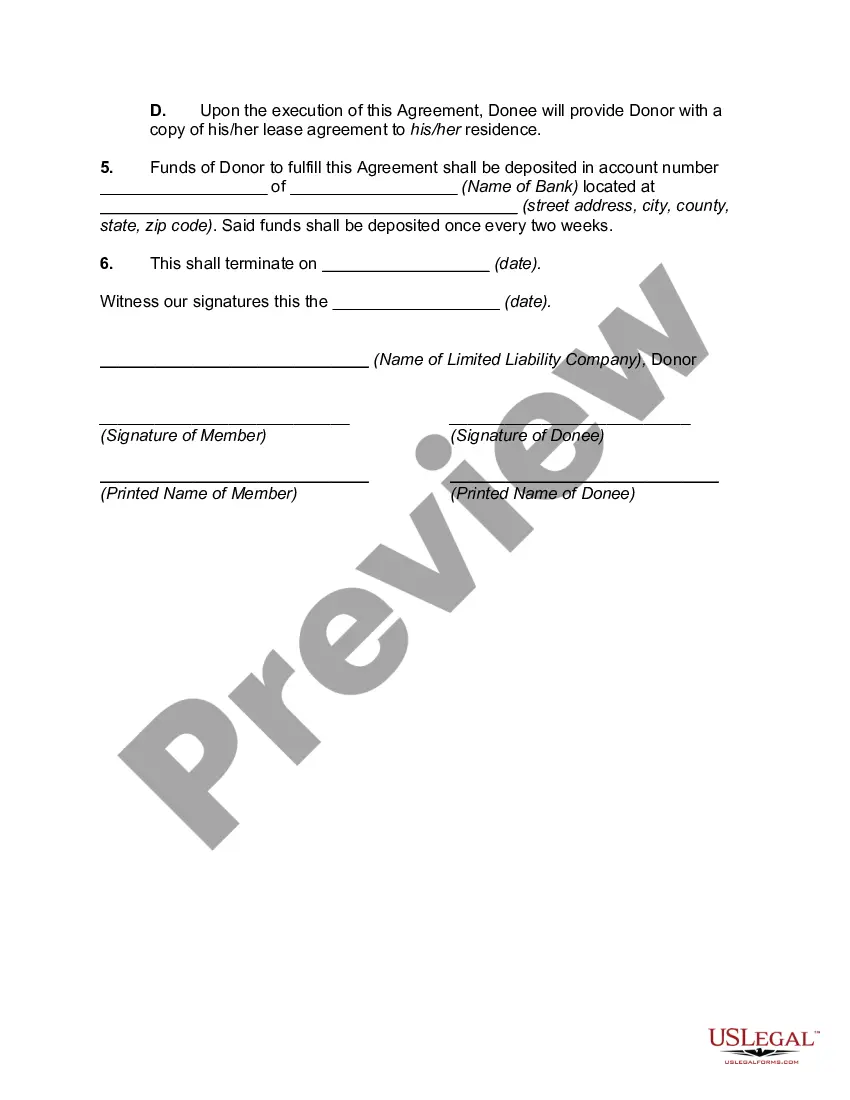

The Suffolk New York Agreement for Conditional Gifts is a legally binding contract that outlines the terms and conditions for donating or receiving conditional gifts in Suffolk, New York. Conditional gifts are assets or properties granted to a recipient on the condition that certain requirements are met. This agreement serves as a comprehensive guide to ensure that both the donor and the recipient understand their rights, responsibilities, and obligations when it comes to conditional gifts. It provides clarity, transparency, and protection for all parties involved. The Suffolk New York Agreement for Conditional Gifts can encompass various types of conditional gifts, including but not limited to: 1. Scholarship Funds: This type of conditional gift entails a donation made to support educational expenses for students. The agreement would specify the conditions for awarding scholarships, such as academic performance, financial need, or specific areas of study. 2. Charitable Grants: When individuals or organizations wish to donate funds to charities or nonprofits in Suffolk, they may do so through conditional gifts. This agreement would outline the specific conditions for disbursing the funds, ensuring they are used for designated purposes. 3. Property Donations: In some cases, individuals may choose to donate real estate or other valuable assets as conditional gifts. The agreement would outline the conditions under which the property is transferred, ensuring compliance with legal requirements and expectations. 4. Endowment Funds: Donors may establish endowment funds to support ongoing operations or specific programs of charitable organizations. The agreement would detail the terms and conditions under which the endowment funds are to be managed and disbursed. The Suffolk New York Agreement for Conditional Gifts covers essential aspects such as the rights of the donor, the responsibilities of the recipient, the conditions to be met, the consequences of non-compliance, and the process for resolving disputes. It also addresses issues related to confidentiality, tax implications, and any legal requirements associated with conditional gifts. By implementing the Suffolk New York Agreement for Conditional Gifts, both donors and recipients can ensure a clear understanding of their roles and responsibilities, fostering a mutually beneficial and transparent relationship. Whether it involves scholarships, grants, property donations, or endowment funds, this agreement safeguards the intentions of the donor and ensures that conditional gifts are used in the manner intended.

Suffolk New York Agreement for Conditional Gifts

Description

How to fill out Suffolk New York Agreement For Conditional Gifts?

Preparing papers for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Suffolk Agreement for Conditional Gifts without expert help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Suffolk Agreement for Conditional Gifts by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, follow the step-by-step instruction below to get the Suffolk Agreement for Conditional Gifts:

- Examine the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!