Harris Texas Renunciation of Legacy to Give Effect to Intend of Testator: A Comprehensive Guide Introduction: In estate planning, the primary objective is to ensure that the testator's final wishes are carried out according to their intent. However, circumstances may arise where it becomes necessary to renounce or disclaim a legacy. In Harris County, Texas, individuals have the option to renounce a specific legacy left to them in a will, thereby giving effect to the testator's overall intent. This article aims to provide a detailed description of the Harris Texas Renunciation of Legacy to Give Effect to Intend of Testator, highlighting its significance, procedural requirements, and potential variations. Understanding Legacy and Renunciation: A legacy refers to a bequest or gift, usually of a specific item, sum of money, or property, that is bequeathed by a testator within their will. However, circumstances may occur where the beneficiary of a legacy is unable or unwilling to accept the gift. In such situations, the beneficiary can choose to renounce the legacy, thereby forfeiting their right to receive it. The Significance of Renunciation: Renunciation of a legacy serves several purposes. It allows the beneficiary to refuse a gift they do not wish to accept, which may arise due to personal circumstances, concerns about tax implications, or potential legal liabilities associated with the legacy. Additionally, renunciation ensures the overall intent of the testator is preserved by allowing the inheritance to pass to the alternate beneficiary determined by the testator. Procedure for Harris Texas Renunciation of Legacy: To renounce a legacy in Harris County, Texas, individuals must adhere to specific procedural requirements outlined by the Texas Estates Code. These requirements include: 1. Written Renunciation: The renunciation must be in writing and signed by the renouncing beneficiary. It should clearly state the intention to renounce the specific legacy left to them in the testator's will. 2. Timely Renunciation: The renunciation must be completed within a specific timeframe. In Texas, beneficiaries typically have nine months from the date of the testator's death to renounce a legacy. It is crucial to ensure the renunciation is timely filed with the appropriate court. Types of Renunciation: Different scenarios may require various types of renunciation, such as: 1. Full Renunciation: This type of renunciation involves completely relinquishing all rights, claims, and interests in the legacy. The renouncing beneficiary will have no further involvement or entitlement to the asset. 2. Partial Renunciation: In certain situations, a beneficiary may choose to renounce only a fraction or portion of the legacy, expressing their desire to accept the rest. This option allows for a more nuanced approach when the beneficiary wishes to renounce certain assets or monetary amounts while retaining others. 3. Conditional Renunciation: In rare cases, beneficiaries might reconsider their decision to renounce a legacy if specific conditions or circumstances change. In such instances, a conditional renunciation may be employed, allowing the beneficiary to revoke the renunciation should the predefined conditions be met. Conclusion: Harris Texas Renunciation of Legacy to Give Effect to Intend of Testator is a vital legal action that allows beneficiaries to decline a gift outlined in a testator's will. By renouncing a legacy in compliance with the procedural requirements, individuals can ensure that the testator's overall intent is respected, while also addressing personal and legal concerns. Whether opting for a full, partial, or conditional renunciation, beneficiaries in Harris County, Texas, have options to align the administration of an estate with the desired outcomes of the testator.

Harris Texas Renunciation of Legacy to give Effect to Intent of Testator

Description

How to fill out Harris Texas Renunciation Of Legacy To Give Effect To Intent Of Testator?

Preparing documents for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Harris Renunciation of Legacy to give Effect to Intent of Testator without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Harris Renunciation of Legacy to give Effect to Intent of Testator on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Harris Renunciation of Legacy to give Effect to Intent of Testator:

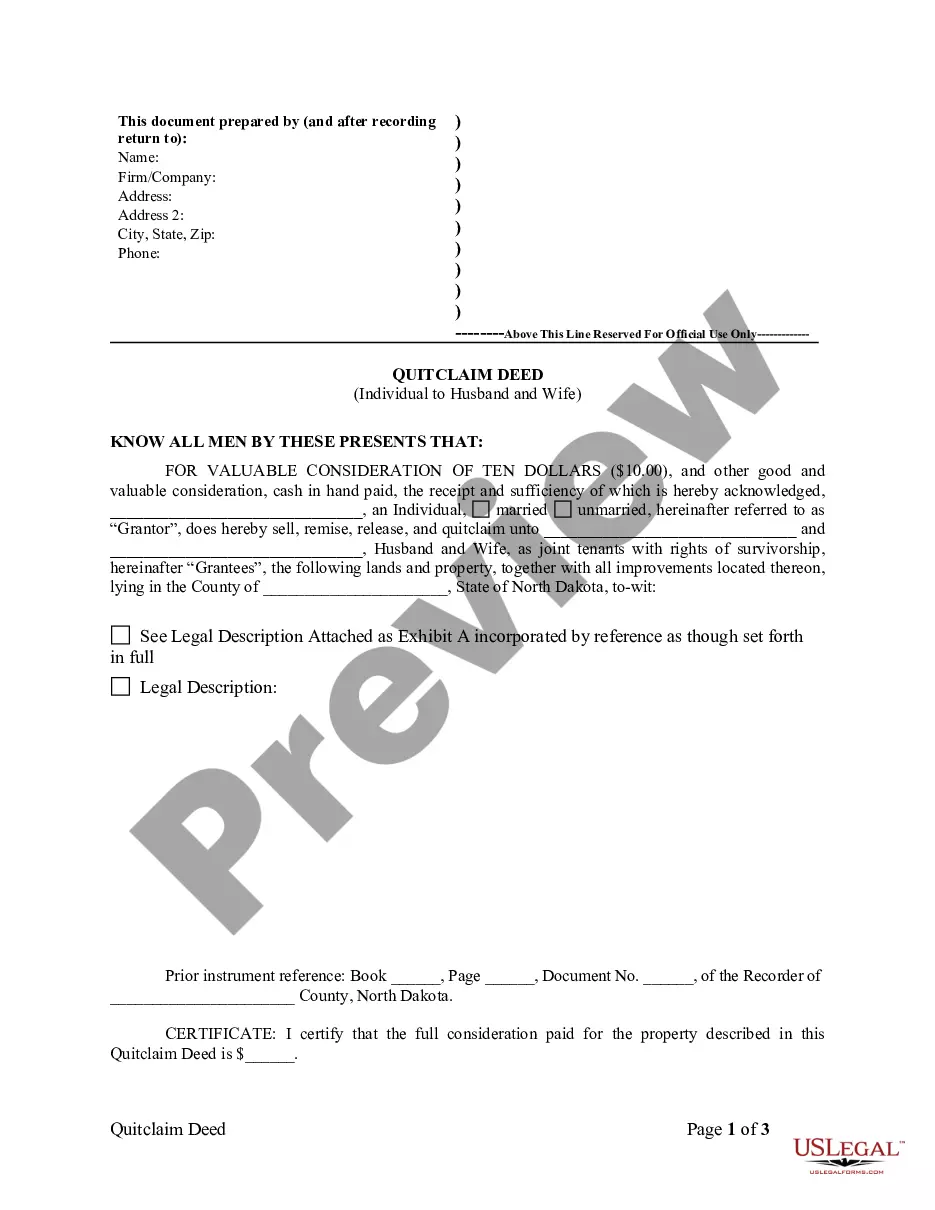

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!