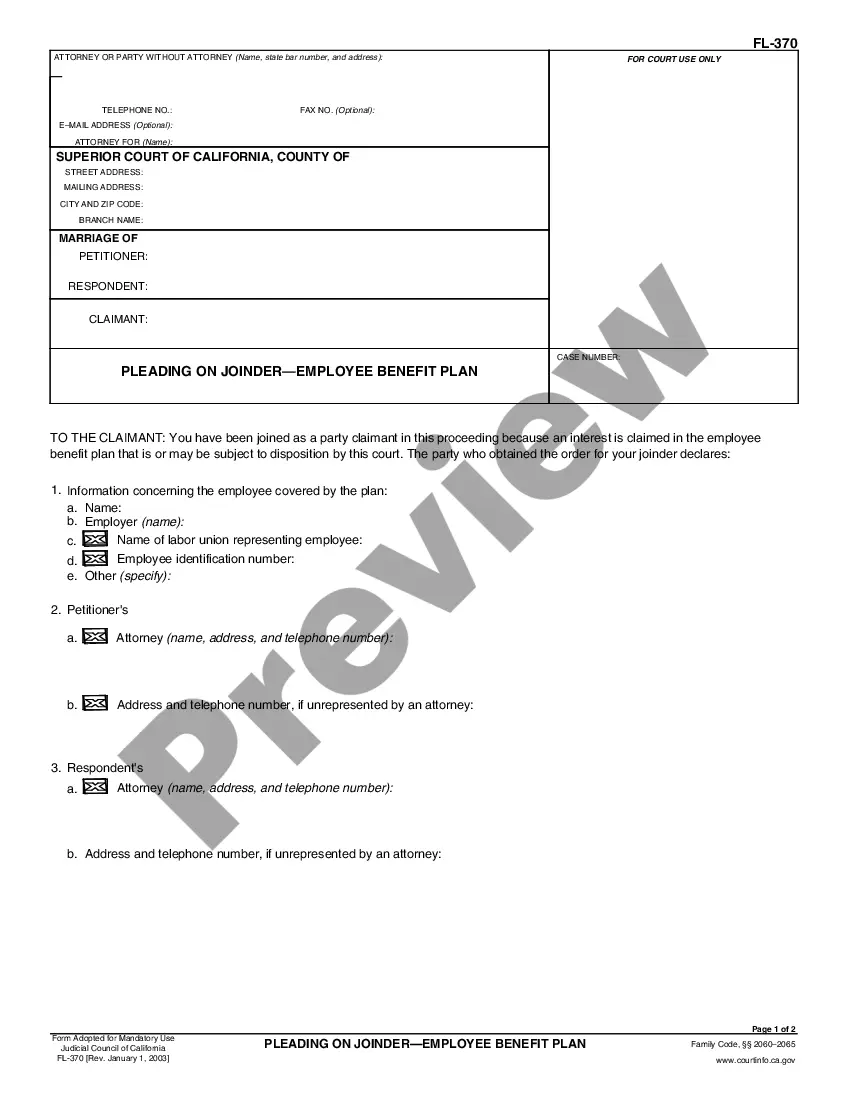

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa PLLC Operating Statement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!