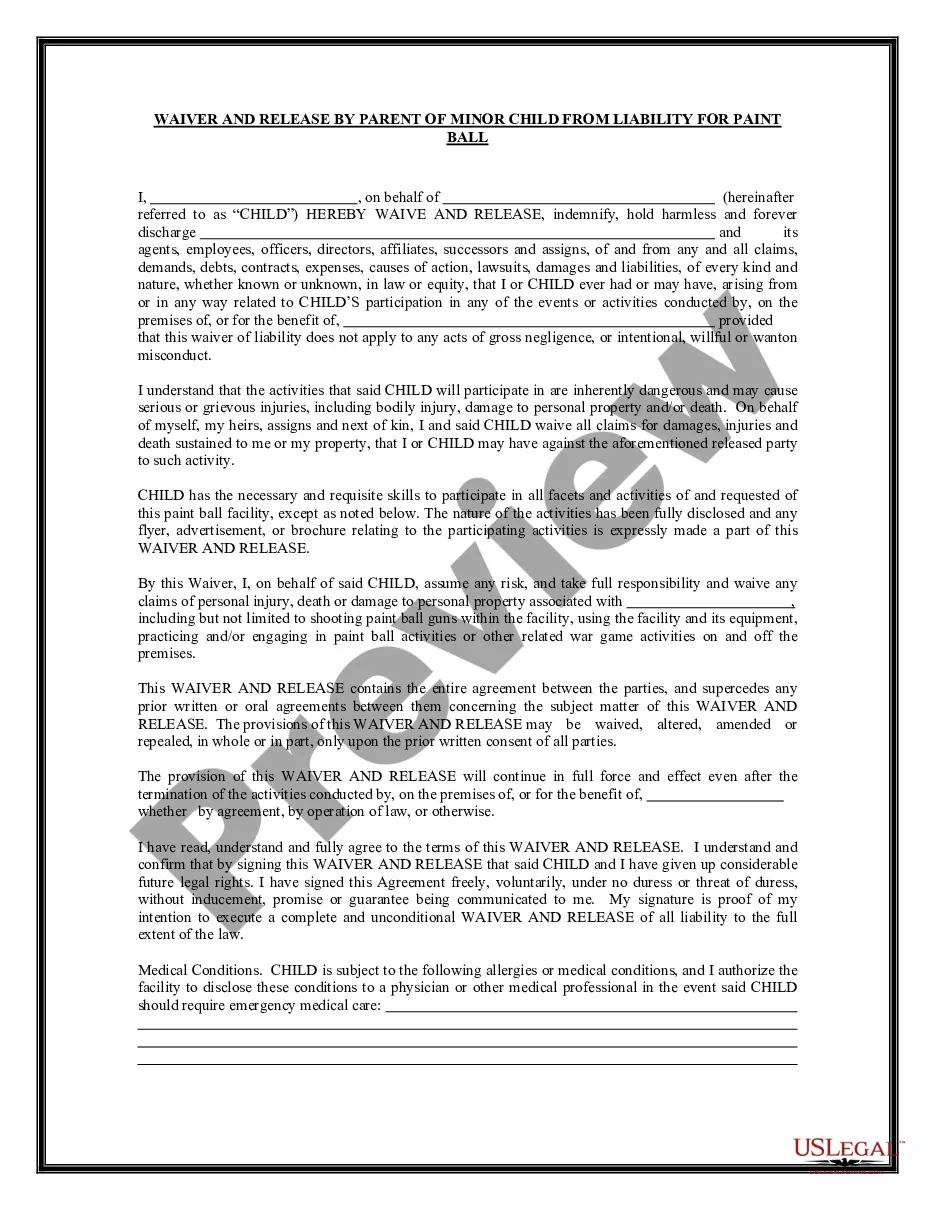

The Harris Texas Agreement for Conditional Gifts is a legally binding document that outlines the terms and conditions of gifting property and assets under certain conditions. This agreement ensures that both the donor and recipient are in agreement on the conditions, preserving the intentions of the donation and avoiding potential disputes in the future. Conditional gifts refer to donations that are subject to certain conditions or requirements that must be met before the transfer of ownership is complete. This type of agreement is commonly used in estate planning to ensure that property or assets are passed down in accordance with the donor's wishes. There are different types of Harris Texas Agreement for Conditional Gifts, and each serves a specific purpose: 1. Conditional Gift Agreement for Education: This type of agreement stipulates that the donated assets or funds will be used solely for educational purposes, such as funding a scholarship, establishing an educational institution, or supporting research initiatives. 2. Conditional Gift Agreement for Charitable Purposes: This agreement is designed for individuals or organizations who wish to make a charitable donation with specific conditions or restrictions. It ensures that the gift is used for a particular charitable cause, such as supporting medical research, aiding disaster relief efforts, or promoting environmental conservation. 3. Conditional Gift Agreement for Property Transfer: This type of agreement is used when the donor wishes to gift real estate or other valuable property under certain conditions. For example, the agreement may require the recipient to maintain the property in a specific condition, use it for a particular purpose, or restrict its sale or transfer to a predetermined period. 4. Conditional Gift Agreement for Endowment: This agreement is commonly employed by nonprofit organizations or educational institutions to establish an endowment fund with specific conditions. The agreement outlines how the endowment will be managed, invested, and utilized to support the organization's ongoing operations or specific activities. Regardless of the type, a Harris Texas Agreement for Conditional Gifts ensures that the gift is used as intended by the donor, safeguarding their philanthropic goals and minimizing any misuse or misunderstandings regarding the donation. It is crucial for both parties to carefully draft and review the agreement to ensure all conditions are clear, enforceable, and legally sound.

Harris Texas Agreement for Conditional Gifts

Description

How to fill out Harris Texas Agreement For Conditional Gifts?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life situation, locating a Harris Agreement for Conditional Gifts meeting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Harris Agreement for Conditional Gifts, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Harris Agreement for Conditional Gifts:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Agreement for Conditional Gifts.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!