San Diego California Renunciation of Legacy by Child of Testator refers to the legal action taken by a child of the deceased testator to voluntarily give up their right to receive a specific bequest or inheritance outlined in the will or trust of their parent. This renunciation can be done for various reasons, such as personal choice, financial considerations, or disagreements with the terms of the inheritance. The renunciation process in San Diego, California follows specific legal guidelines. It is essential for individuals to understand the implications and consequences of renouncing a legacy before proceeding. A child who decides to renounce their inheritance must file a written renunciation with the appropriate probate court in San Diego, within a specific timeframe prescribed by state laws. By renouncing the legacy, the child relinquishes their claim to the property or assets they would have otherwise received. This renunciation will effectively treat the child as if they had predeceased the testator, meaning their share of the inheritance will be distributed to other beneficiaries, or as outlined by the terms of the will or trust document. San Diego California Renunciation of Legacy by Child of Testator may come in various types or circumstances. Some common scenarios where a child may opt to renounce their inheritance include: 1. Disputes or disagreements: If the child disagrees with the distribution of assets or has conflicts with other beneficiaries, they may choose to renounce their legacy as a way to avoid legal disputes and preserve family relationships. 2. Financial considerations: A child may choose to renounce their inheritance if the assets or bequests come with substantial financial obligations, such as outstanding debts, taxes, or liabilities. By renouncing, they can avoid assuming these financial burdens. 3. Personal preferences: Some individuals may have personal reasons to renounce their legacy, such as having no need for the inherited assets, wanting to maintain financial independence, or pursuing alternative life goals that are incompatible with receiving an inheritance. 4. Estate planning strategies: In certain cases, parents and children may agree on a renunciation as part of broader estate planning strategies. This could involve redirecting the renounced assets to other family members or establishing trusts or charitable donations. It is crucial for individuals considering the renunciation of a legacy in San Diego, California, to consult with experienced attorneys or legal professionals specializing in estate planning and probate law. They can guide the child through the process, explain the legal implications, and ensure compliance with all applicable laws and regulations.

San Diego California Renunciation of Legacy by Child of Testator

Description

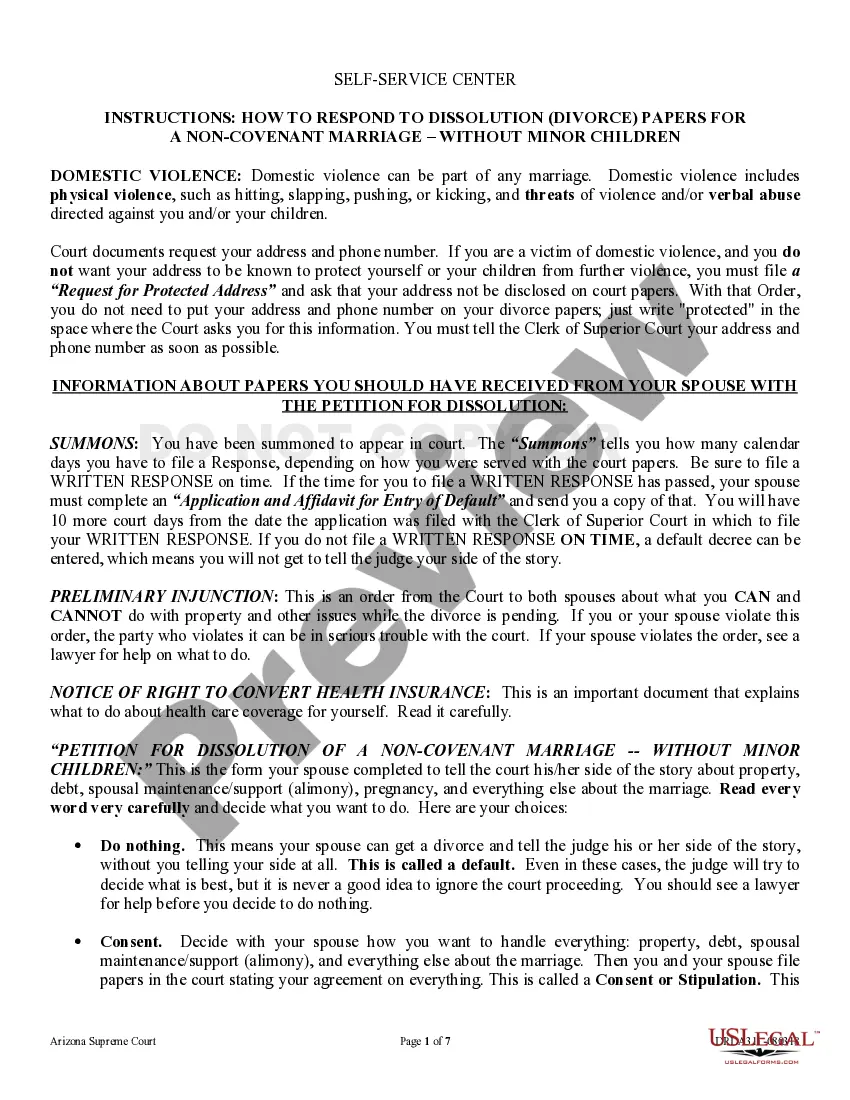

How to fill out San Diego California Renunciation Of Legacy By Child Of Testator?

Draftwing documents, like San Diego Renunciation of Legacy by Child of Testator, to take care of your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for various scenarios and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the San Diego Renunciation of Legacy by Child of Testator form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before getting San Diego Renunciation of Legacy by Child of Testator:

- Ensure that your form is specific to your state/county since the regulations for writing legal papers may differ from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the San Diego Renunciation of Legacy by Child of Testator isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our service and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your template is all set. You can try and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

To properly disclaim or renounce your share or a specific part of a share, at minimum the renunciation must: Be in writing; Describe the specific property being disclaimed; Be dated within nine months of the death of the decedent, or once the beneficiary attains the age of 21; And filed with the Executor and/or Court.

As heir, you can either walk away from the inheritance and the debt disappears, or you can deal with lenders to reduce the balancea better choice if you hope to lay claim to that 1955 Thunderbird convertible your grandfather left in your name.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estateusually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

Yes, an executor can override a beneficiary's wishes as long as they are following the will or, alternative, any court orders. Executors have a fiduciary duty to the estate beneficiaries requiring them to distribute estate assets as stated in the will.

Can a Beneficiary Be Changed After Death? A beneficiary cannot be changed after the death of an insured. When the insured dies, the interest in the life insurance proceeds immediately transfers to the primary beneficiary named on the policy and only that designated person has the right to collect the proceeds.

Revocable, which means the owner of the life insurance policy can change the beneficiary at any time without notifying the previous beneficiary. Irrevocable, which means the owner of the policy cannot change the beneficiary without that individual's consent.

15404. (a) A trust may be modified or terminated by the written consent of the settlor and all beneficiaries without court approval of the modification or termination.

A revocable beneficiary is a more flexible option. It allows the policy owner to change the beneficiary on their policy without restriction. To make a change, the policy owner simply submits the request to the insurance company, and there's no need to notify or ask the current beneficiaries before proceeding.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

The legal requirements to disclaim an inheritance are minimal. A disclaimer may be effected by contract, by deed, by writing or even informally through conduct. The intended recipient of the gift need only renounce the interest, in effect, by saying I will not be the owner of it.