Oakland Michigan Renunciation of Legacy in Favor of Other Family Members refers to the legal process by which an individual voluntarily relinquishes or disclaims their right to inherit property or assets in favor of other family members. This renunciation typically occurs when the individual either does not want or cannot accept the legacy due to personal reasons or financial circumstances. In Oakland County, Michigan, there are different types of renunciations that can be made, each with its own specific purpose and implications. Some of these include: 1. Intestate Renunciation: When a person dies without leaving a valid will, their estate is distributed according to state law. In some cases, a potential beneficiary may decide to renounce their right to inherit under intestacy laws in favor of other eligible family members. This renunciation must be made in writing and submitted to the appropriate probate court. 2. Testamentary Renunciation: This type of renunciation occurs when an individual named as a beneficiary in a will decides to disclaim their inheritance. It is important to note that this renunciation must be made before accepting any part of the inheritance or performing any act indicating acceptance. 3. Partial Renunciation: In some situations, a beneficiary may choose to renounce only a portion of their inheritance, allowing other family members to receive a greater share. This can be done when the renouncing party believes it is in the best interest of the estate or to reduce potential tax liabilities. 4. Renunciation of Trust Interests: In cases where a trust has been established, a beneficiary may wish to renounce their interest in the trust assets. This renunciation can vary in scope, ranging from a complete disclaiming of all rights to a specific renunciation of certain assets or income streams. 5. Renunciation of Life Insurance Policies: When a person is named as a beneficiary in a life insurance policy, they may choose to renounce their right to the proceeds. This could occur if the beneficiary has sufficient financial stability, or when the proceeds would be better utilized by other family members. It is important to consult with an estate planning attorney or legal professional to navigate the renunciation process correctly. Each type of renunciation carries legal consequences and may require specific documentation. Renouncing a legacy in favor of other family members should be done thoughtfully, considering individual circumstances and ensuring compliance with applicable laws.

Oakland Michigan Renunciation of Legacy in Favor of Other Family Members

Description

How to fill out Oakland Michigan Renunciation Of Legacy In Favor Of Other Family Members?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Oakland Renunciation of Legacy in Favor of Other Family Members meeting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Oakland Renunciation of Legacy in Favor of Other Family Members, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Oakland Renunciation of Legacy in Favor of Other Family Members:

- Check the content of the page you’re on.

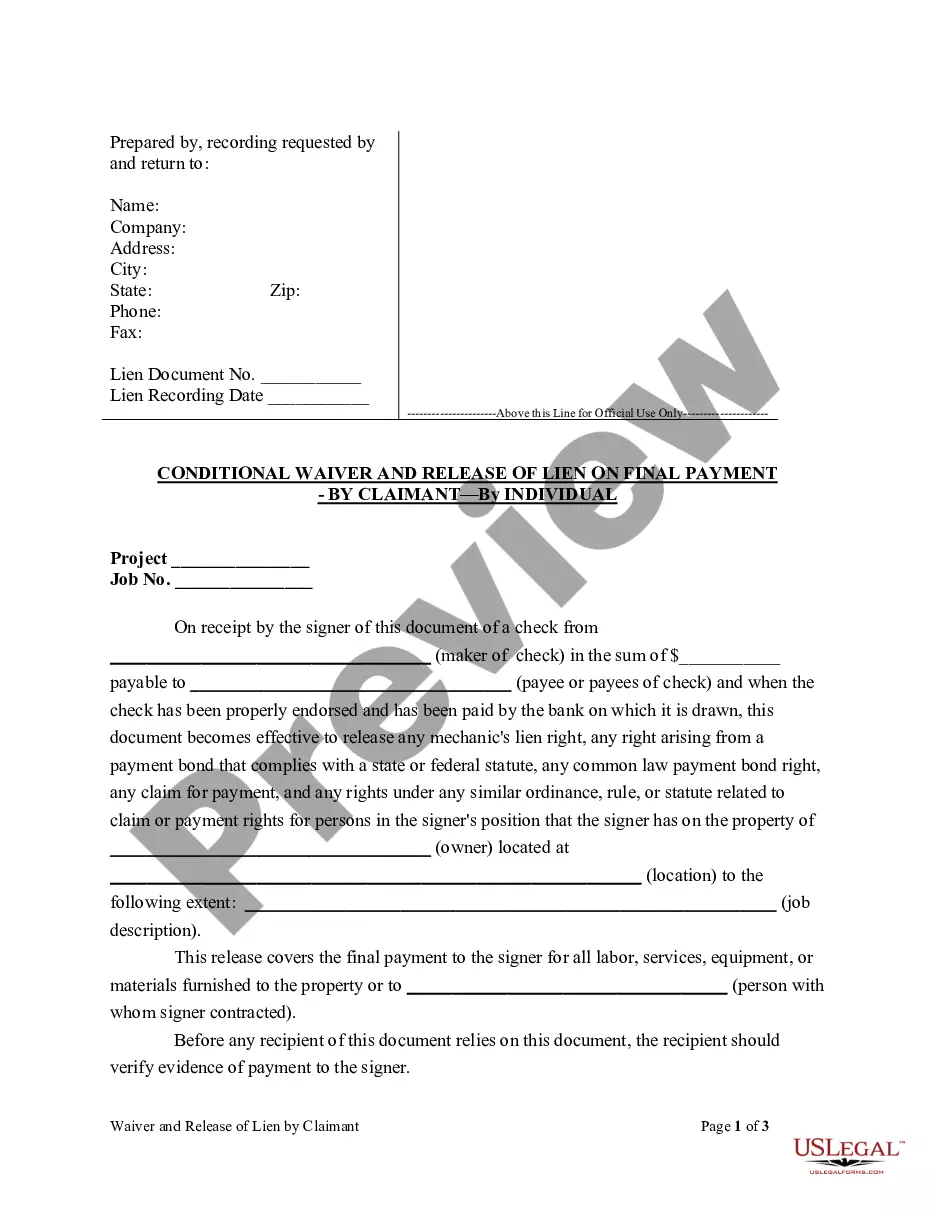

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Oakland Renunciation of Legacy in Favor of Other Family Members.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!